Weekly Outlook: 5/24/21 - 5/28/21

Ready for another week of trading? Don’t miss the latest market news with our weekly outlook!

What happened last week?

As you probably know, most crypto currencies collapsed last week after a number of announcements cast doubt on the markets.

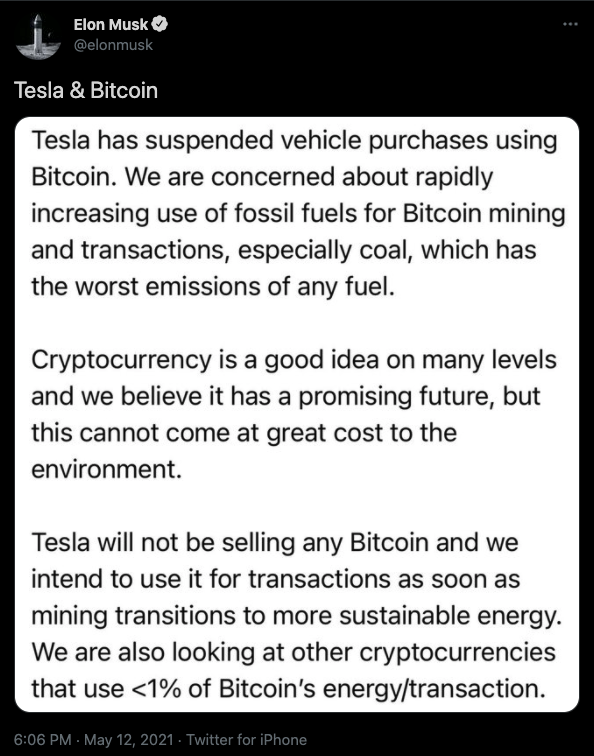

The first wave of pessimism was launched by Elon Musk, becoming one of the most influential figures in the crypto market, when he announced that Tesla would stop accepting Bitcoin until it became more eco-friendly.

Here’s the tweet he posted:

After that, other announcements shook up the price of Bitcoin, and consequently that of all cryptos, such as China declaring that it was banning Bitcoin and its mining. A real bombshell on the market that followed closely on the heels of US President Joe Biden’s announcement that the tax on Bitcoin could increase dramatically. Following this pile of bad news, Bitcoin did not resist and collapsed causing a real crash of all cryptos. Bitcoin has lost more than 50% of its value in ten days and is now around $36,000, compared to more than $64,000 previously. Panic is the order of the day in the markets, and minds are confused.

At the same time, on the metals market, gold has continued to soar, approaching $1,900 once again. Gold being the safe haven par excellence, its price is logically soaring after so much uncertainty in all financial markets. Investors need stability, which they find in gold.

Speaking of instability, let’s take a look at the dollar index. After poor economic results released during the previous NFP (Non Farm Payroll), during which the U.S. government announced that it had only created 266,000 jobs versus the 1 million jobs announced, the dollar continued to fall and is back on its major technical support located at 90.00. Pessimism is also the order of the day for the dollar, with the specter of inflation casting doubt on the markets’ dominant currency.

Looking ahead to next week: what moves should we be watching for?

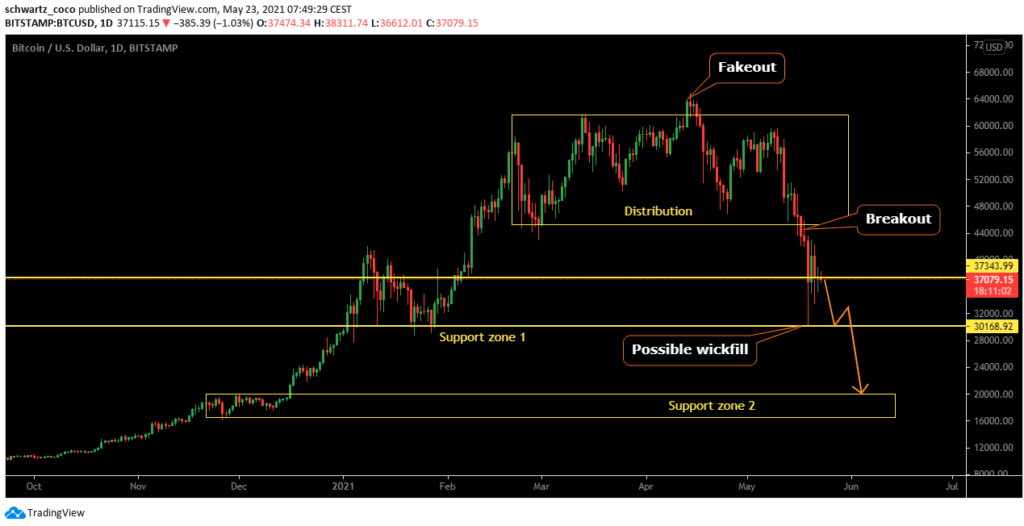

Bitcoin Technical Analysis: Rebound or fatal fall?

From a technical perspective, the bearish scenario may be the most likely. Bullish signs are weak, and support zones are being broken one by one under the pressure of market panic. The distribution phase is over, the $BTC has broken out of this range after a fakeout and continues to fall to its supports. How far could it fall?

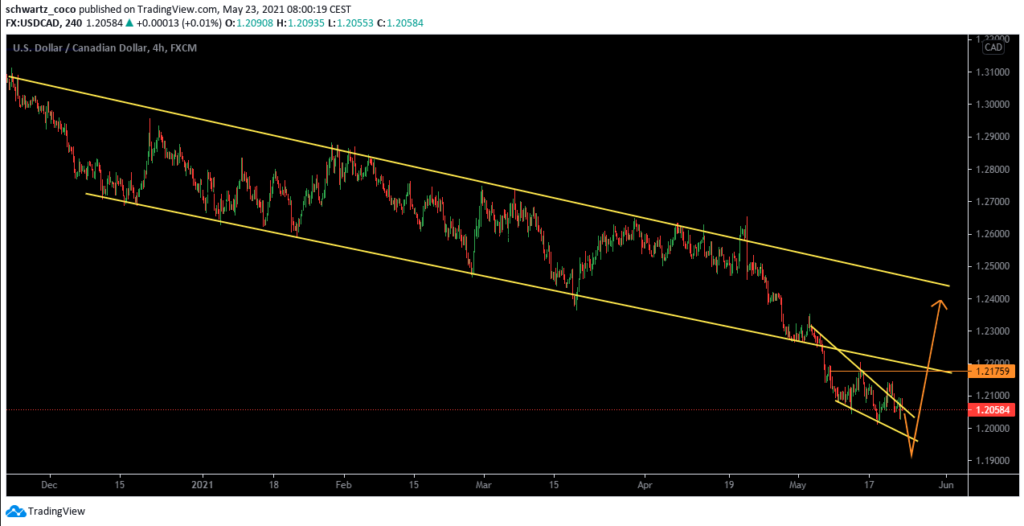

USDCAD Technical Analysis: Continued weakness, but a more optimistic future ahead?

USDCAD is contained in a short-term bearish channel below the long-term bearish channel that recently broke out on impulse. Buyers who had been in the majority for weeks despite the sharp drop in price seem to be losing hope, and a final bearish move may well discourage them from their positions. From a technical standpoint, it could be that this pair will continue to fall in order to chase cash at the bottom of the channel before considering a possible bullish rebound by re-entering the long-term channel.

GOLD – XAUUSD Technical Analysis: a bullish continuation to come?

Gold continues to create higher highs and higher lows. The uptrend is confirmed, and the price has now reached resistance and the top of its uptrend channel. A possible rejection zone initiating a retracement before continuing upwards towards the previous highs?

Fundamentals to watch for this new trading week:

Monday, May 24th: The week begins with bank holidays for the following currencies: CHF, EUR, CAD. Volatility could be affected a little bit, but the main sessions (London and New York) will be open. The movements should therefore occur despite these bank holidays.

At the same time, important news will take place on the Great British Pound (GBP) pairs:

BOE Gov Bailey Speaks. How does this affect traders? As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

Wednesday, May 26th: Important news to watch for on the New Zealand Dollar (NZD):

-RBNZ Monetary Policy Statement

-RBNZ Rate Statement

-RBNZ Press Conference

These announcements will give a clue on the macroeconomic direction of the NZD via its monetary policy, thus having a strong impact on the financial markets. This is the equivalent of the FOMC for NZD pairs.

Finally, Thursday May 27th, the important news of the week for the USD:

USD – Prelim GDP q/q. Why are traders watching this carefully? Because it is the broadest measure of economic activity and the primary gauge of the economy’s health.

Quote of the week – Psychological Preparation

“Desire is the key to motivation, but it’s determination and commitment to an unrelenting pursuit of your goal – a commitment to excellence – that will enable you to attain the success you seek.” ― Mario Andretti

Trading is about the pursuit of excellence. To succeed, you must be demanding of yourself and never rest on your laurels. Just because you’ve made progress and are now profitable doesn’t mean you should relax: quite the opposite! When you gain confidence and relax your efforts… the market will make you pay for it in cash. To be profitable and successful in the long run, it is essential to be passionate, committed and dedicated to improving your skills as a trader. This determination will push you to the top, because you’ve earned it.