Weekly Outlook: 8/23/21 - 8/27/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

This week, we were able to witness a correction movement on the cryptos before starting a new bullish rebound. It’s a good thing, this is once again exactly what we had analyzed!

BITCOIN: The $49,000 target we’ve been telling you about for a few weeks now (since $38,000, or +$10,000 for BTC) was recently reached. What a rebound!

BTC before:

BTC after:

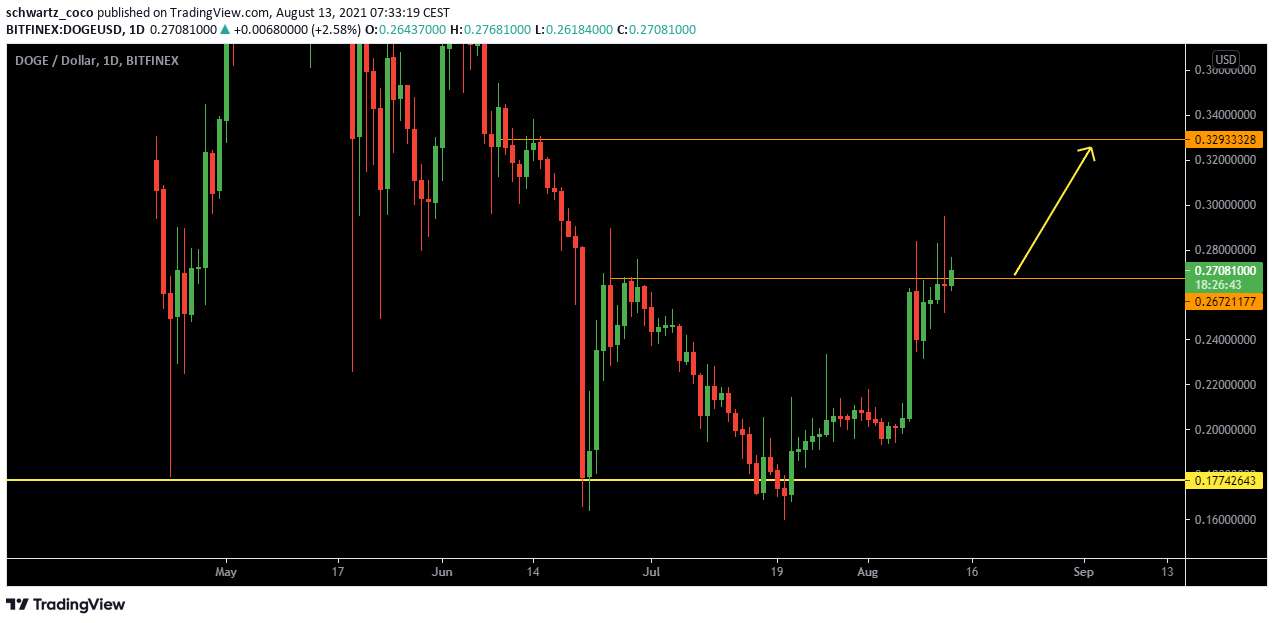

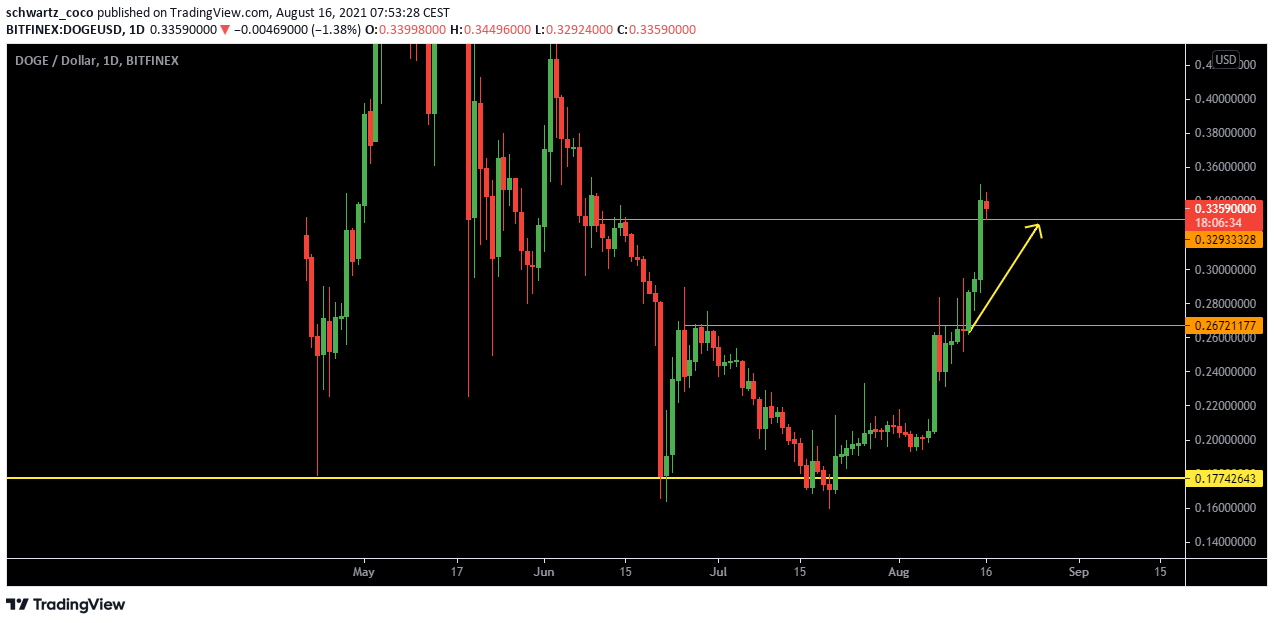

DOGECOIN: the price has also reached its target around $0.33, again perfectly following our analysis.

DOGE before:

DOGE after:

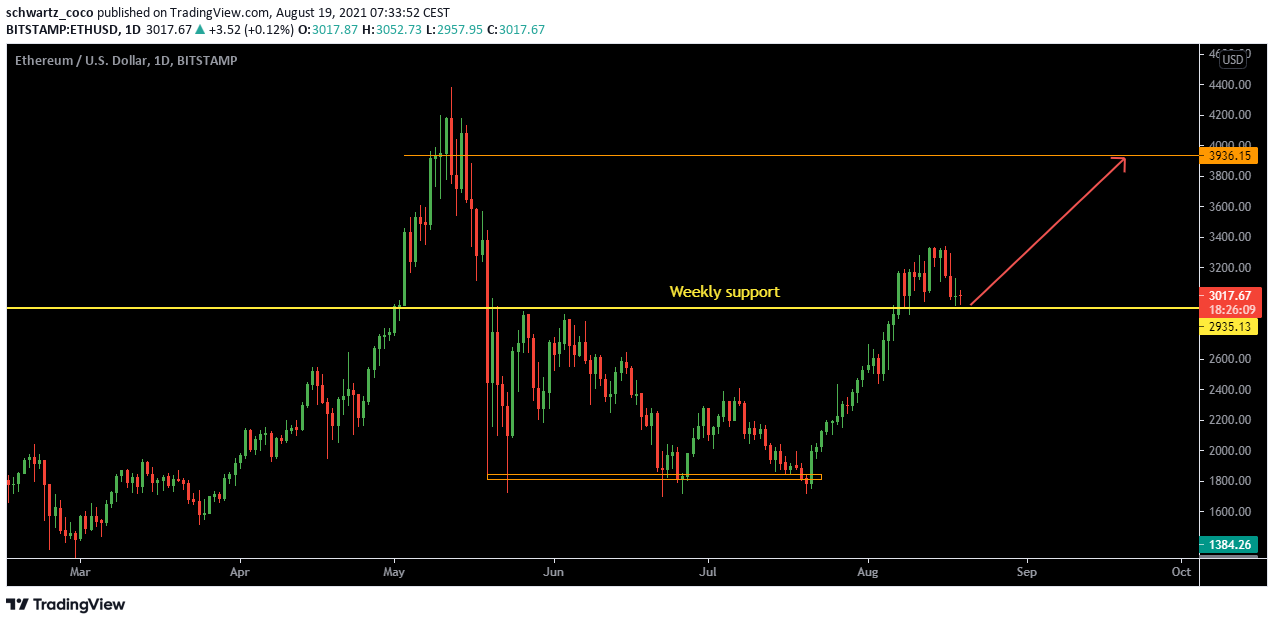

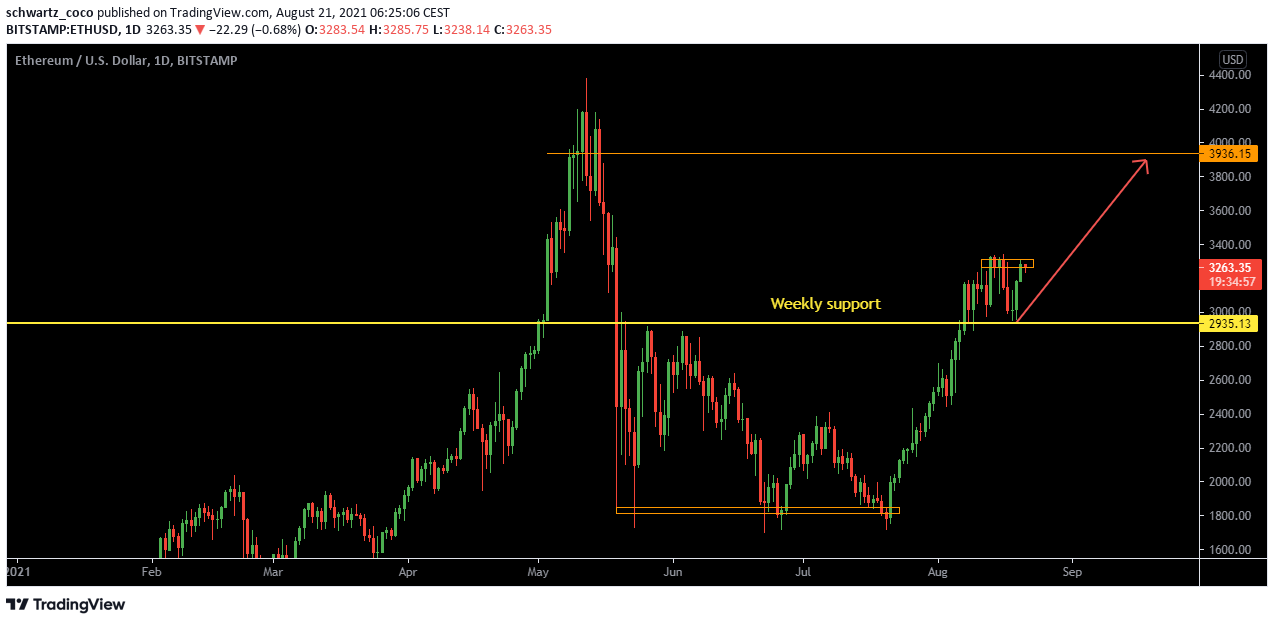

ETHEREUM : very nice rebound of ETH on the technical support we had talked about the same day on Discord, Telegram and Twitter. The price could continue to rise after this beautiful rebound of continuation of trend!

ETH before:

ETH after:

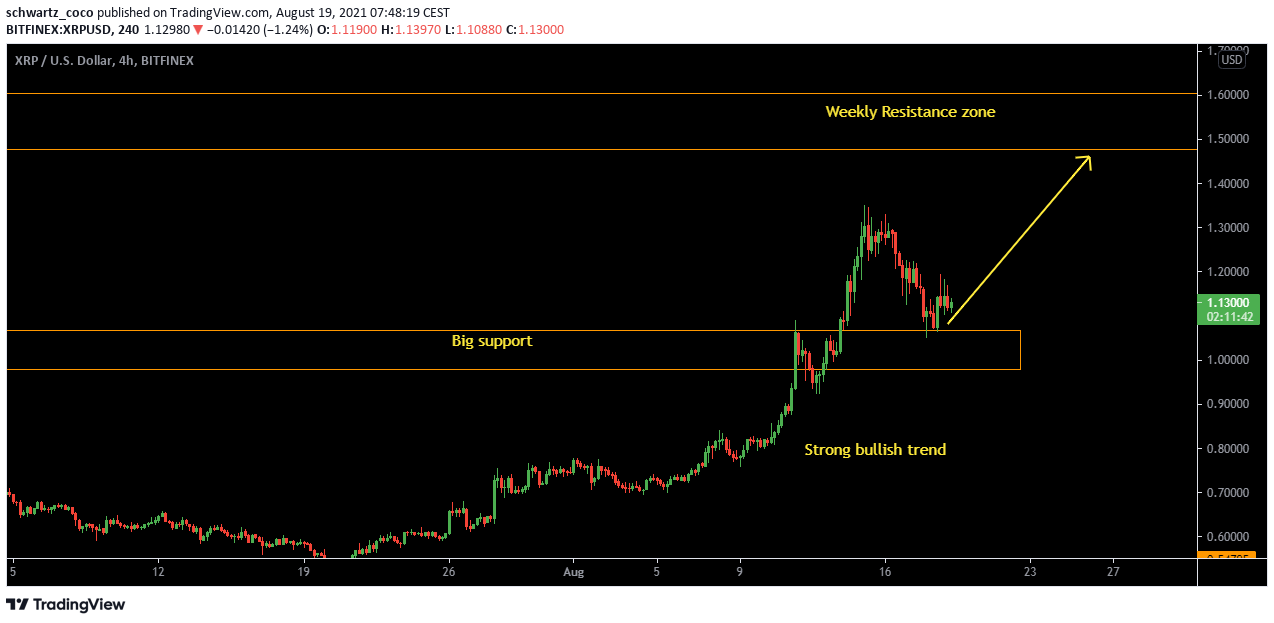

XRP: same pattern as on ETHEREUM for XRP with a magnificent rebound on the previous resistance which became a major support of this bull run. The price has well started to follow our analysis!

XRP before:

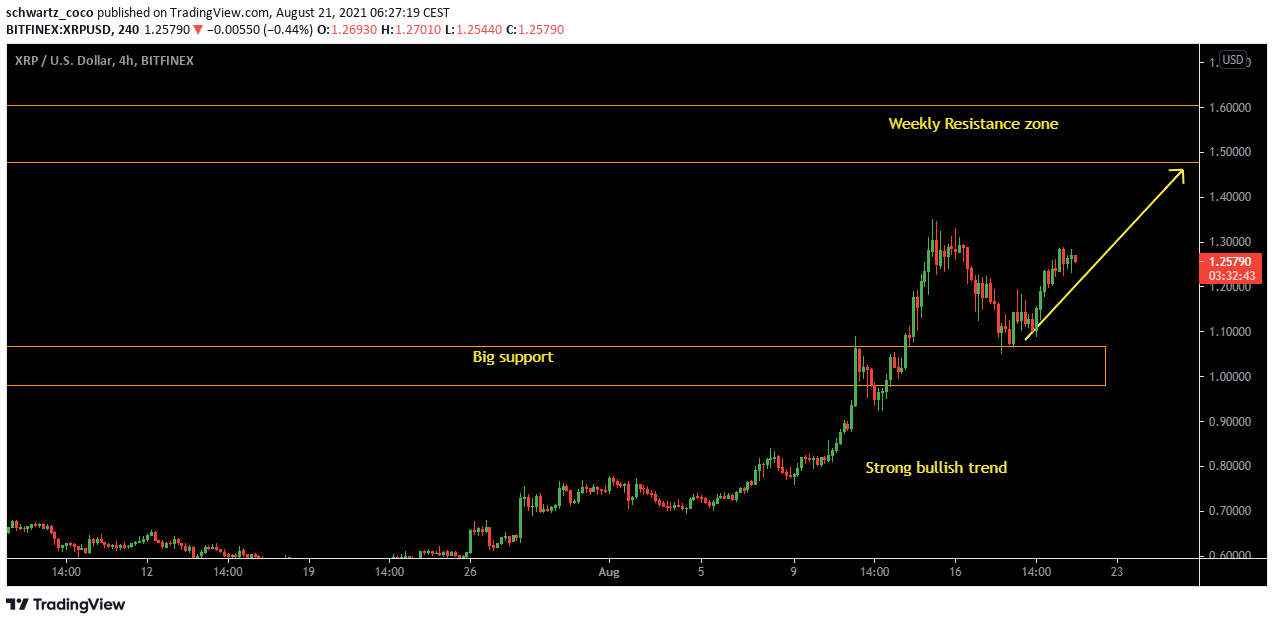

XRP after:

EURJPY: As explained in the previous weekly outlook, the odds were stacked in favor of a fall as a continuation of the trend on EURJPY. The price has fallen widely and reached the target area with over 100 pips of profit!

EURJPY before:

EURJPY after:

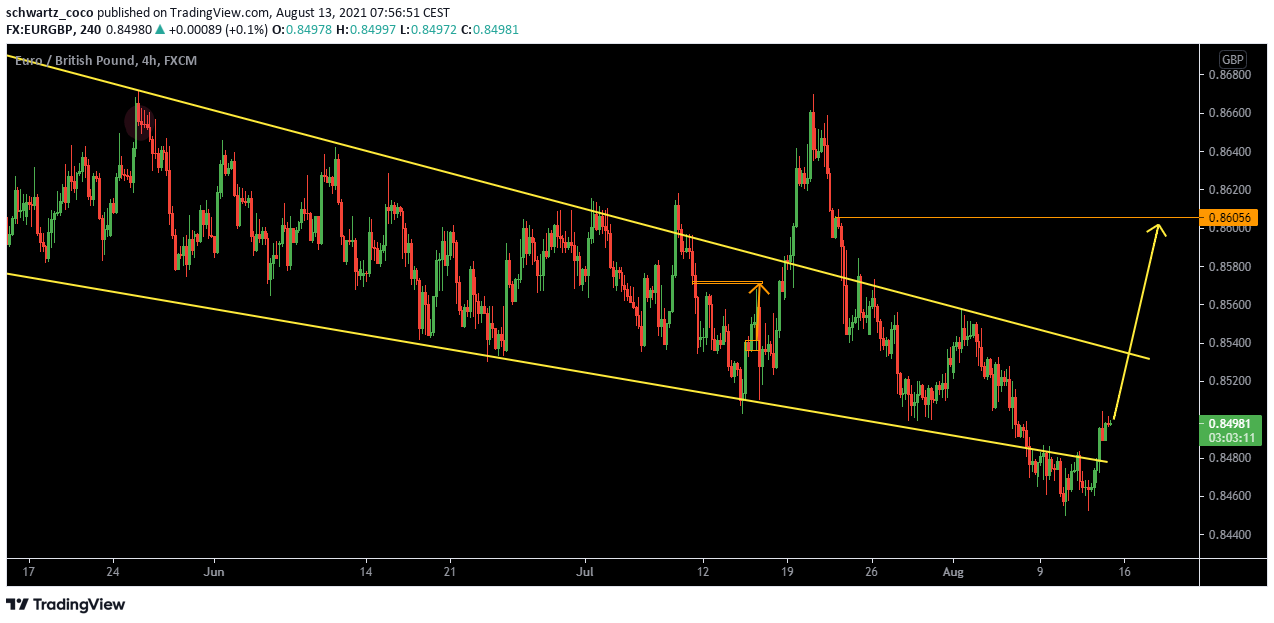

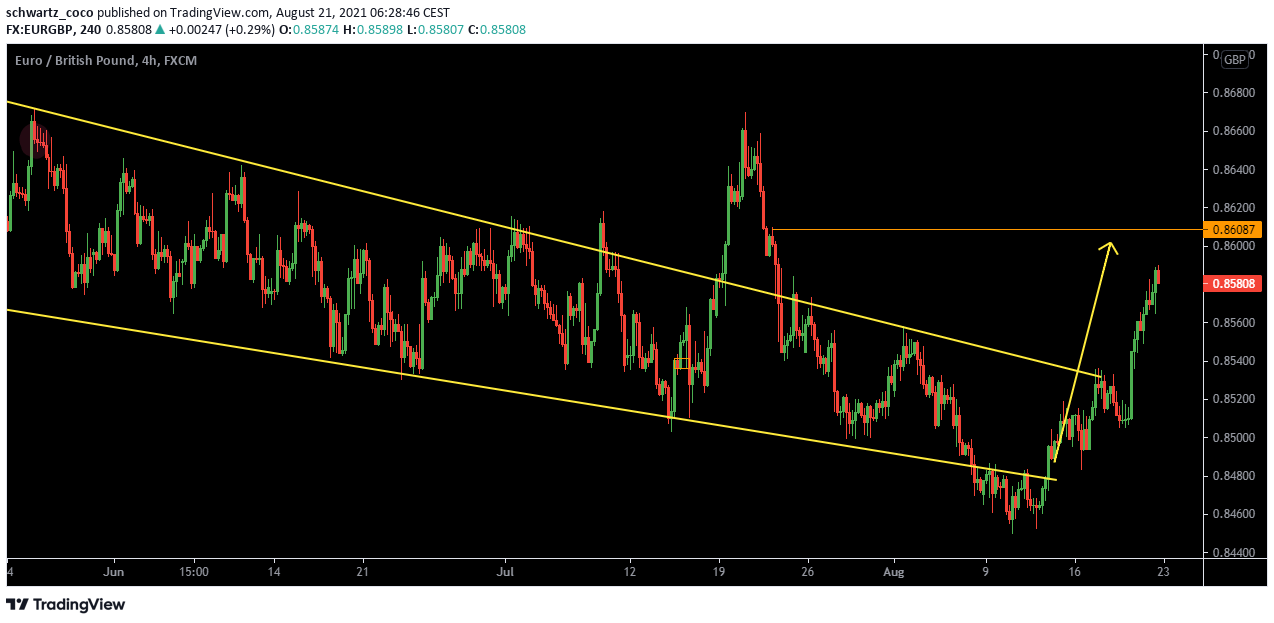

EURGBP also rebounded nicely, respecting the bottom of its bearish channel and perfectly following our analysis

EURGBP before:

EURGBP after:

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

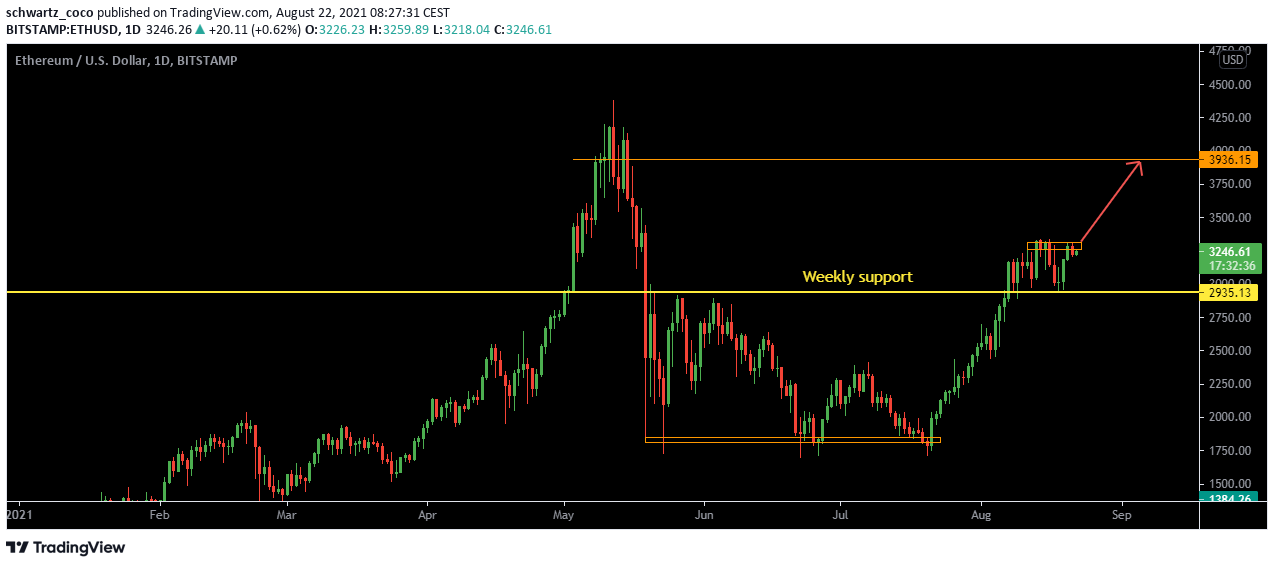

ETHEREUM: Bullish continuation towards $4000?

ETH could continue to rise if the resistance that currently holds the price is broken. The rejection of the previous support zone was very clean and could cause a new impulse.

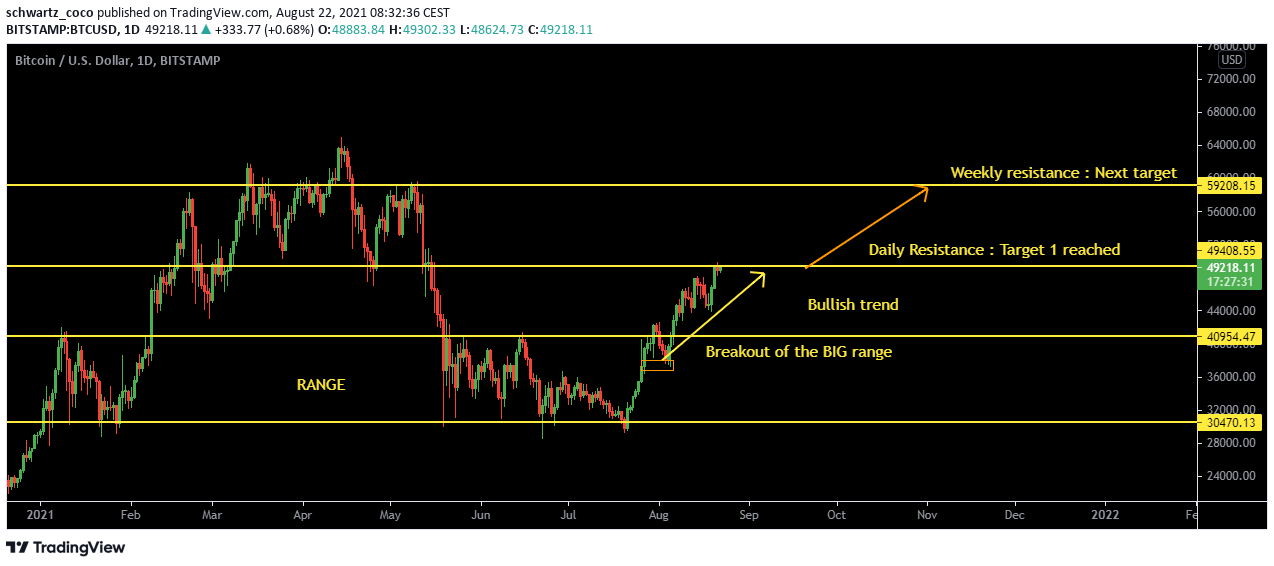

BITCOIN: New zone reached, new targets?

The price has now entered a new zone between $49,000 and $59,000. In case of bullish continuation, the margin is large and the bull run might not stop there!

XRP: Towards $1.49?

The price could continue to rise after this magnificent bullish impulse that broke everything in its path. At present, the next target resistance could be the $1.49, which gives the price a nice margin of movement!

DXY: Back to normal?

As we explained earlier, the Dollar could correct the downward movement linked to COVID19 if the resistance of this long-term range is broken. The Dollar price has already rebounded well, and this could continue in the coming weeks.

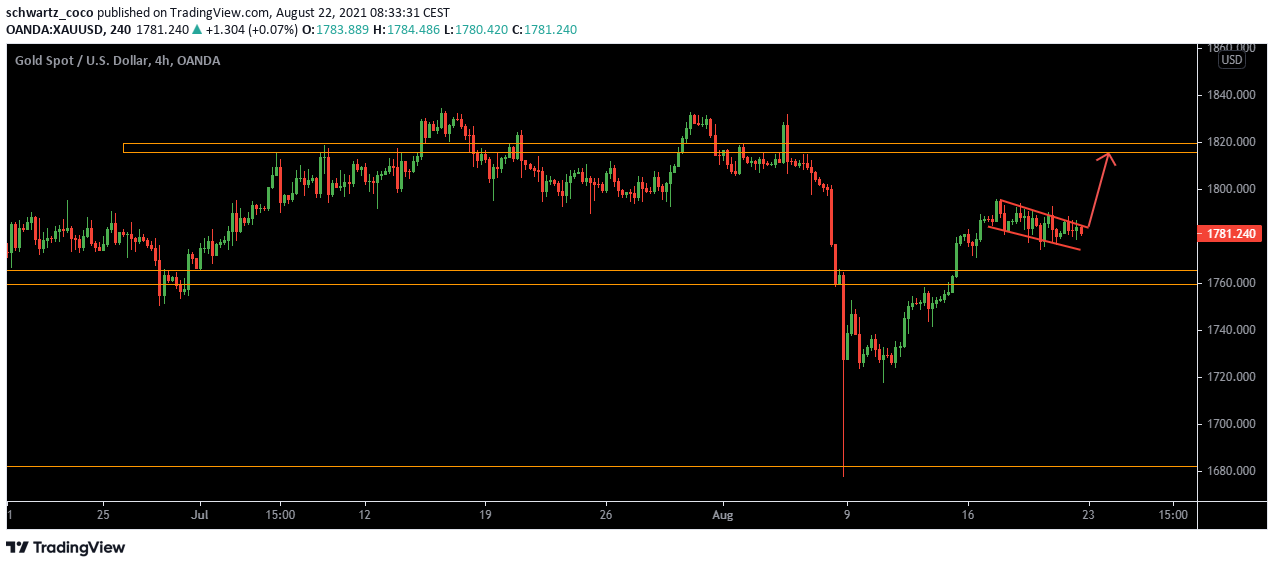

GOLD (XAUUSD) Towards $1816?

GOLD could continue to rise on a bullish breach of this bearish channel and correct the impulsive downward movement that can be seen on the left side of the chart.

NZDUSD: Respect for the bearish channel and correction?

NZDUSD has made an overextended bearish move and the price could retrace to the top of this channel if it re-enters the channel.

EURAUD: Impulse then correction?

EURAUD could also retrace after the huge upward impulse in price. A breath of fresh air before a possible continuation of the long-term trend?

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, August 23rd

EUR – German Flash Manufacturing PMI & German Flash Services PMI

These are major indicators of the economic health of Germany, which is considered the economic engine of the euro zone.

Thursday, August 26th

USD – Prelim GDP q/q

It’s the broadest measure of economic activity and the primary gauge of the economy’s health

ALL – Jackson Hole Symposium

The Economic Policy Symposium, held in Jackson Hole, Wyoming, is attended by central bankers, finance ministers, academics, and financial market participants from around the world. The meetings are closed to the press but officials usually talk with reporters throughout the day. Comments and speeches from central bankers and other influential officials can create significant market volatility.

Friday, August 27th

USD – Core PCE Price Index m/m

Differs from Core CPI in that it only measures goods and services targeted towards and consumed by individuals. Prices are weighted according to total expenditure per item which gives important insights into consumer spending behavior. This is rumored to be the Federal Reserve’s favorite inflation measure, but CPI is released about 10 days earlier and tends to garner most of the attention.

USD – Fed Chair Powell Speaks As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person..

ALL – Jackson Hole Symposium Day 2.

Quote of the week – Psychological Preparation

“Life is not about waiting for the storm to pass, but learning to dance in the rain.”

Failures, doubts, fears, periods when nothing goes right are inevitable. You will encounter more than one on the long road to profitability, but you must not allow yourself to sink into negativity. These times are much more rewarding than those when everything is going well, because pain is much more instructive than euphoria. Your fears give you the opportunity to learn more about yourself and to become a stronger person in order to master and control them. Your doubts are made to push you to give the best of yourself every day. The losses are made to make you learn from your mistakes. The storm is not a negative thing… you just have to tame it to use the strength of its wind to push you towards your goals.