Weekly Outlook: 8/9/21 - 8/13/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

This week has been very eventful, which is synonymous with many opportunities in the markets! We will look back at the highlights (crypto bull run, NFP,…) before focusing on the preparation for next week.

Let’s start with the most notable this week: the comeback of cryptos. After several weeks of fall and consolidation during which cryptos failed to bounce off weakening technical supports, they finally managed to break out of their downtrend to create a new bullish structure. For more than two weeks, bullish analysis hinting at a possible bull run return has been posted on Discord, Twitter and Telegram. Right now, cryptos are on fire! Let’s take a look back at these analyses:

XRP: A bullish move as a result of selling strength running out of steam and buyers regaining control with remarkable pressure.

XRP before:

XRP after:

XRP has reached its target resistance, and may now continue to establish its uptrend. The Bull Run is back and cryptos are soaring again!

ETH has continued well upwards from the $1800 liquidity zone and has followed our bullish analysis twice. The price has now broken through the psychological resistance of $3000, and the Bull Run is clearly back on. What a move!

ETH before (part 1 – $1800 to $2400):

ETH before (part 2- $2600 to $2900):

ETH after (full move):

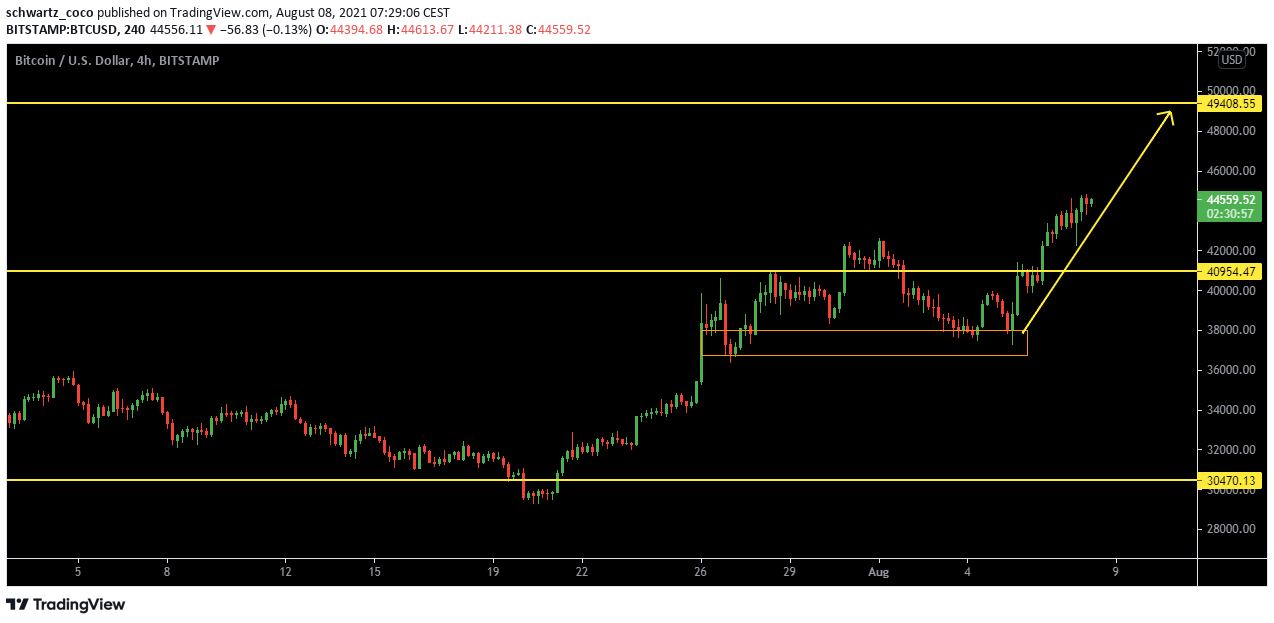

BTC: Bullish rebound after a false range break. BTC could be on its way to the $49k resistance since the final break of the range resistance and the rejection of the support inside the range after the recent fakeout. What an incredible move! Everything had been explained by our analysts live, day after day.

BTC before:

BTC after:

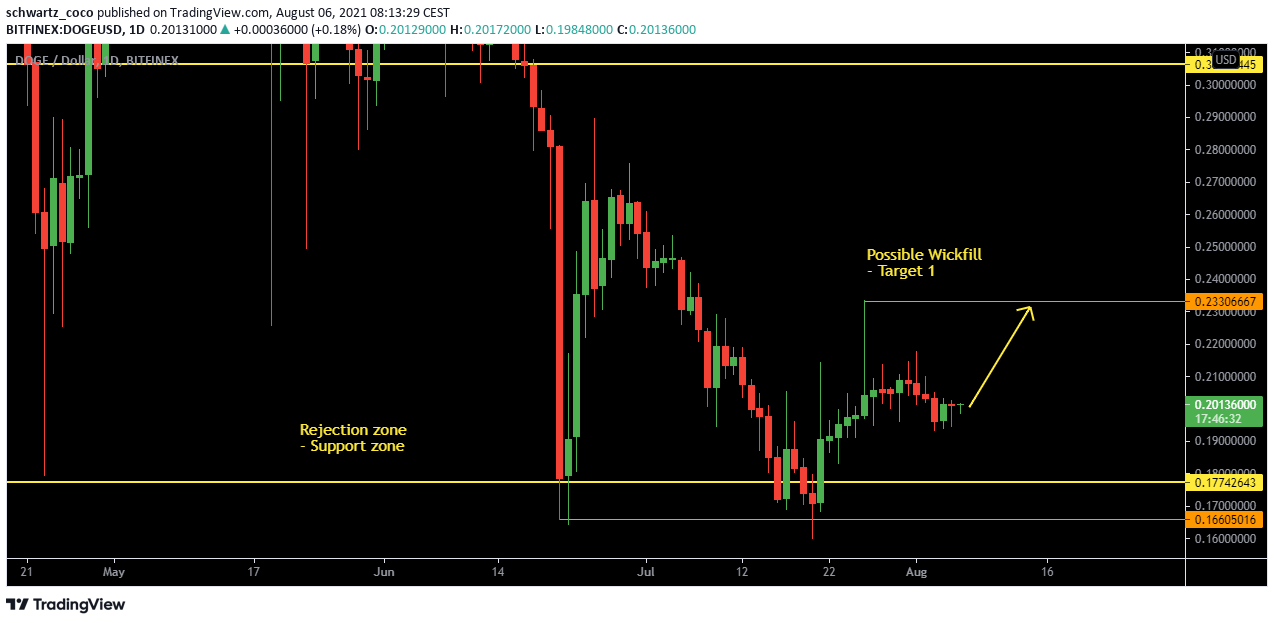

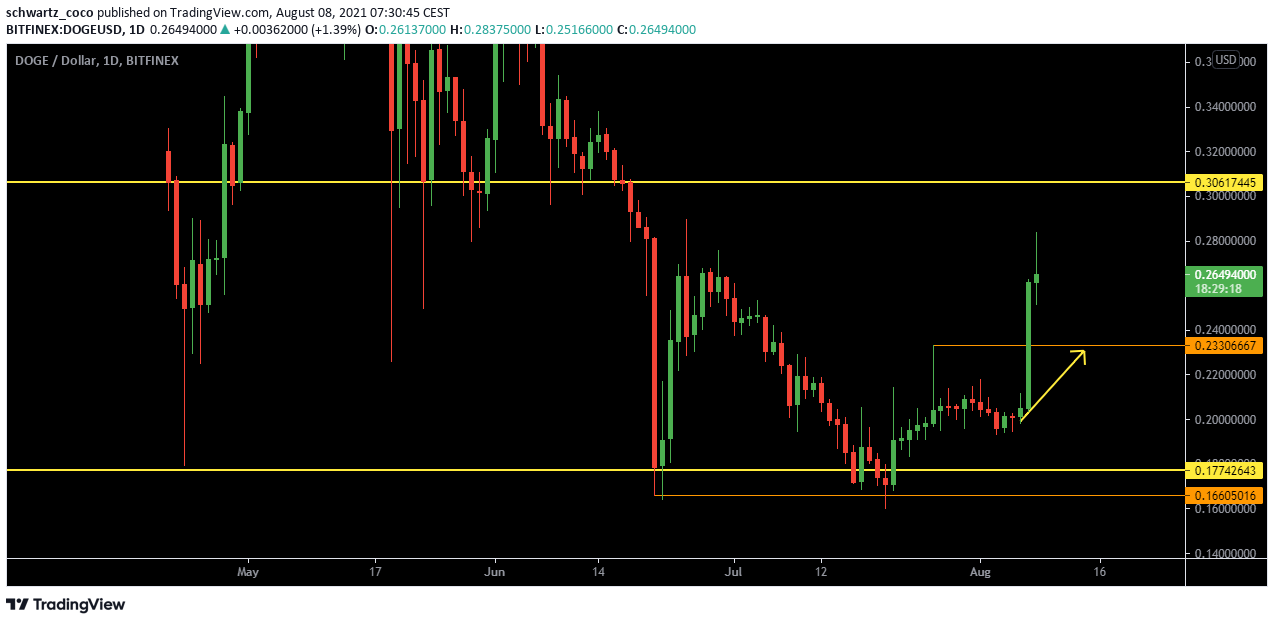

DOGECOIN: What a bullish move! The analysis was published well before the Bull Run, when the Doge was still showing signs of weakness with momentum lagging. However, on a daily basis, the selling strength seemed to be clearly waning and the bullish probabilities continued to increase little by little for a potential wick-fill during the upcoming momentum. That’s what happened, and the Doge continued higher!

DOGECOIN before:

DOGECOIN after:

A huge comeback for cryptos that may be starting a new bull run. Meanwhile, on Forex, there were also huge moves especially in connection with Friday’s NFP. Let’s break it all down together.

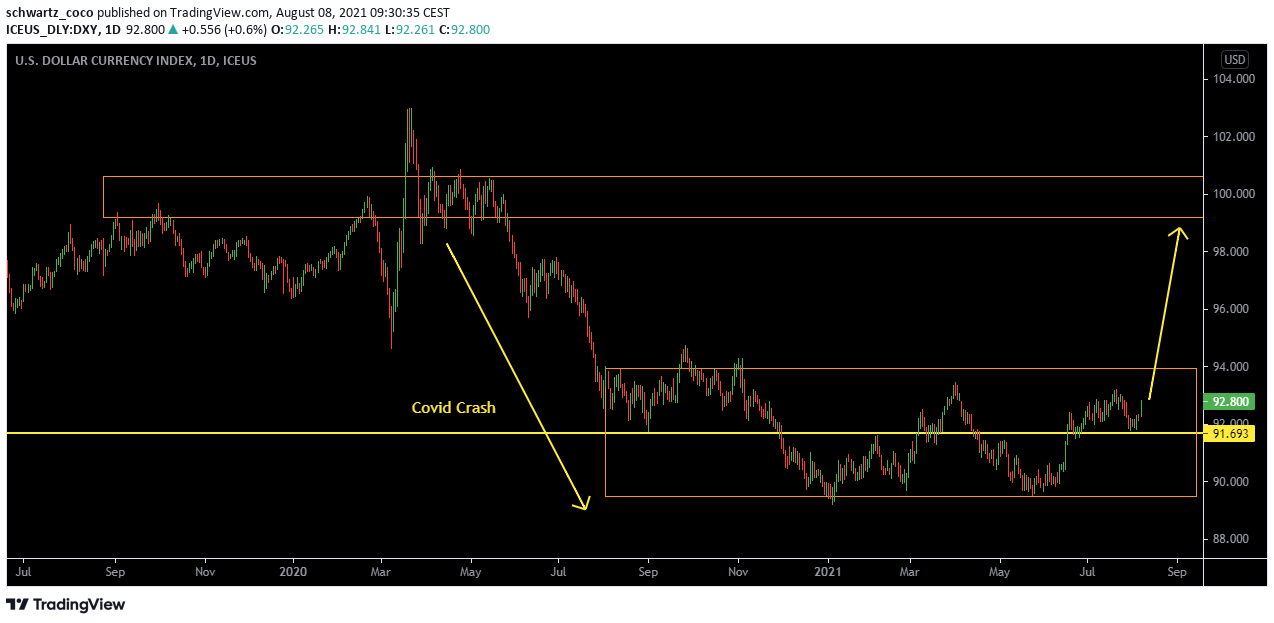

On Friday, the most important and expected news of the month for the Dollar was finally released. The NFP once again shook the markets, with very good results in favor of the Dollar: all three news items in the NFP came out better than expected.

– Average Hourly Earnings m/m – 0.4% vs 0.3% expected

– Non-Farm Employment Change – 943k vs 870k expected

– Unemployment Rate – 5.4% vs 5.7% expected

When such results come out as a surprise, the market reaction is immediate: optimism generates large bullish impulses and volatility instantly becomes very high. All pairs in XXXUSD fell, and those in USDXXX rebounded sharply upwards. The Dollar Index is a testament to this huge bullish move in favor of the Dollar, with a clear rebound:

DXY

What is the short and medium term future for the dollar after these very positive results? This is what we will now see as we prepare for this new trading week.

It was another great week for our analysis! Now that this little recap is over, let’s get ready for next week.

Looking ahead to next week: what moves should we be watching for?

DXY (Dollar Index): Long-term bullish continuation for the Dollar?

Since the Covid-19 crisis, the Dollar has fallen significantly and only the actions of the Fed and the overhaul of the economic policy (stimulus, rate cuts…) have stopped the bleeding. Since the Fed took charge of the crisis, the dollar has entered a consolidation phase from which it could soon emerge. If the resistance of this consolidation (94.00) is broken, we could perhaps see the impulsive fall totally or partially corrected, and the Dollar could take the path of a solid uptrend with a gradual return to its “normal” price level.

EURCHF: Liquidity hunt and bullish rebound?

EURCHF has so far respected the analysis we published a few weeks ago mentioning a possible fall as a liquidity hunt in the areas below the bottom of the bearish channel before a possible rebound. Now, with liquidity being chased, the price could re-enter the channel on its recent bullish bounce and make a bullish push to its bearish channel top thereafter.

EURUSD: 100 pips of further decline?

EURUSD could continue its fall after this magnificent break of the support zone turned resistance zone following the recent price rejection. Now the odds could be bearish until the next major daily support area located at 100 pips from the current market price. A continuation of the trend may be the most likely configuration!

XAUUSD (GOLD): A Return to the March 2020 Price?

Gold has dropped to a major technical support zone. If this zone is broken, the price could continue its downward trend until it reaches the price level prior to the Covid crisis, acting as a correction move. The strength of the Dollar and the renewed optimism could precipitate this potential fall, and show very nice bearish movements in the coming days.

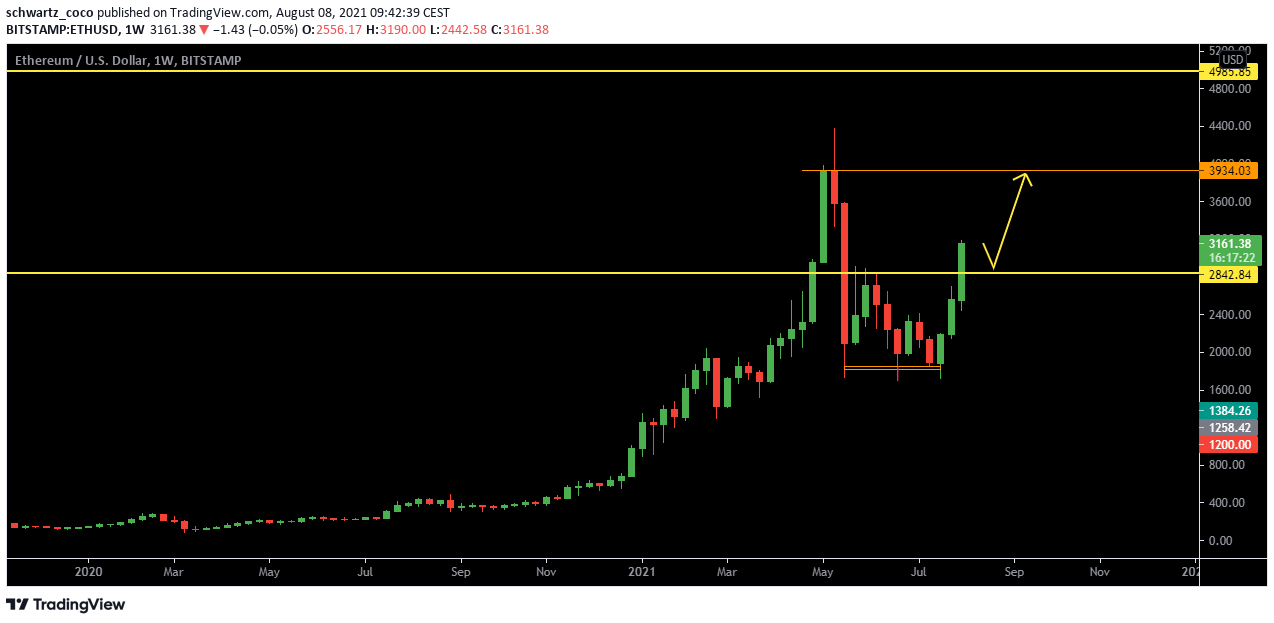

ETHUSD: bullish continuation and return to previous highs?

On the weekly time frame, there seems to be no obstacles in the way of ETH since the break of the previous key resistance area. After a quick retracement to give the price time to breathe, ETH could take off towards the next major resistance of $3900 and test the psychological resistance of $4000 once again.

US30: price driven by Dollar strength?

With the economic news being very good and the resistance being broken, US30 could make a new bullish impulse in the next few days and confirm this renewed optimism of the markets.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

A much less busy week in terms of fundamentals, but with some key news to watch anyway:

Monday, August 9th

JPY – Bank holiday.

Beware, this means that volatility could be altered significantly during today’s Asian session.

Wednesday, August 11th

USD – CPI m/m + Core CPI m/m

These are major indicators in terms of recording and measuring inflation and have a direct impact on the Dollar’s price.

Thursday, August 12th

USD– PPI m/m

Another major indicator measuring inflation.

Quote of the week – Psychological Preparation

“Your only limit is you.” – Unknown

Hard work and determination to achieve your goals can really push you to results you once thought impossible. Nothing can stop you but yourself. You must not leave room for doubt, and never question the learning process you have recently entered. Just because the short term results are not up to the long term results you hope for does not mean there is a problem and you should blame yourself. The more you criticize and belittle yourself, the more time and energy you will waste fighting unnecessary negative pressure you put on yourself.

Anything is possible when you are determined to work for it. Nothing and no one can stop you from succeeding if you do everything you can to make it happen. Continue to learn from your mistakes and build on your successes, and get ready for a new trading week full of learning and opportunity.