Weekly Outlook: 7/26/21 - 7/30/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

To begin, let’s review the analysis published in the previous weekly outlook.

SILVER (XAGUSD) has effectively broken its weakening technical support, as we explained earlier this week in the previous outlook. A very nice bearish impulse has taken place, but the final target of the technical support has not yet been reached. The price could continue to fall on the breakout of this small bullish channel next week, up to the technical support by then respecting our 100% analysis.

SILVER before:

SILVER after:

USDJPY quickly made the bearish move we told you about to technical support, with a drop of 90 pips and a target reached very easily in continuation of the trend. Another validated analysis!

USDJPY before:

USDJPY after:

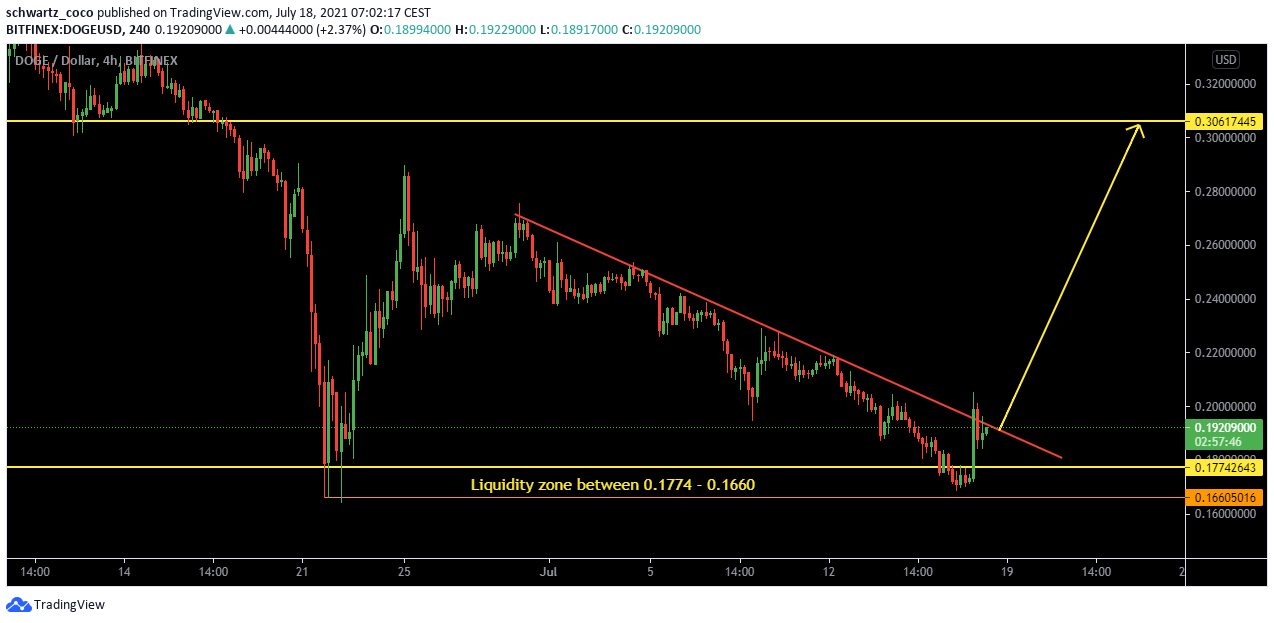

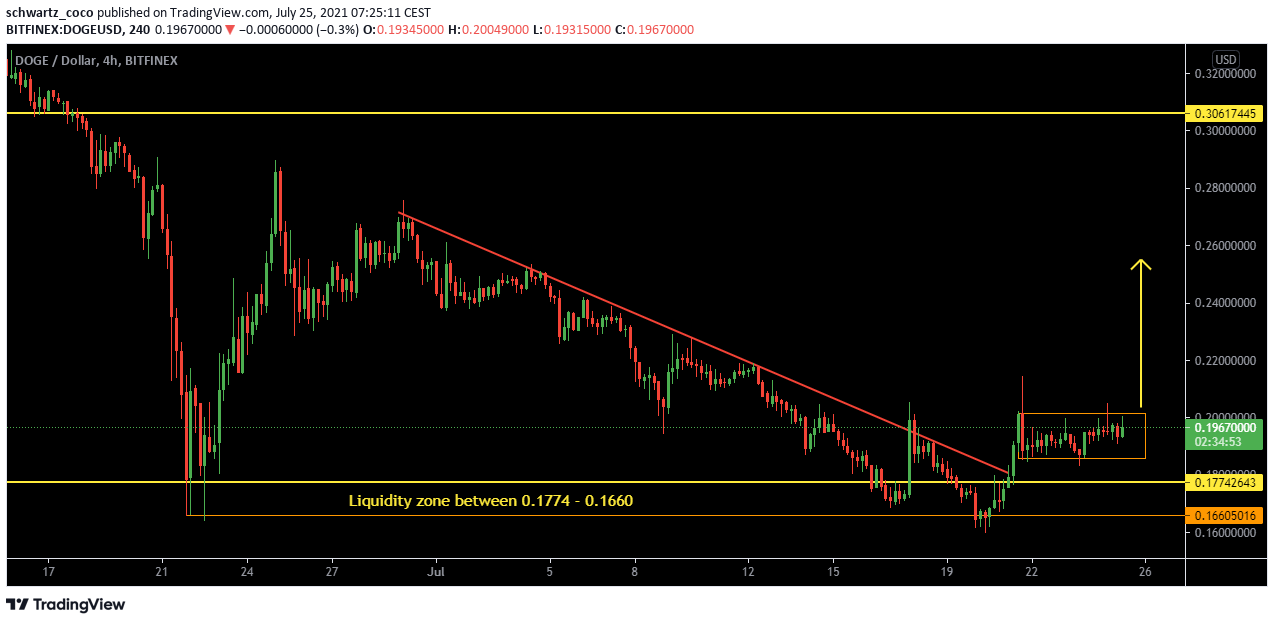

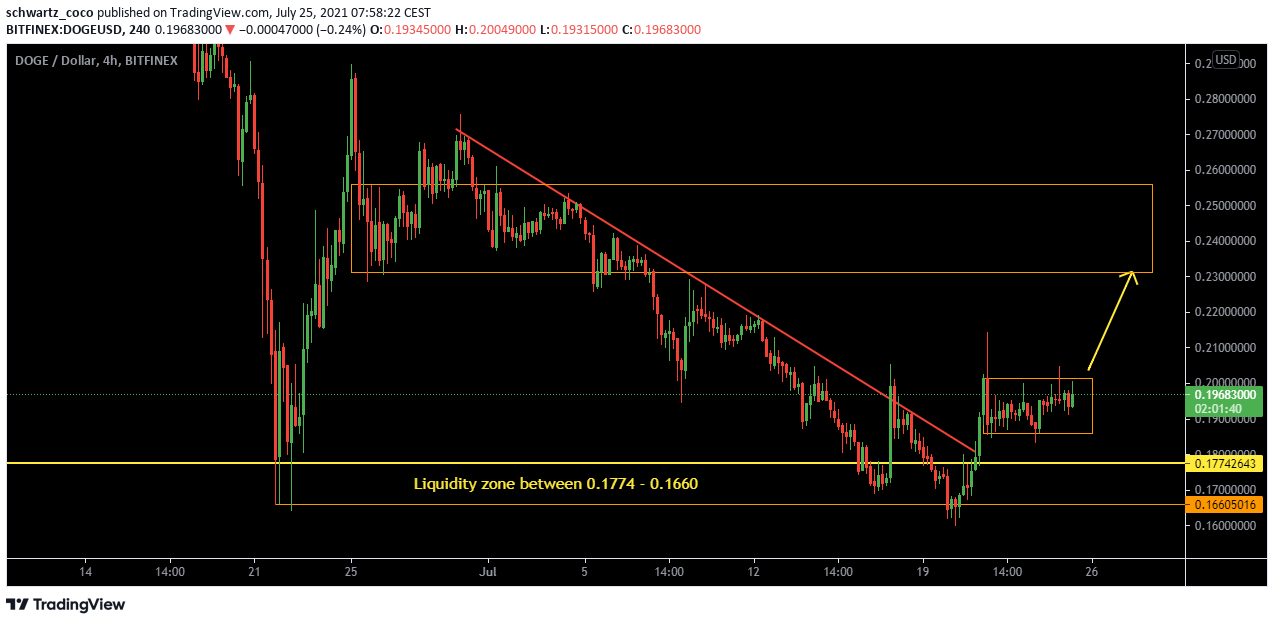

DOGECOIN also respected our analysis by making a very nice bullish impulse after the break of the bearish trend line. It did not give way directly, but now the price could continue upwards if the consolidation it is currently trapped in is broken.

DOGECOIN before:

DOGECOIN after:

EURUSD also did well with our analysis, with a continuation of the downtrend throughout the week. After a resounding start to the week, the EUR all fell once the liquidity was cleared. We have also sent some nice selling analysis on EURCAD and EURAUD in our free Telegram & Discord groups which also played out very well.

EURUSD before:

EURUSD after:

EURAUD has indeed followed the analysis sent in the Telegram & Discord groups perfectly. At the very beginning of the week we could see that the EUR pairs all made a huge bullish move to chase liquidity. Once the high for the week was established and the price rejected an important daily resistance area, EURAUD was able to fall and re-enter its bearish channel as we expected.

EURAUD before:

EURAUD after:

Finally, we can’t end this recap without talking about Bitcoin, which also followed our analysis perfectly. We first explained that the odds were bearish until the liquidity zone below the support, and then that BTC could rebound and break the bearish structure to establish a new uptrend. This is exactly what happened, and it was all published on Telegram, Discord and Twitter!

BTC before:

BTC after:

It was another great week for our analysis! Now that this little recap is over, let’s get ready for next week.

Looking ahead to next week: what moves should we be watching for?

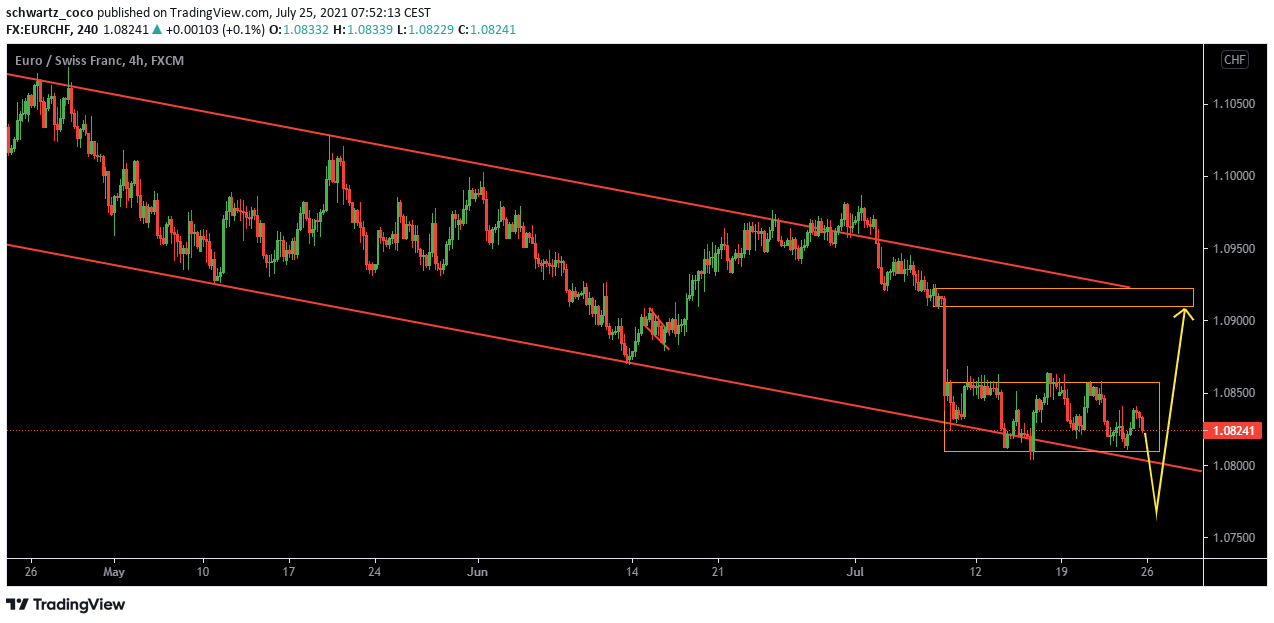

EURCHF: A hunt for liquidity then a bullish reversal?

It has been a very long time since EURCHF last retested its bearish channel top. The price is currently in a consolidation period, but we could soon see a bearish breakout with a hunt for liquidity below the bearish channel before continuing upwards once sellers are introduced and current buyers exit.

GBPUSD: A bullish move of more than 100 pips ahead?

After the false breakout from the bottom of its bearish channel, GBPUSD made a first bullish impulse towards the top of the channel. This week, we could see a continuation of a 100 pips bullish move to the top of the channel.

DOGECOIN: A bullish impulse to come?

If DOGECOIN manages to break its consolidation, the price could make a very nice bullish impulse until the next strong resistance zone and create the beginning of a bullish trend.

DXY (DOLLAR INDEX): Bearish movement closer than ever?

As the month comes to a close, DXY could retrace leading to big dollar weakness after this fakeout of resistance and the top of the bullish channel.

XAUUSD (GOLD): Bullish impulse ahead?

The price could make a new bullish impulse of a size close to the previous one if it manages to break this bearish channel from above.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Tuesday, July 27th:

USD – CB Consumer Confidence

Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

Wednesday, July 28th:

AUD – CPI q/q + Trimmed Mean CPI q/q

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

CAD – CPI m/m

The average price of various goods and services are sampled and then compared to the previous sampling to assess inflation.

USD – FOMC Statement + FOMC Press Conference.

It’s among the primary methods the Fed uses to communicate with investors regarding monetary policy (Interest Rate Statement, Fed Statement, Monetary Policy Statement…).

Thursday, July 29th:

USD – Advance GDP q/q

There are 3 versions of GDP released a month apart – Advance, Preliminary, and Final. The Advance release is the earliest and thus tends to have the most impact

Friday, July 30th:

CAD – GDP m/m

It’s the broadest measure of economic activity and the primary gauge of the economy’s health

USD – Core PCE Price Index m/m

Differs from Core CPI in that it only measures goods and services targeted towards and consumed by individuals. Prices are weighted according to total expenditure per item which gives important insights into consumer spending behavior. This is rumored to be the Federal Reserve’s favorite inflation measure, but CPI is released about 10 days earlier and tends to garner most of the attention.

Quote of the week – Psychological Preparation

“The tragedy in life doesn’t lie in not reaching your goal. The tragedy lies in having no goal to reach.” – Benjamin Mays

New week, new goals! Sometimes it’s normal to feel discouraged when things don’t really go as planned. We come to think that we won’t make it, and thinking about the potential failure is depressing. However, it is totally normal that things take time because trading is more than a discipline, it is a profession. As such, since a trade is not learned in a month, it is obvious that you will have to stay in the markets for months or even years before you can finally take advantage of your new skills. This time is not wasted, and you should not be frustrated by it: it is the engine of all the experience that will enrich you psychologically and technically.

Your goals will take time to achieve. It is important to have that motivation and ambition that drives you every day to be a better version of yourself in order to become a better trader. Believe in yourself, and trust the process. Experience and time will accomplish all your dreams and your goals will all be reached one by one.

We hope we have helped you prepare for it with these detailed analyses of what to expect at the end of the month and we wish you a great trading week!