Weekly Outlook: 10/4/21 - 10/8/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

Once again this week, the USD has shown surprising strength in the markets and has dominated a large number of pairs in the Forex market. Are you surprised by this movement? The truth is that this doesn’t just happen, even though you might think that these bullish moves are irrational. Remember this analysis published in the weekly outlook for the week 9/13/21 – 9/17/21….

DXY before:

We were talking about a possible rebound of the dollar in the short term as well as in the long term with a price that could soar out of the post-pandemic consolidation to return to its “normal” price level.

Indeed, we can see on this chart that the price fell sharply around March 2020 when the first lockdowns were announced. The economy suffered for weeks, and the fall was stabilized and minimized by the various actions of the FED (with, for example, the drastic reduction of interest rates). Now, the economic landscape is picking up and the Dollar is immediately taking advantage of this to regain strength and value. In the long term, the price could even return to its preferred zone between 97 and 100, a price zone around which the dollar often stagnates.

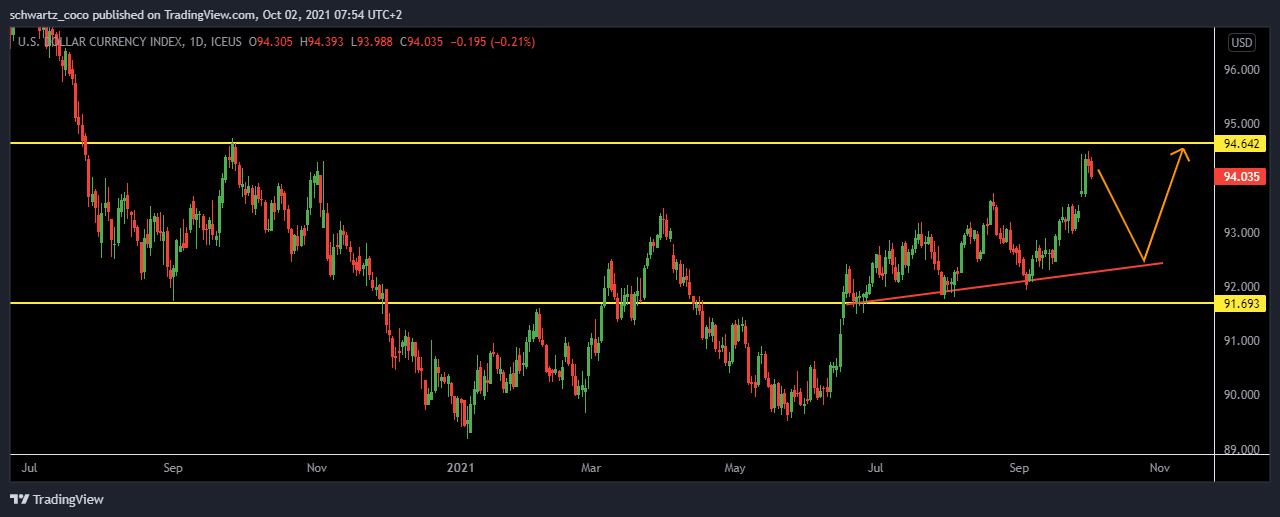

Here is the current price action for the dollar, which could continue its rebound in the coming weeks.

DXY after:

In addition, some economic announcements could strongly influence the price of the dollar this week… Stay put, we’ll tell you about them right after.

October: the month of rebound for cryptos?

After a mostly bearish month of September for all major cryptos, the rebounds on the support zones might have given the necessary strength to the prices to take off soon.

Indeed, we have been talking for a few days about a possible rebound around the 50% Fibonacci zone and the closely related support zone. This area has contained the price and the bearish pressure for many days, and the rebound has finally taken place with the beginning of October.

Here are some analyses posted on our Discord, Telegram groups and on our Twitter account throughout this week hinting at a possible rebound in cryptos:

Bitcoin (BTC/USD) before:

Bitcoin (BTC/USD) after:

Ethereum (ETH/USD) before:

Ethereum (ETH/USD) after:

A month of rise to come for cryptos after a difficult month of September? It is possible and conceivable in view of these new impulses! To do this, let’s now study the opportunities to come this week.

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: what moves should we be watching for?

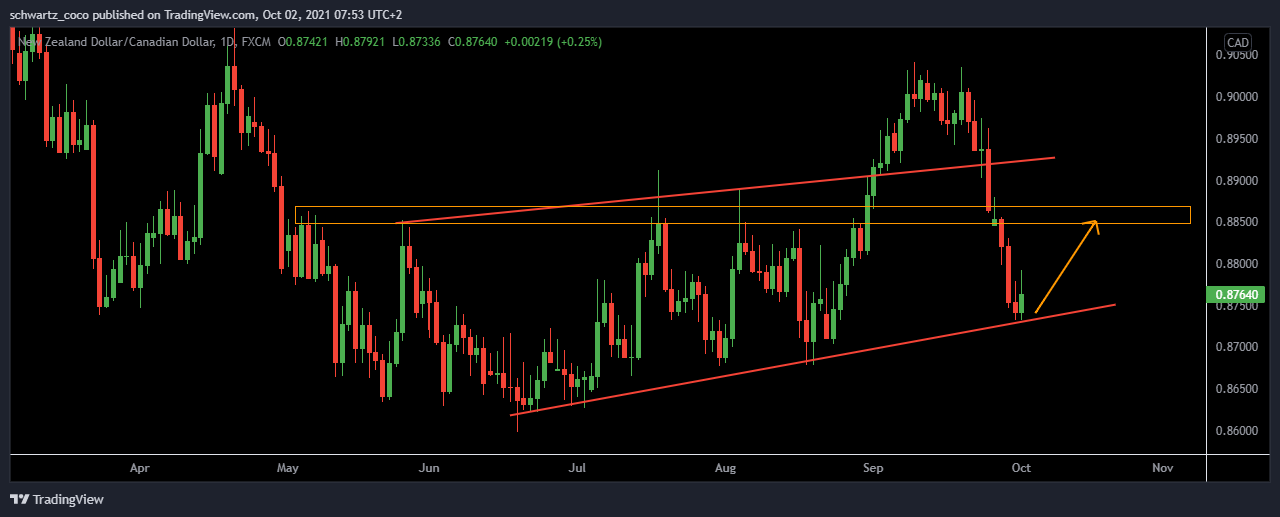

NZD/CAD: Potential rebound of 190 pips?

After a huge drop at the end of September, the price could bounce off its bullish channel bottom to continue to the next resistance located in the middle of the channel.

DXY: A retracement to come?

Dollar Index could retrace after this huge and widespread bullish move. The price could rejoin the bullish trendline before potentially moving back up on a technical rebound.

USD/CHF: Back to the bottom of the channel?

USD/CHF could continue to retrace after the huge bullish impulse made in the middle of last week, and the price could rejoin the bottom of the bullish channel in case of momentary dollar weakness.

Gold (XAU/USD): Bullish impulse?

Gold could continue to rise after the recent bounce off the major technical support area and the break of the bearish structure from above. The next potential target of the bullish move could be the sensitivity zone corresponding to the next resistance.

AUD/CHF: Continuation of the trend?

After several failed bullish breakout attempts, AUDCHF could finally find its direction with a new breakout of the short-term bearish structure from above in a general context of bullish signs. Where to next major resistance?

Ethereum (ETH/USD): New bullish phase?

ETH has broken its short-term bearish channel and could now continue to the next major resistance around $4000.

Bitcoin (BTC/USD): The return of the bull run?

After a complicated September, the signs could be bullish on Bitcoin with a very nice rejection of support and a break of the bearish structure that could generate a large bullish impulse.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, October 4th

OPEC Meetings

OPEC nations represent around 40% of the world’s oil supply and are unified in their oil production levels. With so much control over oil’s supply-side, shifts in their production levels can have a significant impact on oil prices which could also have an impact on currency pairs of countries with an economy strongly linked to oil (like the CAD for example).

Tuesday, October 5th

AUD – RBA Rate Statement

It’s among the primary tools the RBA Reserve Bank Board uses to communicate with investors about monetary policy.

USD – ISM Services PMI

It’s a leading indicator of economic health – businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company’s view of the economy.

Wednesday, October 6th

NZD – Official Cash Rate & RBNZ Rate Statement

The central bank will also address major issues such as interest rates and take stock of the country’s economic situation, as well as its economic policy.

USD – ADP Non-Farm Employment Change

This news is focused on job creation, which is an important leading indicator of consumer spending, and accounts for the majority of overall economic activity. It also provides a snapshot of the country’s economic situation ahead of the NFP which will be released in the same week.

Thursday, October 7th

CAD – BOC Gov Macklem Speaks

As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

Friday, October 8th

CAD – Employment Change & Unemployment Rate

Even though on this day the eyes are often on the NFP, this news is among the most important of the month for the CAD and often leads to great volatility in the markets.

USD – NFP (Non-Farm Payrolls): Average Hourly Earnings m/m + Non-Farm Employment Change + Unemployment Rate

This is the news that all traders are following as everyone knows that this is probably the most important news of the month regarding the US economic situation. Very often the dollar then takes a direction and finds its trend. Watch out for the volatility of the NFP!

Quote of the week – Psychological Preparation

“If you aren’t making any mistakes, it’s a sure sign you’re playing it too safe.” – John Maxwell

This week, don’t be afraid of your mistakes. They are a great source of learning and knowledge, and often far more important than all the theory in the world. Making mistakes is about learning how to make things right in a given situation where you noticed something wasn’t working. By trying to adapt, you will then correct some of the flaws to become more efficient and effective, which will then improve your trading skills.

Spending time avoiding mistakes is the biggest mistake of all! If you avoid them, you’ll just set them back in time, but they will still happen. And in all the time you’ve been trying to avoid them, you won’t have learned enough to actually become more proficient… and you’ll just be wasting time in the end.

The wealth of success lies in your ability to bounce back from failure. Are you ready for that?

We wish you a great week of trading with us.