Weekly Outlook: 9/20/21 - 9/24/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

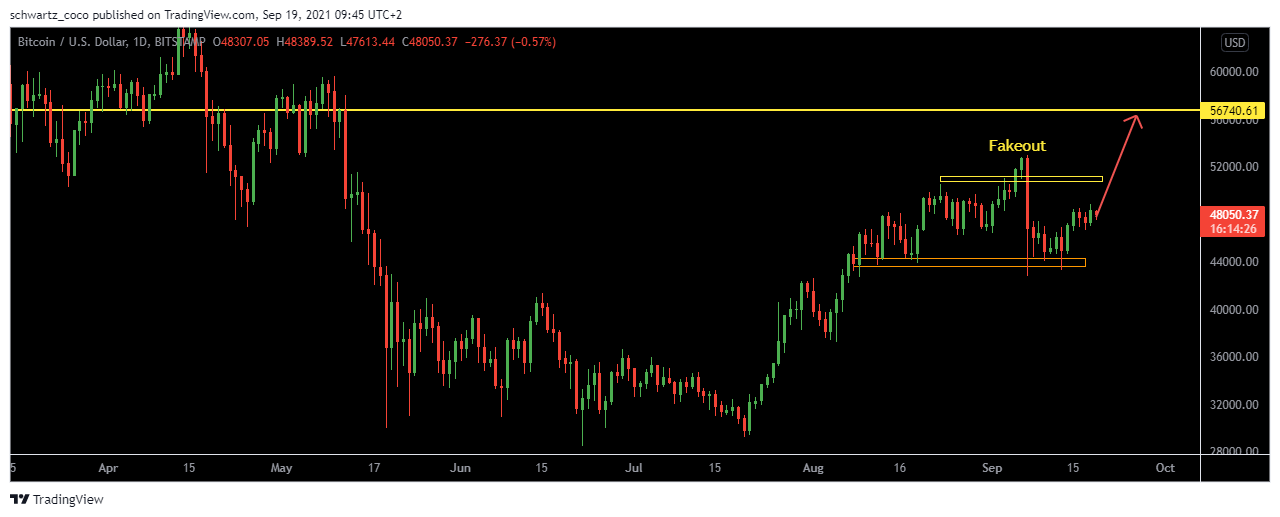

Last week, we could see the beginning of the rebound of cryptos after the big liquidity hunt that we dissected in the previous weekly outlook. If you didn’t read it, feel free to go do so! Since then, BTC and ETH have started to bounce off their technical supports after breaking short-term downtrends from above and making several micro-pulses. Now the odds could be bullish and a return to the Bull Run seems to be the most likely scenario (see analysis below for this new week). On the Forex side, there have been a lot of trend continuation moves, and these trends may soon reverse as we are now entering the 3rd and final part of the month.

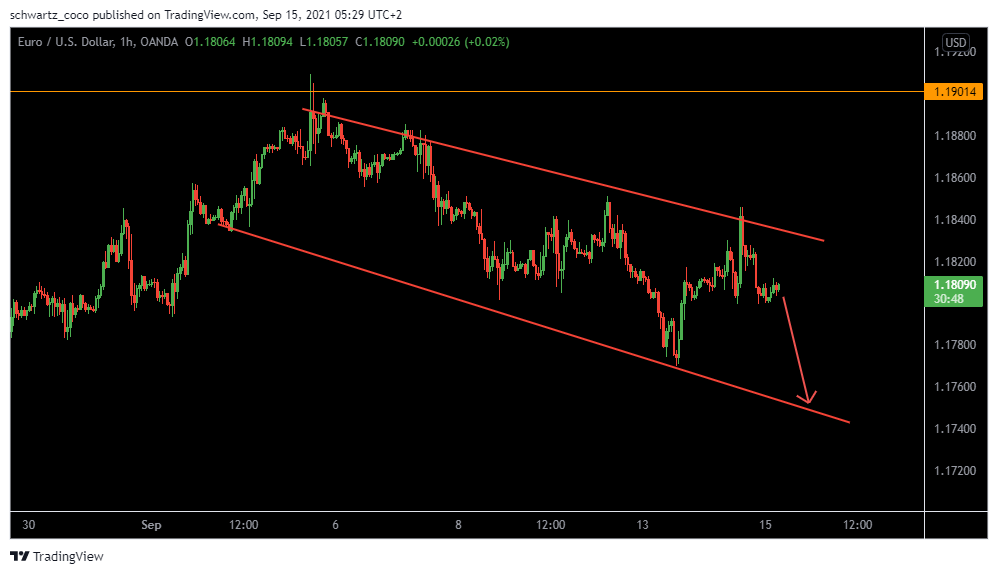

As you can see, this week again some very nice analysis has hit the mark. Among them, a very nice bearish trend-following move on EURUSD and a beautiful bearish continuation move after a reversal on XAUUSD (Gold).

EURUSD – The price followed our trend continuation analysis perfectly by having created a new low from the top of its bearish channel.

EURUSD before:

EURUSD after:

XAUUSD – Bearish impulse of a similar size to the first one that followed the break of the uptrend.

GOLD before:

GOLD after:

This new trading week seems to hold many opportunities. Are you ready to catch them?

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

AUDCHF: Continuation of the upward trend?

The price could continue its downtrend after the previous rebound to the bottom of the downtrend channel confirmed the strong presence of buyers. At the end of last week, the price stumbled on the top of the downtrend channel, but its break could give a good chance for a new momentum towards the next resistance.

EURCAD: Short-term bullish channel breakout and bearish continuation?

EURCAD has made a first bearish impulse from the top of its bullish channel. Since then, a smaller channel has been created within the long-term uptrend channel and the break below this could result in a return to the bottom of the long-term channel.

NZDUSD: After the reversal, the impulse?

NZDUSD could continue to rise after breaking the long-term downtrend. Since then, the price has made a nice bullish impulse and is now consolidating within a short-term bearish channel that the price has broken from below. Its reintegration could allow the price to make a bullish move to the next long-term resistance.

USDCAD: Momentum, retracement, continuation?

Since its huge bearish impulse, USDCAD has been moving upwards within a channel. This channel has recently broken from above, and its reintegration could mean a nice fall in price towards the next support.

XAUUSD (GOLD): Falling towards support?

Gold could fall to technical support as it continues the downward movement it started last week.

DXY: Bullish continuation?

The dollar is following our bullish analysis with another week closing higher, and the price could continue to climb until it fully corrects the Covid-19 crash.

BITCOIN: On the way to $56,000 in the medium term?

Technical support has reacted well and BTC seems to be back in a bullish phase. After the fakeout of the resistance, the real breakout could be close and the price could again soar quickly.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, September 20th

CAD – Federal Election

These elections are held every 4 years and are decisive for the evolution of the currency situation.

Tuesday, September 21st

AUD – Monetary Policy Meeting Minutes

It’s a detailed record of the RBA Reserve Bank Board’s most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates

Wednesday, September 22nd

USD – FOMC Statement, FOMC Press Conference, FOMC Economic Projections

FOMC Economic Projections includes the FOMC’s projection for inflation and economic growth over the next 2 years and, more importantly, a breakdown of individual FOMC member’s interest rate forecasts. This news will be very important and should bring a lot of volatility to the USD pairs.

Thursday, September 23rd

JPY – Bank Holiday

Be careful, this means that the volume might be lower during the Asian session.

CHF – SNB Monetary Policy Assessment

It’s the primary tool the SNB Governing Board uses to communicate with investors about monetary policy. It contains the outcome of their decision on interest rates and commentary about the economic conditions that influenced their decision.

EUR – German Flash Manufacturing PMI & German Flash Services PMI

These figures will be closely watched and will be crucial for the Euro, as Germany is considered the driving force of the zone.

GBP – Asset Purchase Facility, MPC Asset Purchase Facility Votes, Monetary Policy Summary

This news could bring a lot of volatility to the GBP pairs due to their diversity and large size.

Friday, September 24th

USD – FED Chair Powell Speaks

As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

Quote of the week – Psychological Preparation

“The difference between success and mediocrity is all in the way you think.” – Dean Francis

Are you ready to face this new week in the best way? To do so, psychological preparation is very important, because it is your mind that will allow you to make the most of the opportunities that will be offered to you with discipline.

The best way to return to the markets with the right mindset is to disconnect from trading for at least one day over the weekend. Take some time for yourself, and then come back with a recap of the past week: note what you did well and what you did poorly. Learn from it, and adjust it for the new week. Then, all you have to do is plan your trades and execute them realistically. Here are the keys to approaching your new week in a professional manner!

We wish you a great trading week.