Weekly Outlook: 7/5/21 - 7/9/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

Last Friday was the Non Farm Payroll (NFP), the economic news that traders have been waiting for because of the volatility it creates in the market. What happened? How could you have anticipated the NFP move? How do you trade the NFP professionally? We will answer all these questions in the following lines.

Friday’s NFP movement was similar to the previous NFP. Last month (June), the Dollar made a large move up two days before the Friday news, chasing all the cash before the real results were out. The market was expecting a very strong NFP due to the recent excellent economic news leading up to the NFP, and as a result, the dollar jumped on this optimism. On the day of the NFP, the market totally corrected this bullish move as the results were not as good as expected, directly resulting in investors’ optimism falling.

This week, this scenario was repeated. Indeed, in the middle of the week, the pre-NFP news suggested a strong NFP with the ADP Non-Farm Employment Change (economic indicator linked to the NFP) coming out much stronger than expected on Wednesday (692k vs. 555k expected). Optimism then increased, almost to the point of euphoria in the markets for two days. On the USDJPY, this resulted in an impulsive move up by 120 pips. On the first day of the month, the price was already overexploited and the move appeared to be a possible liquidity hunt. Explanation: The question to ask is why did the USDJPY make a 120 pips bullish move on the eve of the NFP when the pair could have waited for the NFP results to move? The reason is simple: the market anticipated, due to some strong signals such as the ADP, an excellent NFP. As a result, there were only 2 possible solutions left:

– Either the NFP came out really strong, and in this case the market would have continued to rise very slightly by not correcting the strong movements that had been anticipated in the previous days

– Or the NFP came out weak, normal (mixed), or weak, and then the price would have been forced to correct the impulsive upward movement that was only caused by the optimism anticipating a very strong NFP.

Clearly, if the results were not at least equal to those expected, the dollar would be exposed to a strong correction on the day of the NFP. Once all the liquidity was chased before NFP with these huge bullish moves, the results came in: the NFP was mixed:

-Non-Farm Employment Change 850k vs 725k expected: better than expected

– Unemployment Rate 5.9% vs 5.6% expected: worse than expected

As we explained, the mixed NFP ended the optimism and contradicted the market expectations, and the correction was inevitable. As a result, USDJPY corrected half of its impulsive bullish move right after the NFP, as seen below.

Here is one way to trade the NFP professionally: based on the concepts of liquidity and optimism, and thinking logically about the impact of these numbers on the markets more than their actual value.

Looking ahead to next week: what moves should we be watching for?

EURGBP: A reversal of the downward trend likely?

EURGBP has recently made a fakeout of the short-term downtrend. Therefore, the next bullish breakout could mean a reversal and the price could retrace the entire previous bearish move.

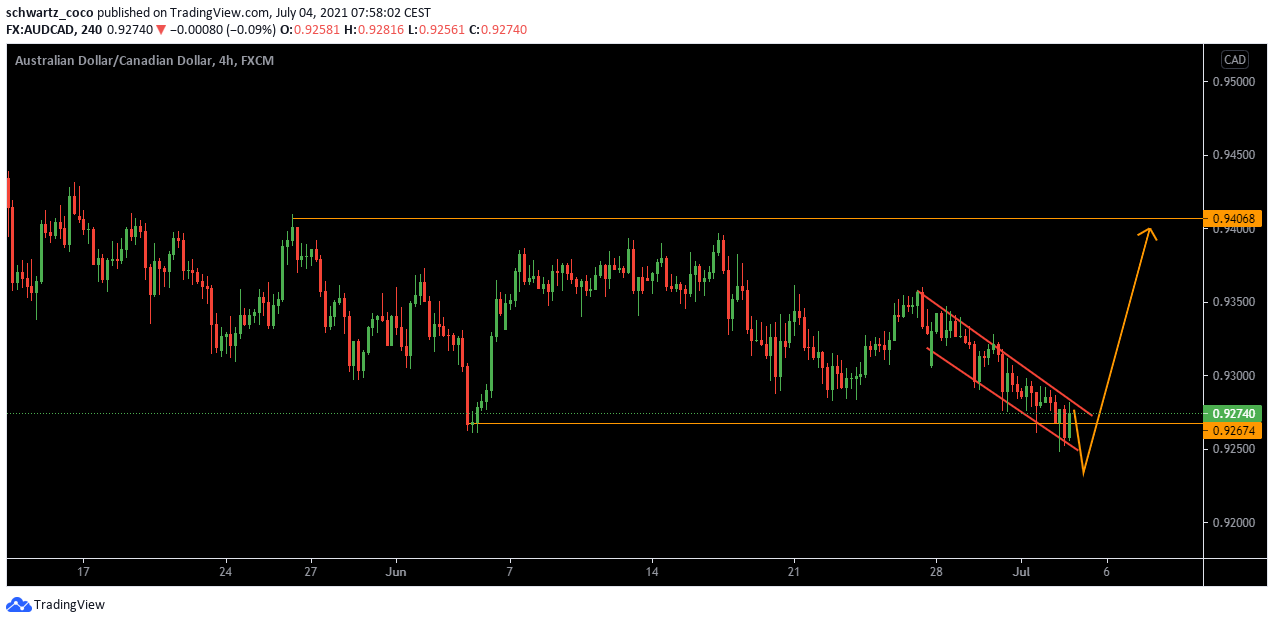

AUDCAD: A hunt for liquidity below support and a reversal?

AUDCAD could create a “fake-out” of support and the channel, to chase liquidity and reverse to continue to the next resistance.

EURCHF: A bullish reversal?

EURCHF has also recently made a fakeout of the downtrend and could reverse on a further breakout. Impulsive buyers have been trapped, liquidity has been driven out and the real move could potentially come soon.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, July 5th:

OPEC – JMMC Meetings. The OPEC meetings concern all currencies, especially those of countries that are strongly impacted by the price of oil and its production (e.g. CAD).

USD – Bank Holiday. Be careful, there will be no New York session on Monday and therefore volatility could be altered. The New York opening moves will not take place, but the London and Asian sessions will be well open.

Tuesday, July 6th:

AUD – RBA Rate Statement & RBA Gov Lowe Speak. This news is very important for the AUD as it will dictate the monetary policy of the central bank with the announcement and explanation of the next interest rates.

USD – ISM Services PMI. It’s a leading indicator of economic health which usually brings volatility to the markets.

Wednesday, July 7th:

USD – FOMC Meeting Minutes. It’s a detailed record of the FOMC’s most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

Thursday, July 8th:

AUD – RBA Gov Lowe Speaks.

Friday, July 9th:

GBP – BOE Gov Bailey Speaks. As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

CAD – Employment Change & Unemployment Rate. These are the most important news of the month concerning the Canadian economy.

Quote of the week – Psychological Preparation

“If we have the attitude that it’s going to be a great day, it usually is.” – Catherine Pulsifier

Your state of mind at the beginning of the week will strongly impact the outcome of that week. If you go to work on Monday morning thinking, “this week is going to be endless, I’m going to hate it” then guess what… this week is going to be endless, and you’ll hate it. On the other hand, if you start the week with clear goals and with enthusiasm to move forward with your projects, then you will devour the days without even thinking about the difficulties you might encounter.

Your brain is the engine of your body and your actions. Mental preparation before a new trading week is very important because if you don’t get yourself in the right conditions to succeed, emotions could quickly take over. Indeed, imagine that you start this new week still frustrated with the NFP (because of a trade you missed, because of a loss, or because of a risk management mistake for example) and that you only think of making up for it on your next trade. Obviously, this mentality will lead you directly to making basic risk management or discipline mistakes, and you will feed your frustration until it explodes. However, if you start the week with a calm mindset after taking a break over the weekend and taking the opportunity to learn from your mistakes and prepare for the new week ahead, then you are much more likely to have positive results the rest of the week.

Preparation is not only technical, it is also mental. Start the week with the right mindset, and you’re already putting the odds in your favor for success!

Have a great trading week everyone!