Weekly Outlook: 9/6/21 - 9/10/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

This week there were again some very nice moves in the markets and many analyses hit their targets.

NZDJPY: At the beginning of last week, we told you about a potential bullishness of more than 300 pips after the downtrend was already broken and weakened by a fakeout. Since then, the price has rebounded over 200 pips.

NZDJPY before:

NZDJPY after:

EURAUD: The price was showing probabilities of a bearish continuation, and that’s exactly what happened with a beautiful rejection of the resistance and a bearish continuation to the bottom of the channel.

EURAUD before:

EURAUD after:

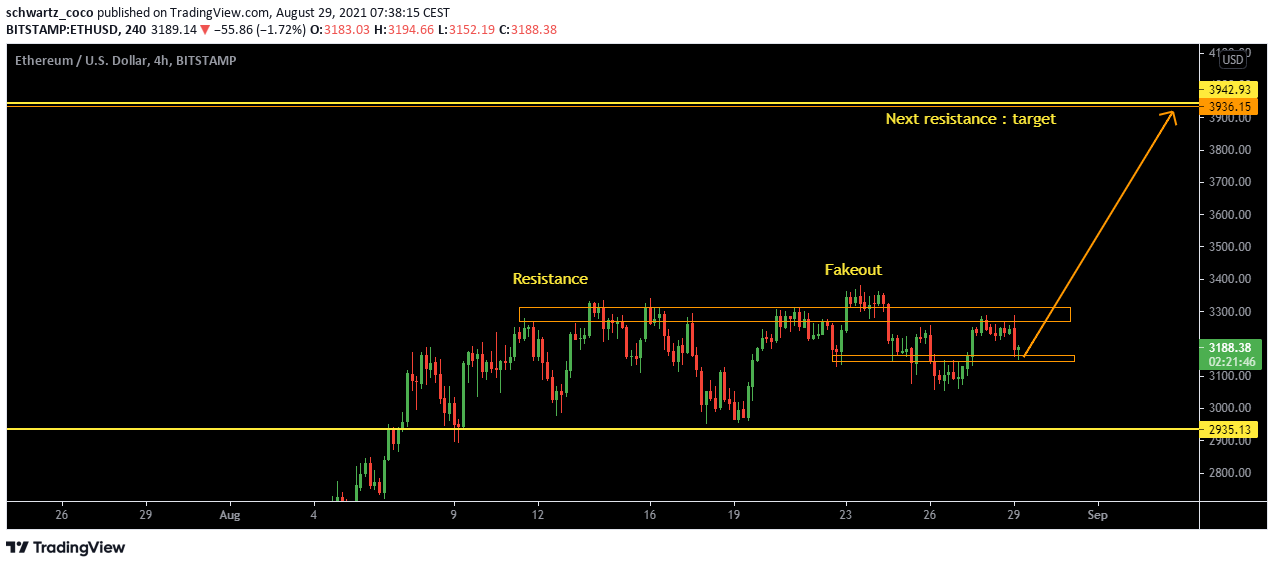

Ethereum: Target reached with a bull run which has been deciphered in its entirety on our Telegram and Discord groups (free) and in this weekly outlook. We were talking about a potential rebound of ETH from 1800$ to 3900$, it’s done!

ETH before:

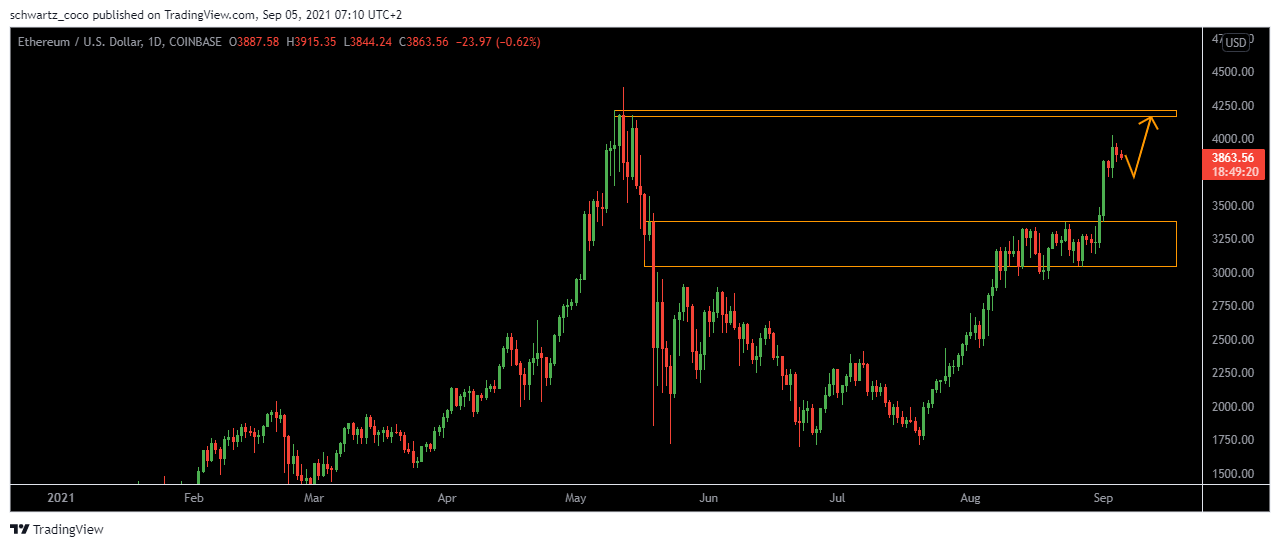

ETH after:

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

EURCHF – Correction after an intense week?

EURCHF made a huge bullish impulse the previous week and could retrace this week to this short term uptrend.

EURCAD – Bearish continuation?

EURCAD could continue to fall after the recent break of this consolidation channel. The price could repeat a bearish impulse of similar size to the previous one and join the bottom of the long term channel.

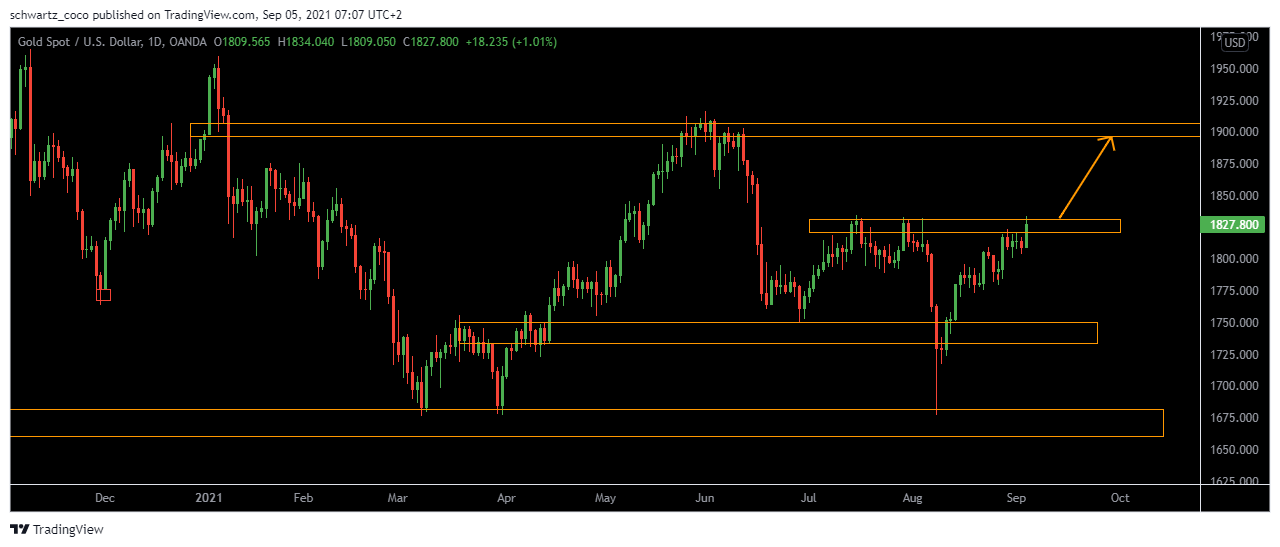

GOLD (XAUUSD) – Bullish continuation?

The price could continue to rise if it manages to break through this medium-term resistance on a sustained basis. Bullish pressure could then drive the price towards the next major resistance.

Ethereum – Towards a retest of the highest resistance?

The price could go on to retest one of its highest daily resistances as the uptrend has clearly been established. What a Bull Run!

Bitcoin – Back to $58,000?

Bitcoin could be on the rise again after this great week of bullish rejection which could be the starting point for a great bullish continuation.

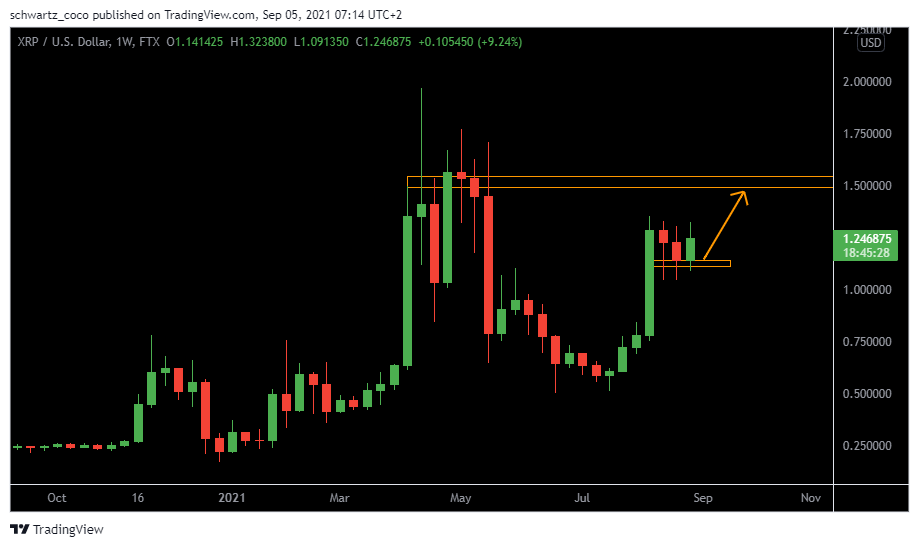

XRP – On the way to $1.49?

XRP has established a huge uptrend and may have found technical support to build on in order to make a new bullish push towards the next resistance.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, September 6th

USD & CAD – Bank Holiday.

Beware, there will be no New York session this Monday, which means that volatility could be altered and the moves could be different from what you are familiar with.

Tuesday, September 7th

AUD – RBA Rate Statement

It’s among the primary tools the RBA Reserve Bank Board uses to communicate with investors about monetary policy.

Wednesday, September 8th

CAD – BOC Rate Statement & BOC Press Conference

It’s the primary tool the BOC uses to communicate with investors about monetary policy. It contains the outcome of their decision on interest rates and commentary about the economic conditions that influenced their decision.

GBP – Monetary Policy Report Hearings

During these hearings the BOE Governor and several MPC members testify on inflation and the economic outlook before Parliament’s Treasury Committee. The hearings are a few hours in length and can create market volatility for the duration. Especially noted are the direct comments made about the currency markets.

Thursday, September 9th

EUR – Monetary Policy Statement & Press Conference

It’s the primary tool the ECB uses to communicate with investors about monetary policy.

CAD – BOC Gov Macklem Speaks

As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

Friday, September 10th

CAD – Employment Change & Unemployment Rate

This news is among the most important of the month for the CAD as it gives a clear view on the economic health of the country.

USD – PPI m/m. It’s a leading indicator of consumer inflation.

Quote of the week – Psychological Preparation

“Absorb what is useful, Discard what is not, Add what is uniquely your own.” – Bruce Lee

Think of your brain as a limited storage space. If you allow yourself to be cluttered with useless or negative information, you reduce the amount of space you can give to useful information. As a result, you minimize your daily progress by focusing on negativity, when you would be much better off by being more selective about what is and isn’t important to you. Sort out and lighten your mental load to start this new week!