Weekly Outlook: 9/13/21 - 9/17/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

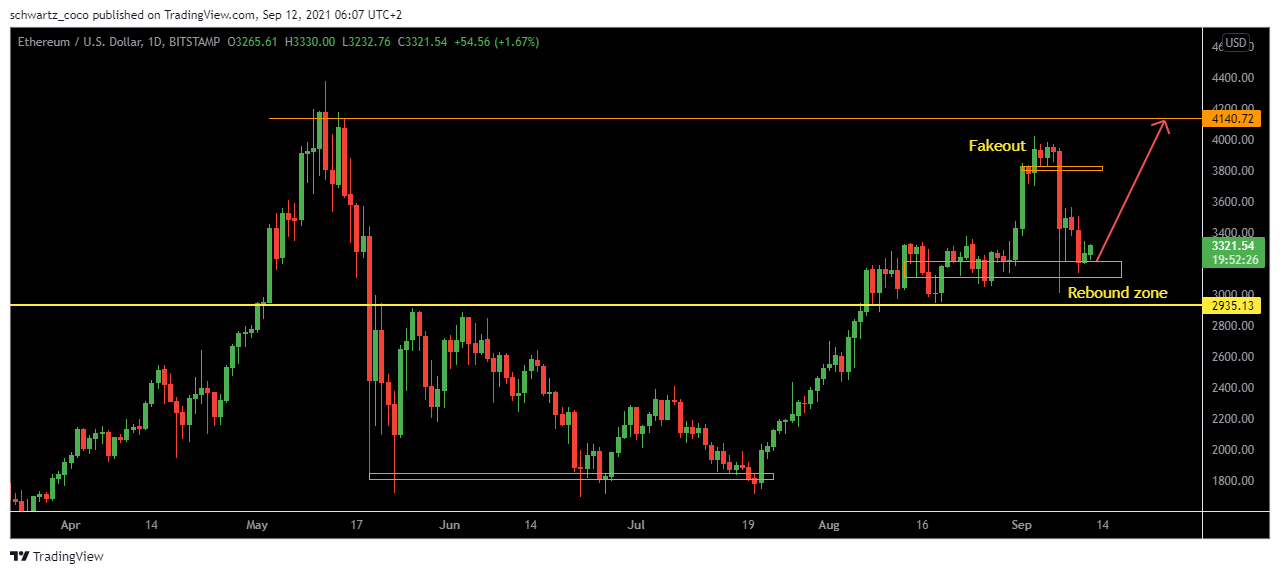

Last week, what had to happen would happen: a liquidity hunt in the middle of the crypto bull run. The goal was the same as during the previous massive crypto crash: to get euphoric buyers out of the market and hunt for their liquidity in order to then continue upwards once the hunt is done. The major cryptos (ETH, BTC, XRP, Dogecoin, etc.) all made huge bearish moves with sometimes more than 10% daily drops, which resulted in a lot of traders using too much leverage on their positions being taken out of the market. The hunt for liquidity turned into a hunt for leverage, in other words a hunt for novice traders who saw this new bull run as an opportunity to make some easy money. In total, more than $2.25 Billion was liquidated in one day, and since then, the market has been consolidating above major technical supports that no longer show much bearish strength.

From a fundamental point of view, the news is rather reassuring on the crypto side. For example, the official announcement that Bitcoin has become a legal currency in El Salvador: a first for a country on a global scale. This is enough to put a smile on investors’ faces and give them optimism after this huge correction day, which reminds all traders to never abuse leverage and to always consider that anything can happen at any time on the markets!

At the same time, our analysis hit the mark again this week with some very nice moves. Here are two examples:

EURCHF followed our analysis to the letter by making a last bullish impulse at the beginning of the week before falling at the end of the week and making this beautiful retest break of the support now becoming resistance of a possible larger bearish move.

EURCHF before:

EURCHF after:

GBPUSD followed our bearish analysis after an overextended bullish move that trapped many traders on the upside. The price respected its bullish channel top before dropping to the bottom of the channel.

GBPUSD before:

GBPUSD after:

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

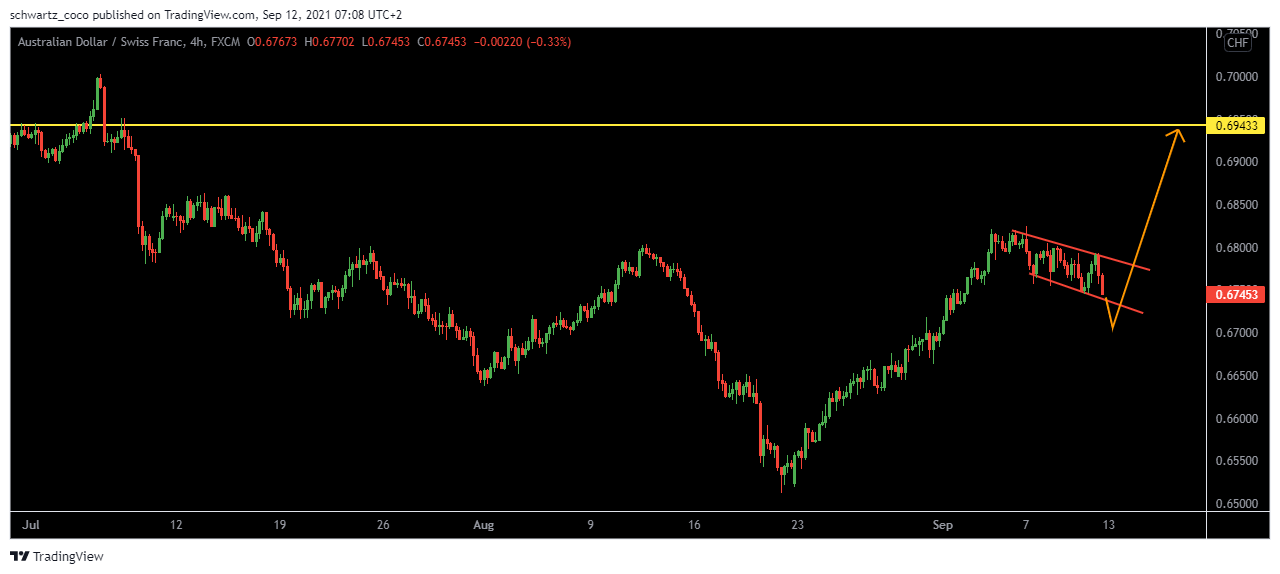

AUDCHF: Bullish continuation for the price?

AUDCHF could continue upwards after this huge impulse that recently broke the bearish structure of the price. If this bearish short-term correction case is broken from above, the price could continue its new trend and make a new impulse of a similar size to the previous one.

EURGBP: Bearish move ahead?

EURGBP could retest the bottom of the bullish channel it recently broke before continuing its long-term downtrend by reaching the next technical support.

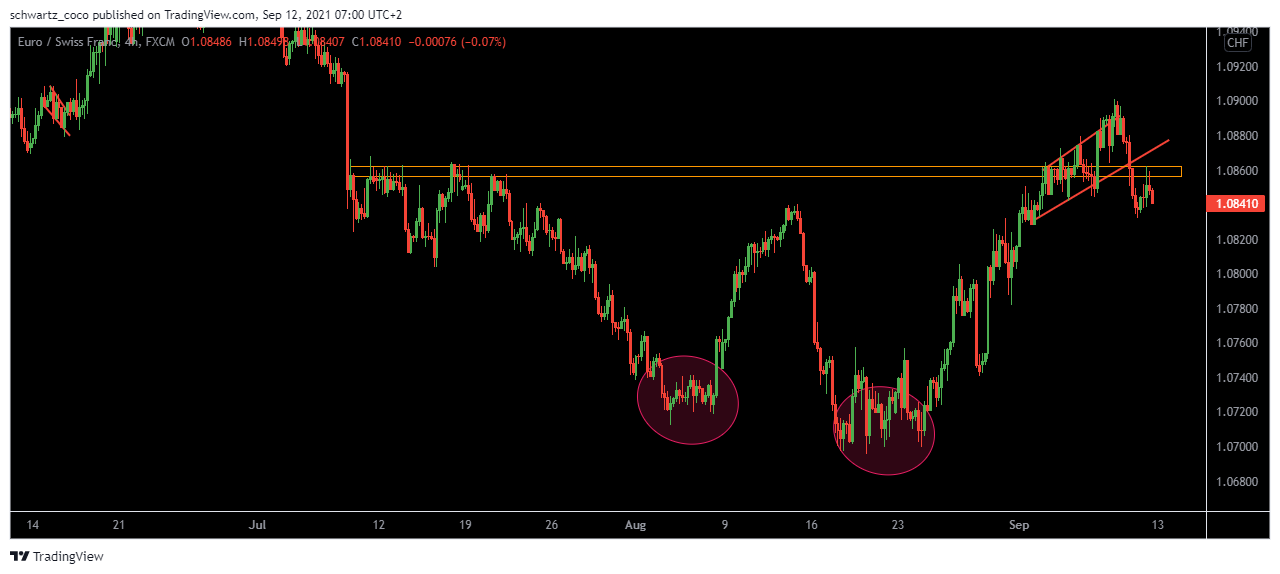

EURCHF: Reversal of the structure?

EURCHF could fake out the uptrend in order to trap impulsive traders and then continue to fall to the next technical support.

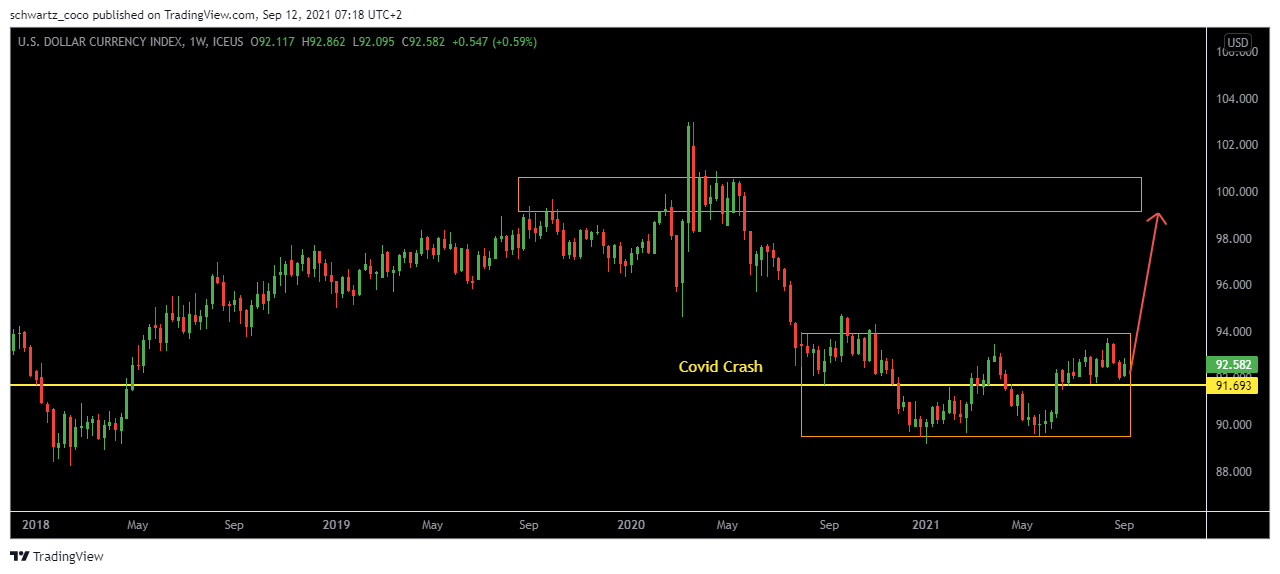

DXY: Massive bullish impulse in the coming weeks?

DXY could take off if this consolidation is broken from above. The price could correct the huge drop that took place during the COVID-19 crisis and return to a normal level.

Gold (XAUUSD): Bearish continuation?

Since the price made this huge bearish impulse, gold is not able to go for new highs. It could continue to fall towards the next long term technical support and then find the strength to rebound.

Ethereum (ETHUSD): Rebound underway?

The last daily candle that closed bullish on technical support shows a strong rebound capacity. The fakeout that caused the liquidity chase has weakened the resistance, and the price could break it on the next retest to continue up to $4100.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, September 13th

AUD – RBA Gov Lowe Speaks

As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

Tuesday, September 14th

USD – CPI m/m & Core CPI m/m

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

Wednesday, September 15th

GBP – CPI y/y

Consumer prices account for a majority of overall inflation.

CAD – CPI m/m

Consumer prices account for a majority of overall inflation.

NZD – GDP q/q

It’s the broadest measure of economic activity and the primary gauge of the economy’s health.

AUD – Employment Change + Unemployment Rate

These two news reports on the economic health of the country are among the most important of the month.

Thursday, September 16th

USD – Core Retail Sales m/m + Retail Sales

It’s the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Quote of the week – Psychological Preparation

“Develop success from failures. Discouragement and failure are two of the surest stepping stones to success.”

– Dale Carnegie

This week of trading did not meet your expectations and you are disappointed with your results? Don’t be discouraged. There is no failure until you choose to give up, because every mistake is just a lesson that will help you become a better trader if you choose to study the triggers of those mistakes.

Why did you act emotionally? Why didn’t you stick to your plan? Why did you take too much risk on this position?

To answer these questions, you’ll need to be honest with yourself and not hide from it. Once you’ve done some deep introspection, you may find that your view of trading may not have been good enough and that you may not have been thinking in terms of probabilities, or that you weren’t ready to accept losses, to accept being wrong, or to accept that trading won’t make you rich overnight.

Accept the process as it is and agree to take it one step at a time. You have the time and opportunity to grow your trading career by focusing on the essentials, so why put pressure on yourself?

We wish you a great trading week.