Weekly Outlook: 5/31/21 - 6/4/21

New month, new goals! Are you well prepared for June, or did you just enjoy the weekend instead? Don’t worry, our insights are here to help you prepare for this new trading week.

What happened last week?

As far as cryptos are concerned, there was an attempt to rebound last week with some notable upside. Many traders thought that this rebound was an opportunity to buy back cryptos, however the truce was not long lasting. Indeed, the bearish movements are back and Bitcoin is notably back around $35k.

As for Forex, there have been many interesting moves and opportunities. For example, the EUR pairs made a false bullish move at the beginning of the week before starting a big retracement from the middle of the week. This happens very regularly and can be explained by the fact that the new weekly candle often takes a direction at the beginning of the week to create its wick and then turns around in the following days. It is said that the market is preparing to make the real move by first making a false move in order to chase liquidity. In the EUR pairs, the liquidity was chased upwards and overextended bullish moves were made, before continuing downwards once the liquidity was collected.

In metals, gold finally managed to continue upwards by breaking the resistance at 1874 under which it was consolidating. The safe haven par excellence is now back in force at the psychological price of 1900, partly as a result of the pronounced weakness of the dollar against most instruments.

Indeed, the dollar is having a very difficult time showing sustained bullish signs and is unable to truly reject the support above which it recently settled. This support is not an insignificant one: it is the lowest of the year, established at least in January (between 89.85 and 90.00). With inflation expectations and economic indicators that have so far failed to satisfy investors, could the dollar continue to fall until it reaches its 2018 low around 89.00? If so, the price of gold could continue to soar between dollar weakness and rising economic uncertainty.

Looking ahead to next week: what moves should we be watching for?

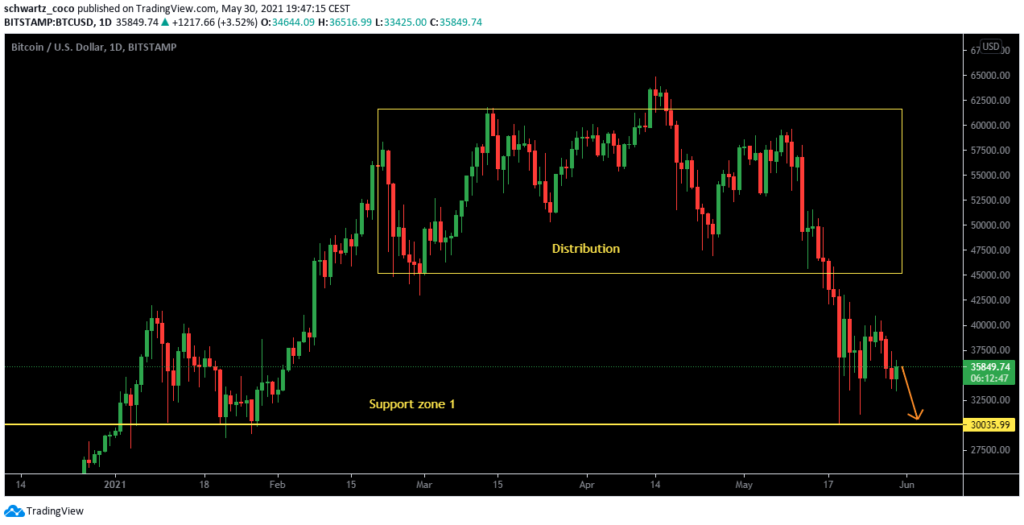

Bitcoin Technical Analysis: Is the second wave coming?

As we predicted in last week’s weekly outlook, the bullish signs for Bitcoin were all too weak in the face of bearish pressure. Now back around $35k, BTC may be able to continue downward to fill that bearish wick at $30k support, and retest that psychological level that has many investors scared. Technically, the signs still look bearish.

EURCHF Technical Analysis: Possible liquidity hunt before a reversal?

EURCHF has been in a bearish channel since March, and is now stabilizing above weakening technical support. The signs look bearish, and EURCHF may well make a significant move lower to chase buyers’ cash out of support, only to continue higher later in the week.

GBPUSD Technical Analysis: Weakening resistance?

The psychological resistance of 1.42 seems to be generating weaker and weaker rejections. As we enter June, GBPUSD may be able to continue upwards to break this resistance and make a final retest of the top of the uptrend channel. Then, a deeper retracement to the bottom of the channel could be in order.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Like every first week of the month, there will be a lot of news to watch!

Tuesday, June 1st:

AUD – RBA Rate Statement: It’s among the primary tools the RBA Reserve Bank Board uses to communicate with investors about monetary policy. It contains the outcome of their decision on interest rates and commentary about the economic conditions that influenced their decision. Most importantly, it discusses the economic outlook and offers clues on the outcome of future decisions.

ALL – OPEC Meetings: OPEC-JMMC meetings are attended by representatives from the 13 OPEC members and 11 other oil-rich nations. They discuss a range of issues regarding energy markets and, most importantly, agree on how much oil they will produce. These discussions are likely to have an impact on countries for which oil revenues are very important for the economy.

USD – ISM Manufacturing PMI

GBP – BOE Gov Bailey Speaks: As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

This Tuesday will be full of news!

Wednesday, June 2nd:

AUD – GDP: one of the leading indicators of economic health.

Thursday June 3rd:

USD – ISM Services PMI

Friday June 4th:

The most important Friday of the month for many pairs is the first Friday of the month. Major news takes place on this day for the USD and CAD.

USD:

– Fed Chair Powell Speaks

– Average Hourly Earnings

– Non-Farm Employment Change

– Unemployment Rate

This first Friday of the month is synonymous with NFP day for USD pairs. The main indicators of the country’s economic health are released, and investors react massively according to the outgoing figures. If they are better than expected and the economic health of the US is very good, then the market will gain optimism and the USD will be strong. Conversely, if the numbers are worse than expected, then pessimism grips the market, and the USD is weak, potentially causing the value of other instruments like gold to soar.

CAD:

– Employment Change

– Unemployment Rate

These indicators also determine a diagnosis of the country’s economic health. Better than expected numbers are good for the currency, and worse than expected numbers are bad.

Quote of the week – Psychological Preparation

“The “lucky” trader is one who minimizes mistakes and, if they do make a mistake, acts to minimize the damage by exiting from the situation quickly. In practice this means having a written plan for each trade you enter, the most important element of which is the stop-loss.” -Jesse Livermore

How better to start the month than by reminding you of some concepts that are essential to profitable trading such as the use of a stop loss, or the disciplined following of a tested plan. The stop loss is not an option and must be used on every trade. It should not be set at a specific amount of pips that you will repeat on all your trades, but should be adapted to the structure of the trade in question. The placement of your stop loss is just as important a part of your plan as your entry strategy, however many traders forget this and focus only on the latter. When it comes to your plan, remember to backtest it thoroughly over hundreds of trades and several years of trading before you rely on it. It is essential to verify that the technical advantage you think you have is real. Once your plan is backtested, act like a professional and trade your plan!

We wish you a great start to the month!