Weekly Outlook: 10/11/21 - 10/15/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

The first week of October again offered many opportunities in the markets.

For Forex, many pairs seemed to be waiting for the NFP results before choosing their direction. The most anticipated economic event of the month for traders took place on Friday, with mixed results regarding the economic health of the US. Here they are:

Average Hourly Earnings m/m: Better than expected at 0.6% vs. 0.4% expected.

Non-Farm Employment Change: Much lower than expected at 194k vs. 490k expected.

Unemployment Rate: Better than expected with 4.8% vs 5.1% expected.

As with every time the NFP gives mixed results like these, the market doesn’t really find its direction. And, even when it does, the dollar often ends up retracing the move made on the news if the news doesn’t have a truly positive or negative outcome.

This is what happened this week with Gold (XAU/USD):

The price broke the range in which it was contained for a week following the NFP, and then resistance rejected the bullish move. Price eventually re-entered the range, and the results were not convincing enough for Gold to find its direction that day.

Despite the indecision, much of our analysis shared in the previous weekly outlook or on our Discord and Telegram groups hit the mark again this week.

Indeed, XAU/USD reached the potential target we told you about at the beginning of the week, after breaking the bearish market structure.

XAU/USD (GOLD) before:

XAU/USD (GOLD) after:

EUR/USD also followed our analysis perfectly in the direction of a continuation of the trend after breaking its short-term uptrend within its long-term downtrend channel.

EUR/USD before:

EUR/USD after:

This week also saw the major rebound in cryptos that we have been talking about for a few weeks now. In all the weekly outlooks as well as in all our analyses on Twitter, Discord and Telegram, we mentioned the possibility of a rebound on the 50% Fibonacci zone for major cryptos like ETH and BTC.

That’s exactly what happened, with analysis that was perfectly followed:

Ethereum (ETH/USD) before:

Ethereum (ETH/USD) after:

Bitcoin (BTC/USD) before:

Bitcoin (BTC/USD) after:

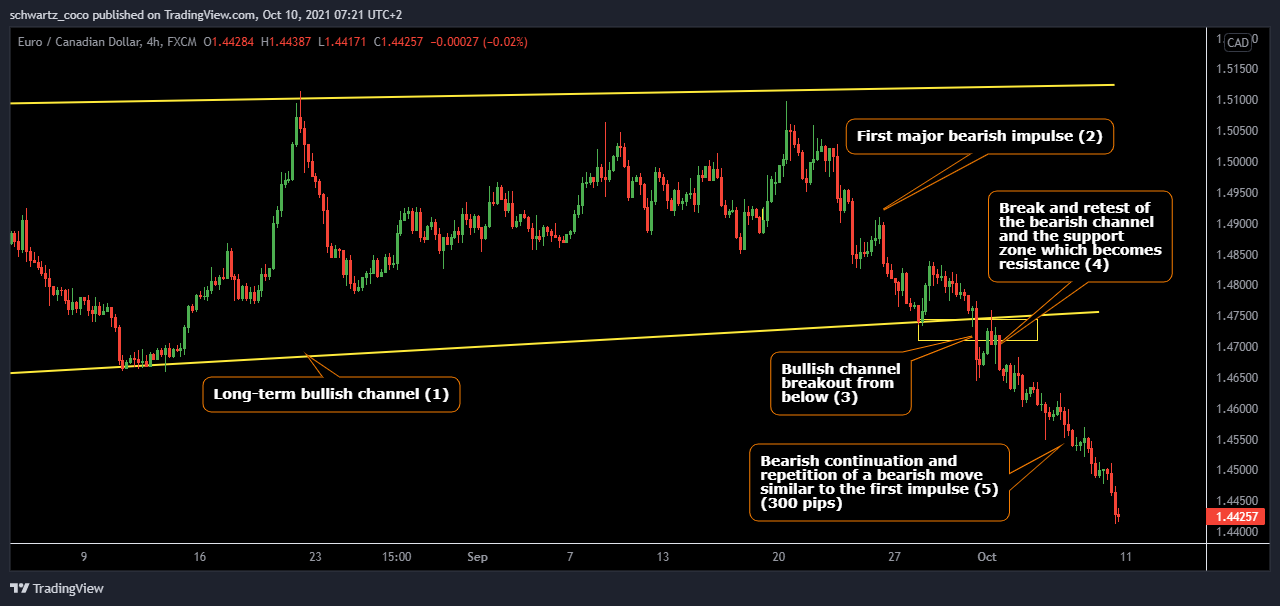

The move of the week: 300 pips drop on EUR/CAD.

The price was contained in a bullish channel since the beginning of July. After a large bearish impulse followed by a break of the channel, the price retested the previous support and rejected it, which made it become resistance. From that moment on, EUR/CAD kept falling and repeated a move similar in size to the first bearish impulse of 300 pips.

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: What moves should we be watching for?

Ripple (XRP/USD): Bullish continuation after range break?

Very recently, XRP broke through its short-term range resistance after bouncing off major technical support. The price could soon continue its long-term uptrend and head towards the next resistance.

EUR/CHF: Liquidity hunting below support and bullish correction?

The price could break the medium term support which seems to be weakening over time and chase liquidity being located below it before correcting back to the top of the bearish channel.

USD/JPY: Bullish impulse then correction to the bottom of the channel?

After this huge bullish impulse, the price could continue to climb to chase the liquidity above the top of the bullish channel. Then, USDJPY could potentially retrace to the bottom of its bullish channel.

GBP/USD: Bearish move to the next support?

GBP/USD could continue to fall until the next major technical support in line with its bearish trend.

Silver (XAG/USD): Bounce off technical support?

Silver could bounce off its support and break the bearish pattern. Indeed, the latter could have been weakened by the previous fakeout, and the next attempt to break it could lead to a reversal.

Ethereum (ETH/USD): On the way to $4100?

After following our bullish analysis from the technical level of $2800, ETH could continue to climb to its next resistance by respecting its new bullish structure.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Monday, October 11th

USD & CAD – Bank Holiday

Beware, there will be no New York session this Monday, which means that the volume may be lower, and therefore the movements may not look like the ones you are used to seeing and trading.

Wednesday, October 13th

USD – CPI m/m & Core CPI m/m

Strong indicators that measure inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate

USD – FOMC Meeting Minutes

It is a detailed record of the FOMC’s most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

Thursday, October 14th

AUD – Employment Change & Unemployment Rate

This news is among the most important of the month for this currency, and will give a clear picture of the economic situation in the country.

USD – PPI m/m

It is also a leading indicator of consumer inflation.

Friday, October 15th

USD – Core Retail Sales m/m & Retail Sales m/m

They are the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Quote of the week – Psychological Preparation

“Through the steel of discipline, you will forge a character rich in courage and peace. Through the virtue of will, you are destined to rise to the highest ideal of life and live in a heavenly place filled with all that is good, joyful and full of vitality. Without these qualities, you are lost like a captain without a compass, who will eventually go down with his ship.”

-Robin S. Sharma

Approaching this new week with discipline is a fundamental thing. If you’ve read this far, you are undoubtedly a passionate trader who is giving yourself every chance to succeed. Congratulations!

Discipline will allow you to move forward each day by making the best decisions for you and your capital in the long run. As a trader, discipline is very important because it is what will allow you to achieve consistent results.

Trading is like a high level sport and requires the same rigor and preparation. Let’s imagine a boxing match in which one fighter trained every day for 6 months on a very strict diet, while the other did some huge irregular sessions and tried to give it his all for the last 3 days. Who has a 99.99% chance of winning? The one who was disciplined and consistent. Why? Because he will be sharper, much fitter, and more confident in his movements. Moreover, it will be easier to react to his opponent’s moves… because he will have prepared his reactions in advance. Doesn’t it remind you of something? Yes, you and your trading plan!

If you want to win your battle with yourself again this week… stay disciplined and focused on your goals!