Weekly Outlook: 7/19/21 - 7/23/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

To begin, let’s review the analysis published in the previous weekly outlook.

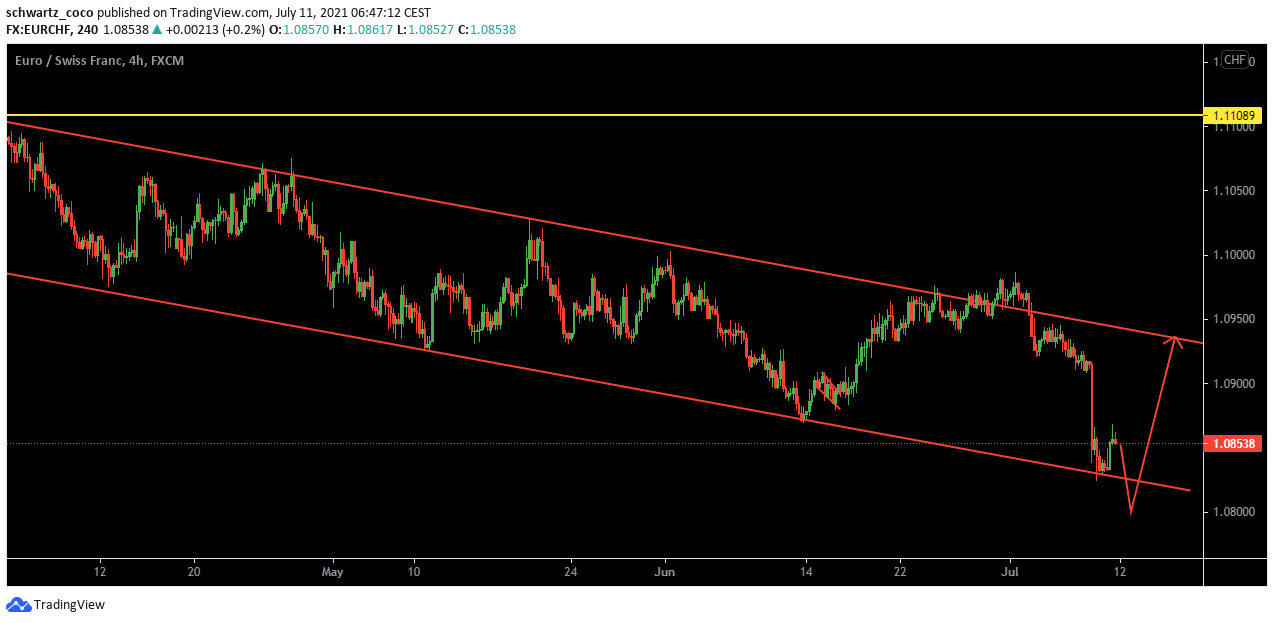

EURCHF did conduct a liquidity hunt below the bottom of the channel before bouncing back, as our analysis probabilities indicated. The bullish directional engulfing that re-entered the bearish channel showed a clear sign of strength, and the price has since begun to build momentum.

Here is EURCHF before:

Here is EURCHF after:

Remember our bearish analysis of Ethereum? The price did fall, and went to the liquidity zone we were talking about by repeating a bearish impulse of a similar size as the first impulse.

ETHUSD before:

ETHUSD after:

The area of support and liquidity then bounced the price.

GBPUSD also followed the published analysis very closely, with a magnificent fakeout of the resistance that surely trapped a large number of buyers before starting a large-scale bearish move. 143 pip drop since our analysis.

GBPUSD before:

GBPUSD after:

Concerning GOLD (XAUUSD), our daily analysis has also been successful despite the big retracement on Friday. We were talking about a bullish continuation movement ahead, which is what happened. Now the trend still looks bullish and the price has made an impulse start.

XAUUSD before:

XAUUSD after:

A very good week and a lot of analysis respected by the market movements! Now it’s time to prepare for the upcoming week to perform just as well and prepare yourself in the most efficient way possible.

Looking ahead to next week: what moves should we be watching for?

DXY (Dollar Index): A possible bearish movement to watch in the coming days.

The dollar finally continued to rise and failed to break the short-term bullish channel in which it is consolidating. If the latter were to break to the downside as in our technical analysis, the Dollar could fall to the next big technical support and make a correction movement of the previous bullish impulse.

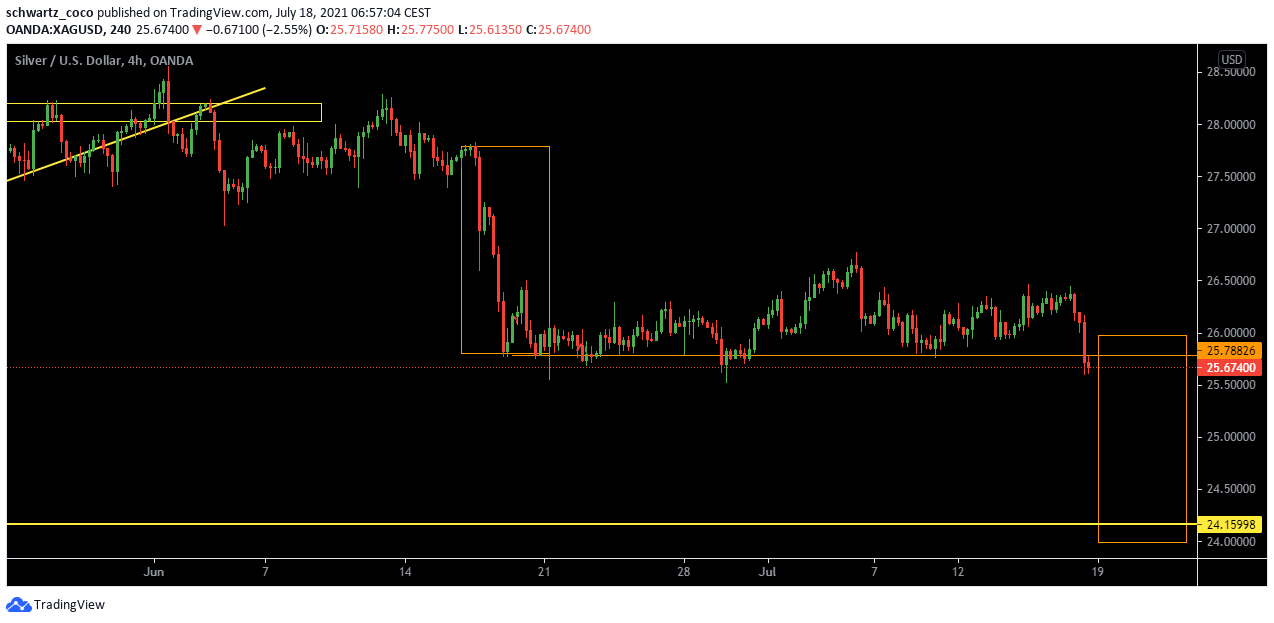

SILVER (XAGUSD): Bearish continuation after breaking a weak support?

Chart 1: General situation

Chart 2: Focus on the weakening technical support

After breaking the long term uptrend and making a first bearish impulse of significant size, Silver has consolidated for some time in a range. The support of this consolidation has recently broken and is clearly weakening due to the number of times it has been retested without ever giving the strength needed for a big bullish impulse breaking the consolidation from above. The odds could be bearish until the previous uptrend is corrected with a bearish move of similar size to the first impulse.

USDJPY: Sellers still in force?

Since the bearish analysis we published of USDJPY prior to the July NFP, the price has dropped over 200 pips. Now, the downtrend seems to be well established and USDJPY could continue its fall by creating a new low very soon.

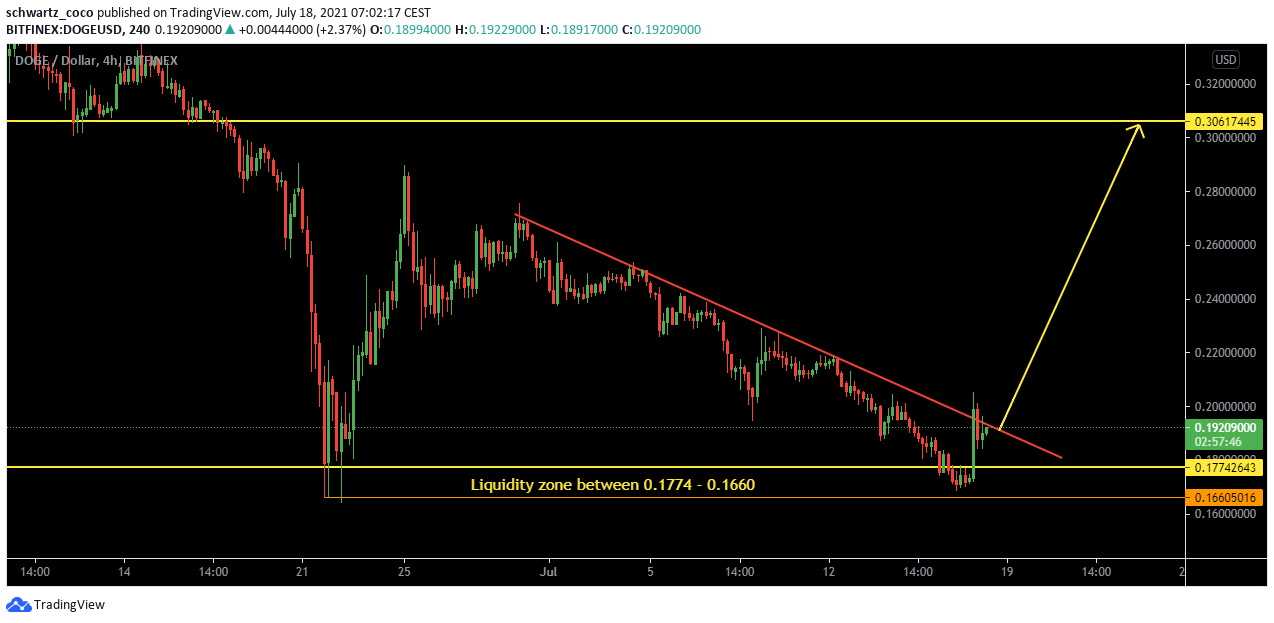

DOGECOIN: Finally a bullish reversal?

This week, we had published bearish analysis several times in our Telegram group and on our Discord server regarding Dogecoin (since 0.24). The price recently hit our target, which was the liquidity zone acting as technical support. Now the price seems to be bouncing off this area with a wonderful bullish impulse that has broken the downtrend, and could be the starting point for a reversal. Will the bull run be back soon?

EURUSD: Continuation of the downtrend?

EURUSD made a huge bearish impulse of more than 370 pips during the month of June. Since the beginning of July, we have seen a tricky situation where EURUSD is stuck in a consolidation before the price finds its direction. Recently, EURUSD broke and retested this consolidation, and may very well continue its fall to the next major technical support very soon.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Tuesday, July 20:

AUD – Monetary Policy Meeting Minutes

It’s a detailed record of the RBA Reserve Bank Board’s most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates. AUD traders will obviously be following this economic news very closely!

Thursday, July 22:

JPY – Bank holiday

Be careful, on bank holidays, volatility is heavily impacted on the major session that corresponds to the country of the currency. As this is a bank holiday for the JPY, the volume of the Asian session may be heavily modified and the movements may not be similar.

EUR – ECB Press Conference & Monetary Policy Statement

This is much anticipated news for the EUR, which is looking for its trend as we have seen in the past few weeks. The economic policy of the Euro-Zone will be closely watched by investors for future trend setting, so this news is very important.

Friday, July 23:

JPY – Bank holiday

Pay attention during the Asian session.

EUR – German Flash Manufacturing PMI & German Flash Services PMI

This economic news is also highly anticipated as Germany is the leading economic power in the Eurozone, in which it is a real driver.

Quote of the week – Psychological Preparation

“Some people want it to happen, some people would like it to happen and some people make it happen.”

-Michael Jordan

Want to succeed in becoming profitable? Put yourself on the side of the winners and adopt their mindset. Many people are dreamers and have high hopes for their future without ever giving themselves the means to succeed… They will say that success only happens to others, that it’s only a matter of luck, and will be almost envious of those who succeed because they didn’t manage to do the same as them. However, they only see the visible part of the iceberg: success. Behind it, the hidden part reflects years of disciplined and consistent hard work behind the scenes to become a better person and a better trader every day.

There is a time to think, and a time to act. Empower yourself to be a better trader this week, prepare as much as you can, give your best every day of the week, and repeat that every other week of the year. Consistency is the key, and your results will let you know!

Have a great trading week everyone!