Weekly Outlook: 7/12/21 - 7/16/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

After a mixed NFP when the market was expecting a strong one, many pairs retraced and corrected the impulsive bullish moves pre-NFP. For example, USDJPY had made a bullish move of 120 pips in two days, just before NFP. Once again, the market showed optimism for a strong NFP, but the results did not follow and the correctional moves began. As a result, we talked about a possible correction of these movements on our discord server and our free Telegram group, as the optimism was gone and these bullish price movements had no reason to be.

We then sent this analysis on USDJPY, with a trade idea of over 110 pips potential:

The correction of the impulsive bullish movement took place in the space of only 3 days, and our analysis was validated very quickly by reaching the envisaged target: the start of the previous bullish movement to be corrected on USDJPY.

Here is USDJPY after:

Last week, other very interesting moves took place. Like every week, traders had to deal with the liquidity chases that they often get trapped in. For example, the price sometimes shows signs of reversal with the break of a trend line or channel, only to re-enter it later. Traders who impulsively buy the breakout of the channel or trendline get trapped, and their stop loss is hit when the price returns to the channel and their analysis is invalidated. They have then provided the liquidity the market needs to make its real move soon. Why do these liquidity hunts happen? Because financial markets work like any other market: if you want to sell something, you have to find a buyer, and if you want to buy something, you have to find a seller. This is what happens when the price goes to hit liquidity zones like the ones we talked about: the price makes a move showing (for example) a breakout from the top of a downtrend channel, so traders enter the breakout to buy. Then, when the fakeout takes place and the price re-enters the bearish channel, we notice that it was just a trap set up by the sellers to bring more buyers into the market, providing them with some of the liquidity needed to make their move. The sellers have found their buyers, so the move can take place!

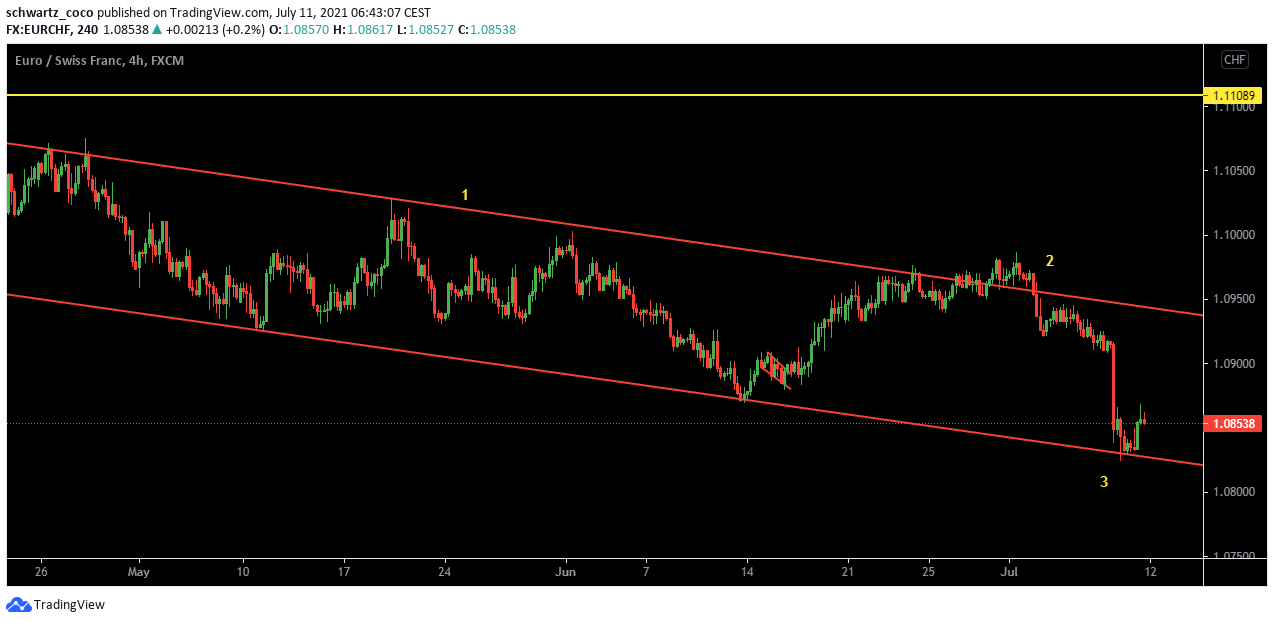

This is what happened this week on EURCHF:

1 – Bearish channel established since the beginning of March 2021

2 – False bullish breakout of the channel: buyers get trapped by the fakeout

3 – Bearish continuation to the bottom of the channel once the trap has been set

These two types of moves are very common in the markets (bullish or bearish correctional moves and liquidity chases), so if you can learn to spot them, you will greatly expand your technical price skills and improve your analytical abilities.

Looking ahead to next week: what moves should we be watching for?

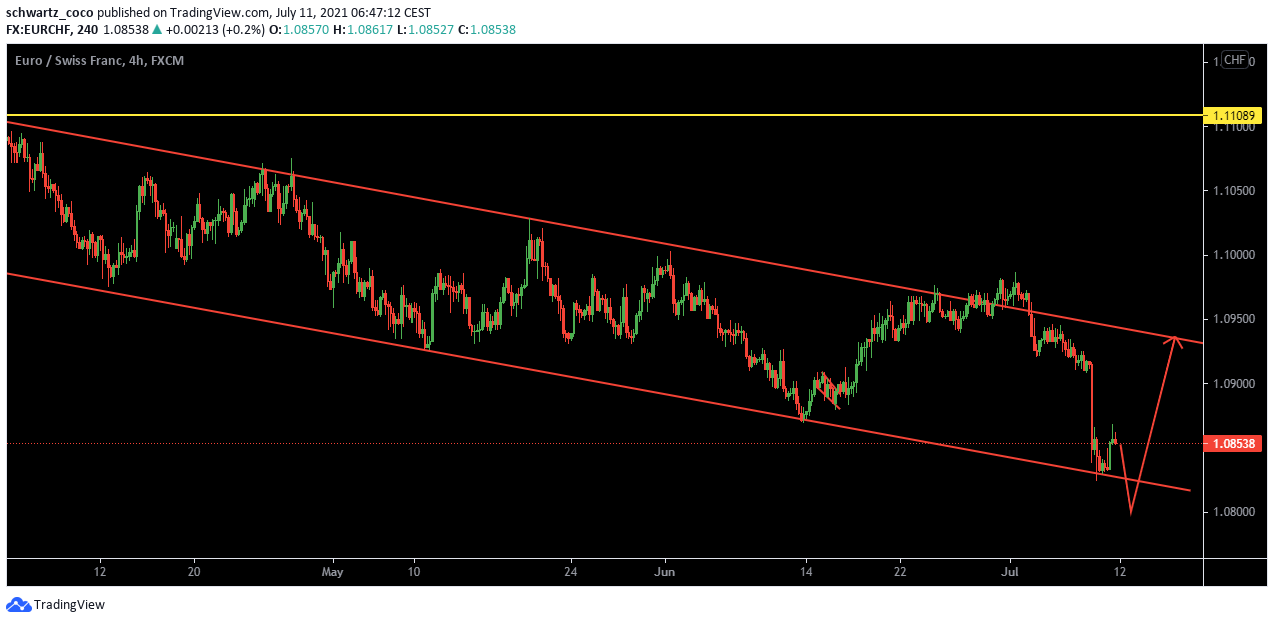

EURCHF: A reversal to come after the previous downward movement?

As we said just now, the bearish channel has been established since March 2021 on EURCHF. After the last bearish move that followed the fakeout of the top of the channel, the price could once again make a bearish impulse before continuing upwards to join the top of the channel (and maybe break it permanently).

Ethereum: A downward movement ahead?

Ethereum is showing bearish signs with the recent breakout of this bullish channel from below. The price could repeat a bearish impulse of similar size to the first impulse, and continue its fall to the $1700 technical support.

GBPUSD: An interesting situation in case of a fakeout.

GBPUSD recently created a double bottom on a technical level representing a contract block, and showed clear bullish strength at the market close. However, we can see that the last H4 candle closed without any rejection wick in the bullish direction, which often means that the potential future upward price movement is limited. Should GBPUSD manage to break back below the resistance created by the double bottom hinge, then we would be looking at a fakeout and the odds could be bearish all the way to the previous technical support.

GOLD (XAUUSD): A continuation of the bullish movement to come?

The price of gold could continue to rise until it reaches the next major resistance level of $1870. Indeed, the price recently made a fakeout of the support created by the previous low allowing the start of this new bullish impulse, and the path now seems clear on the Daily to the next resistance.

DXY (Dollar Index): Is the party over?

After recent impressive bullish impulses, the dollar’s rise may have reached its limits. The uptrend has recently broken and been successfully retested, and the price now appears to be heading for its next supports. A partial or full correction of the previous upward movement may be in order.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Tuesday, July 13th:

USD – CPI m/m and Core CPI m/m.

Why do traders care? Consumer prices account for the majority of global inflation. Inflation is important for currency valuation because rising prices often lead the central bank to raise interest rates out of respect for its inflation control mandate.

Wednesday, July 14th:

NZD – RBNZ Rate Statement

This is one of the main tools used by the RBNZ to communicate with investors about monetary policy. It contains the outcome of their interest rate decision and comments on the economic conditions that influenced their decision. Most importantly, it discusses the economic outlook and provides clues to the outcome of future decisions.

USD – PPI m/m

This is another leading indicator of consumer inflation – when producers charge more for goods and services, the higher costs are usually passed on to the consumer.

CAD – BOC Monetary Policy Report, BOC Rate Statement and BOC Press Conference

These are some of the most important news of the month for the CAD, as the central bank communicates on the economic situation of the country by explaining and justifying the upcoming economic decisions that are going to be taken (e.g. an interest rate change). They often bring quite a bit of volatility to the markets.

USD – Fed Chairman Powell testifies. Why do traders care? Because as the head of the central bank, which controls short-term interest rates, he has more influence on the value of the nation’s currency than anyone else.

Thursday, July 15th:

AUD – Unemployment Rate and Employment Trends.

This news is very important, as it shows the current state of Australia’s economic situation. These figures have a strong impact in case of market disappointment or good surprise, and bring volatility to AUD pairs.

USD – Fed Chairman Powell’s Testimony

Friday, July 16th:

NZD – CPI q/q

USD – Core Retail Sales m/m and Retail Sales m/m. This is news indicating consumer spending, which is used to assess another part of the US economy.

Quote of the week – Psychological Preparation

“The best preparation for tomorrow is doing your best today.” H. Jackson Brown, Jr.

If you want to be ready to face your greatest weaknesses in the markets this week (and not to face the markets, be careful not to confuse this because your only enemy is yourself), you must prepare yourself. What does a boxer do before a new fight? He prepares himself physically and psychologically for months in order to be ready for a fight lasting about an hour. His entire fight will be based on the intensity of his preparation, and the winner will simply be the best prepared. Why? Because preparation allows you to become stronger, more technical, or more resistant to traps, obstacles or emotional shocks that will be in your way.

But then, how can you prepare effectively? It’s simple: do your best today. Don’t put off preparation until tomorrow and don’t procrastinate, because the mountain of work will only get bigger and your motivation will gradually decrease. Do your best to get as much work done as possible in as little time as possible, remembering that the better prepared you are, the more likely you are to succeed.

Good preparation will help you avoid making mistakes by acting in haste. Before you go back to the markets, be prepared!

Have a great trading week everyone!