Weekly Outlook: 8/16/21 - 8/20/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

CRYPTO BULL RUN – This week has seen what we have been telling you about for several weeks already: the return of the Bull Run in the crypto market. After a huge liquidity chase and a bursting of the euphoria bubble a few months ago, cryptos have rebounded sharply and followed our bullish analysis.

Wonderful rebound of the BTC which has definitely left the range zone in which it was stuck since the huge drop of its value a few months ago.

BTC before:

BTC after:

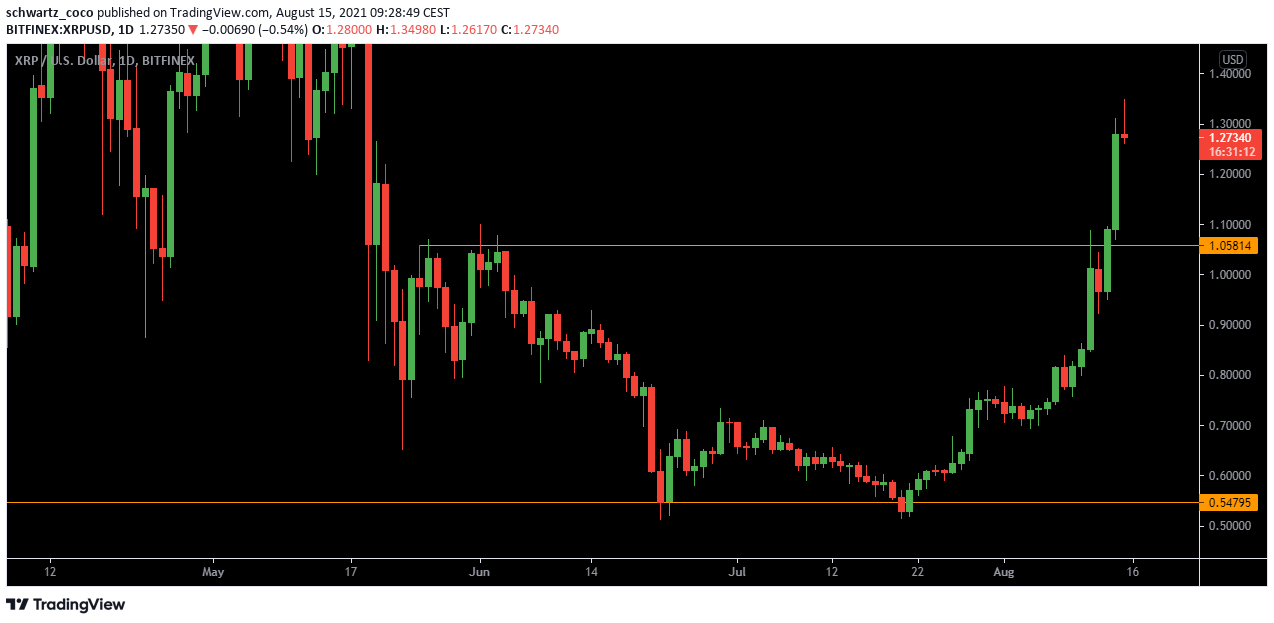

What a bullish move for XRP! Exceeding all possible expectations, the price kept climbing during this week that will remain engraved in the memories of XRP Holders.

XRP before:

XRP after:

The price of Ethereum continues to rise and resistances keep breaking one by one. The bullish pressure seems to be strong, and the sellers might have lost control for good.

ETH before:

ETH after:

The rebound has finally taken place on Dogecoin with a huge bullish move respecting the analysis sent last week.

DOGECOIN (weekly time frame) before:

DOGECOIN (weekly time frame) after:

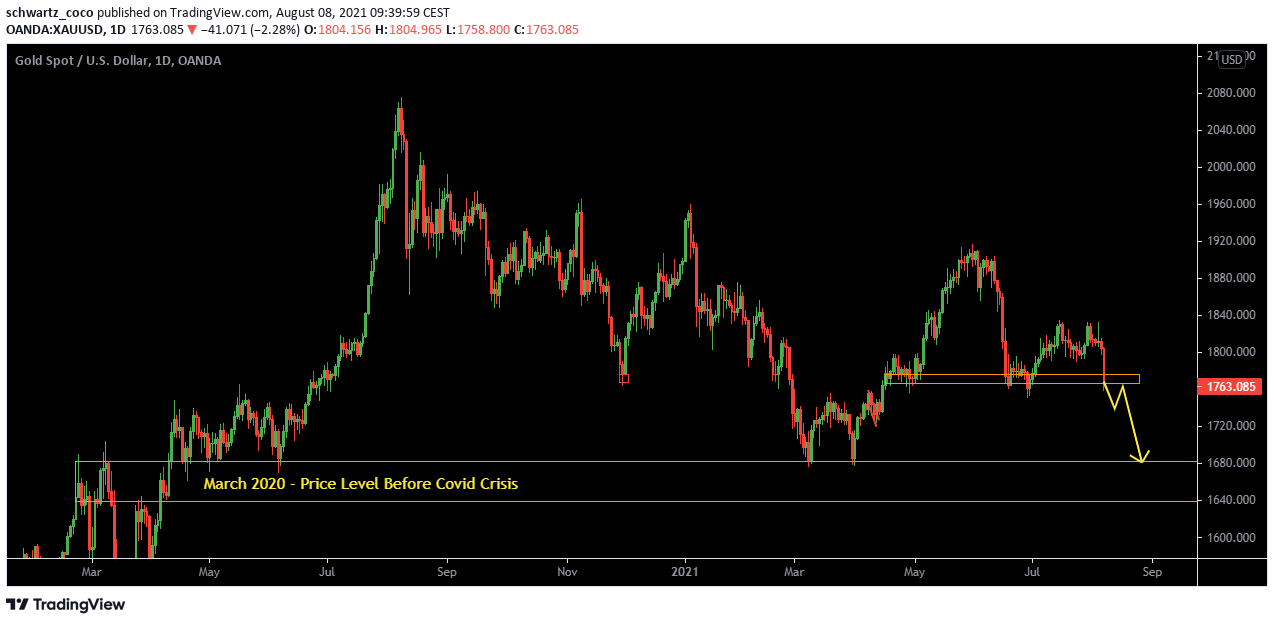

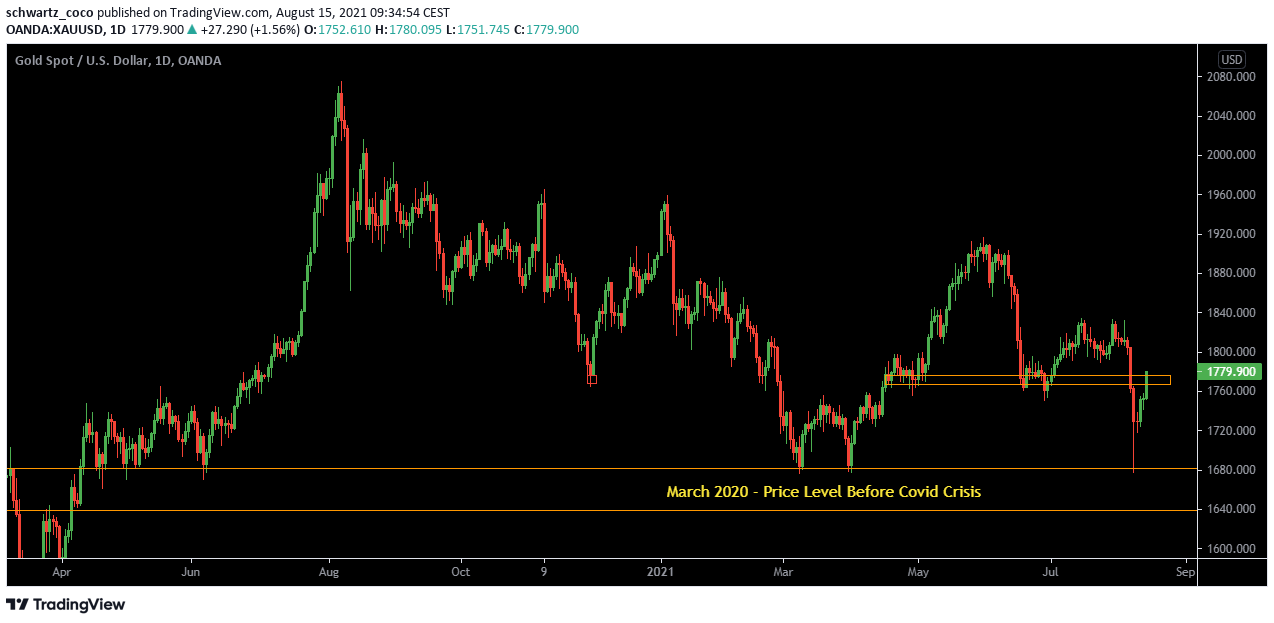

At the same time, other analyses have reached their target like GOLD which has fallen very sharply:

XAUUSD before:

XAUUSD after:

It was another excellent week in terms of analysis. All these movements had been explained and commented day after day on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

US30: a continuation of the upward trend?

In last week’s analysis, we talked about a possible break of the resistance that seemed to be weakening more and more. This resistance has been broken, giving way to a new bullish impulse which could be the engine of a new major trend continuation impulse.

SILVER (XAGUSD): following a downtrend?

Well installed in a medium term downtrend since the break of the uptrend from below, XAGUSD could continue to fall to the major support of the huge range in which it has been contained for a year.

ETHEREUM (ETHUSD): back to previous highs?

The Bull run may not stop next week with a possible continuation to the next weekly resistance around $4000. A retracement before this possible impulse is not to be excluded, with a potential retest of the support of $2723.

BITCOIN (BTCUSD): towards $49,000?

Since the breakout of the long term range in which BTC was contained, the price has continued to rise. The next resistance that the price could hit is around $49,000, a very important technical resistance. Then, if this resistance were to break, BTC would once again enter the more complex range between $50,000 and $64,000.

EURJPY: 100 pips drop and continuation of downtrend?

The price could continue to fall after a recent rejection of long term resistance and make a continuation of the trend until the next major support.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Tuesday, August 17th

USD – 3 important news events:

-Core Retail Sales m/m

-Retail Sales m/m

-Fed Chair Powell Speaks

Major indicators of the current economic situation in the USA, supported by a speech by the head of the Central Bank who has more influence than anyone else on the country’s economic policy.

NZD – 4 important news events

-Official Cash Rate

-RBNZ Monetary Policy Statement

-RBNZ Rate Statement

-RBNZ Press Conference

The central bank will present its economic policy to investors and make a full assessment of the current situation in the country.

Wednesday, August 18th

GBP – CPI y/y

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate

CAD – CPI m/m

Consumer prices account for a majority of overall inflation.

USD – FOMC Meeting Minutes

It’s a detailed record of the FOMC’s most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

AUD – Employment Change & Unemployment Rate

These are key indicators of the country’s economic situation and have a strong impact on the fluctuation of the AUD currency.

Quote of the week – Psychological Preparation

“I find that the harder I work, the more luck I seem to have.” – Thomas Jefferson

Many people still believe that successful people are just lucky people who have been blessed by life without ever trying to see what is behind the apparent success. Hard work, years of sacrifice, sleepless nights, determination, failure and loneliness are often part of the journey of people who have achieved extraordinary things. Where is the luck in all this?

You have your destiny in your hands. This week again, you will be the sole master of your decisions. Nothing can stop you if you decide that nothing can stop you. Nothing and no one can beat someone who will never give up, so always remember that there are no losing traders: there are only traders who give up too soon.