Weekly Outlook: 8/30/21 - 9/3/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

This past week there were again some very nice moves in the markets and many analyses hit their targets.

XAUUSD (GOLD): The price made a new bullish impulse and reached the resistance perfectly following the analysis published in the last weekly outlook. The price broke the short term bearish channel and continued to the major resistance.

GOLD before:

GOLD after:

NZDUSD: The price made a great bullish impulse respecting the analysis of the previous weekly outlook. NZDUSD respected the bottom of its bearish channel after chasing the cash and ended up joining the top of its bearish channel with a retracement of 185 pips.

NZDUSD before:

NZDUSD after:

EURAUD: As we explained last week, EURAUD had made a very overextended bullish move and the price needed to breathe. We were talking about a possible retracement, and the price did follow that direction with a 270 pip downward correction.

EURAUD before:

EURAUD after:

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

NZDJPY: Bullish reversal?

NZDJPY could continue to rise after the new attempt to break the long term bearish channel failed once, resulting in a fakeout. This time the breakout could be final and the price has already started to follow our analysis. The bullish potential is huge: over 300 pips.

EURAUD: Bearish continuation?

EURAUD could continue its fall after a possible retest of the previous support which could become a key resistance for the price. The bearish potential is also very important, with more than 200 pips to the bottom of the bullish channel.

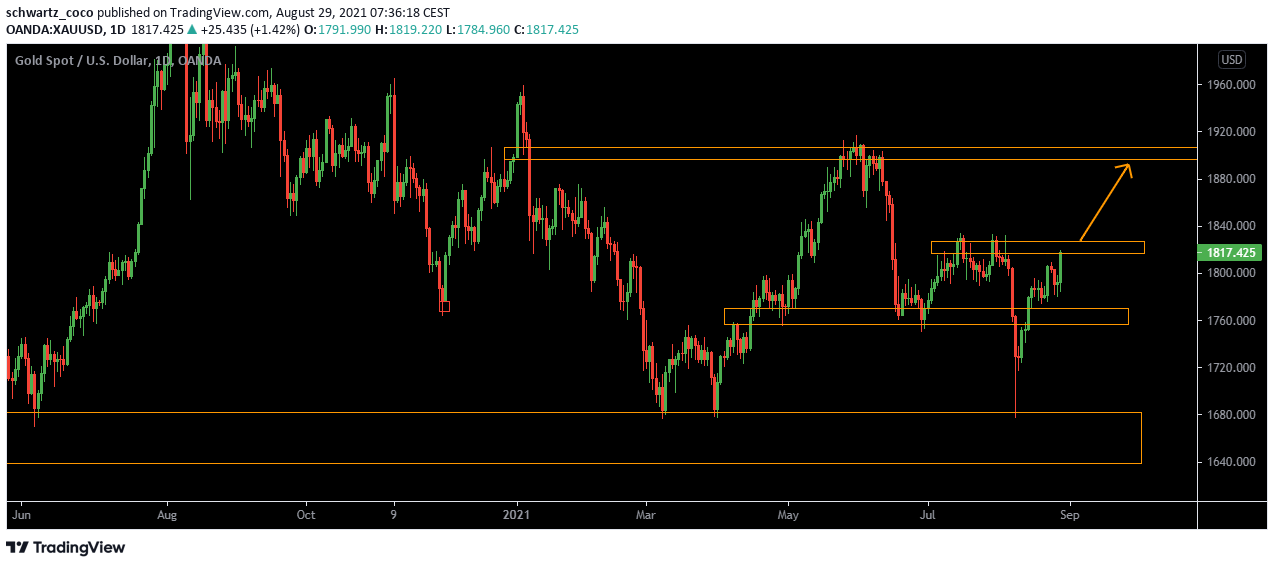

GOLD (XAUUSD): Towards $1900?

XAUUSD could continue its uptrend and reach $1900 soon if the current resistance is broken to the upside. Rejection candles in the previous liquidity zone show strong bullish potential for the price.

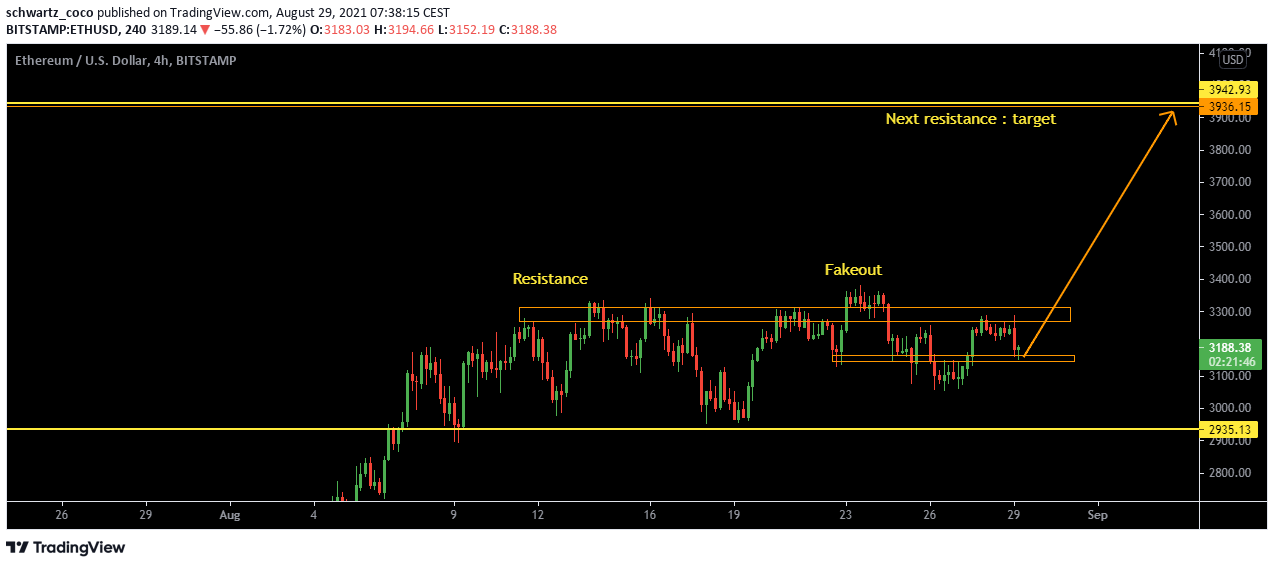

ETHEREUM: Towards $3900?

ETH recently performed a fakeout of the resistance, resulting in a weakening of this key technical level. After a fakeout, the probability of a breakout is (often) higher, and in case of a breakout, the price could make a new large bullish impulse until the next major resistance.

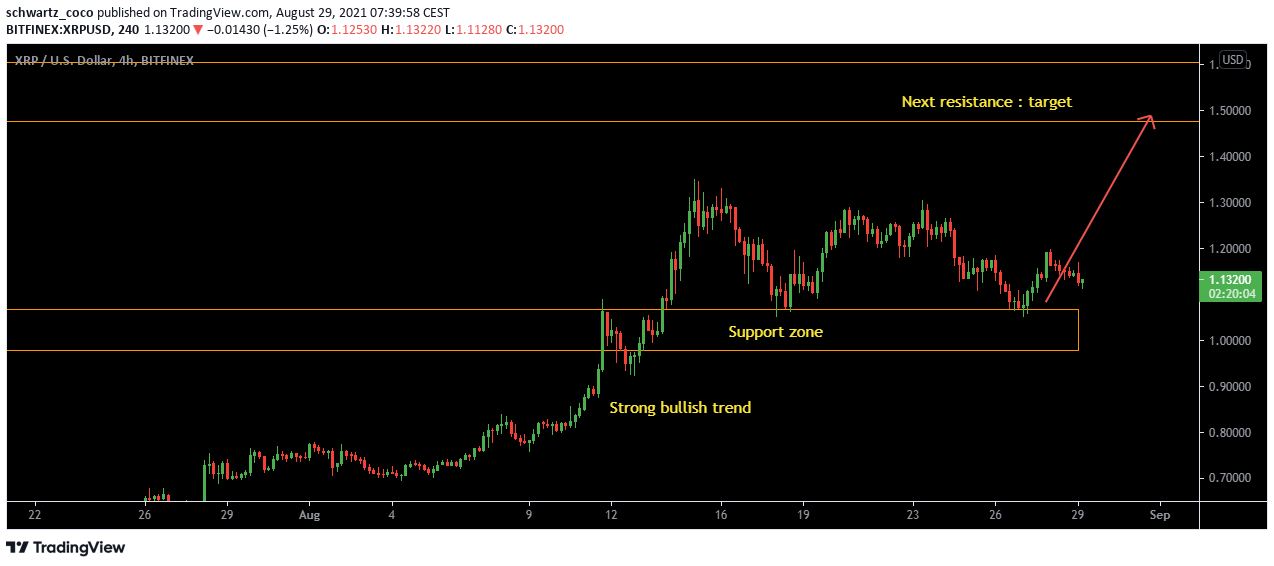

XRP: Bullish continuation to $1.49?

The price has already shown a very nice bullish reaction on the previous support, and buyers seem determined to make it rise in a more sustainable way. We could then see a rise in the price of XRP to $1.49, with a nice continuation of the trend.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, August 30

GBP – Bank Holiday.

Beware, this means that there will be no London session on Monday, and therefore the volatility will potentially not be the same as usual on the London session hours. However, the other sessions will be open (Asian session & New York session).

Thursday, August 31st

AUD – GDP q/q. It is the broadest measure of economic activity and the primary gauge of the economy’s health.

Thursday, September 1st

ALL – OPEC Meetings. OPEC nations represent around 40% of the world’s oil supply and are unified in their oil production levels. With so much control over oil’s supply-side, shifts in their production levels can have a significant impact on oil prices. As a reminder, gold prices can have a considerable impact on the economy of certain countries (such as the USA, Canada, etc.) and therefore have an influence on the price of their currencies.

USD – ADP Non-Farm Employment Change. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

USD – ISM Manufacturing PMI. It is a leading indicator of economic health.

Friday, September 2nd

USD – NFP Day (Average Hourly Earnings m/m + Non-Farm Employment Change + Unemployment Rate). The NFP is the most anticipated and important news of the month for the dollar, as it gives a clear picture of the country’s economic situation and a glimpse of where the dollar’s price might be headed in the short to medium term.

Quote of the week – Psychological Preparation

“The more you talk about negative things in your life, the more you call them in. Speak victory not defeat.” – Joel Osteen

To start the new trading week off right, it’s essential to think positively. Positivity puts you in the psychological conditions to succeed in achieving positive results, while negativity puts you in a situation where you have almost no chance of success. Think about your objectives, visualize your goals and keep in mind each step of your action plan. If you are well prepared and know what you have to do, nothing can stop you this week!