Weekly Outlook: 10/18/21 - 10/22/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

The first few weeks of October continue to offer many opportunities in the markets, both in the crypto-currency market and in Forex and commodities.

Oil – Long term analysis and analysis of last week’s movements.

The price of oil has risen sharply recently, following the surge in commodity prices. Far from the crisis of March 2020, when the price of a barrel fell below zero dollars per barrel, mainly because of the clear superiority of supply over demand, oil is now back to its previous highs.

According to Goldman Sachs, oil prices could remain at higher levels in the coming years as demand rebounds while supply remains tight.

Indeed, the bank said that market fundamentals warrant higher prices and that the bank’s forecast for Brent crude averages $85 a barrel for the next few years.

Goldman Sachs’ baseline scenario calls for Brent to reach $90 a barrel by the end of the year. “The fundamentals actually very much support the idea of higher prices than we’ve seen, pretty much since 2014,” the bank said in closing.

Technical Analysis:

Price has broken the bearish structure that had lasted since the oil crash during the COVID19 crisis by entering a new bullish phase. The trend is clearly defined, and the price made a fakeout of a previous low before continuing upwards and breaking major resistance. At present, the next resistance is between $89 and $92, an area that coincides with Goldman Sachs’ comments.

BTC Breaking News – Market Optimism?

A solution found for the excess energy used and produced during BTC mining? Bullish sign for BTC.

Mining Bitcoin or other crypto-currencies is often blamed for consuming a lot of energy, not only because of the power supply to the GPUs that are used for mining, but also because of the electricity expenses related to cooling these GPUs by air conditioning, to ensure proper operation.

Bitcoin mining will soon be used to heat buildings in a Canadian city

MintGreen, a Canadian-based crypto-currency mining company, yesterday announced plans to partner with Lonsdale Energy Corporation to provide heat to North Vancouver residents as early as 2022.

MintGreen said its “digital boilers” – which it says can recover more than 96 percent of the electricity used for Bitcoin mining – will prevent 20,000 metric tons of greenhouse gases per megawatt from entering the atmosphere. The recovered energy will be used to heat 100 residential and commercial buildings in this Canadian city of about 155,000 people.

A major revolution that could weaken environmental arguments against cryptocurrencies. Enough to trigger a new Bull Run ring in the medium to long term?

Meanwhile, BTC has hit the final target of our bullish analysis we’ve been sharing every week since the key $41,000 bounce zone. We were talking about a potential rise in price to around $59,000, an area that price recently broke after a huge bullish impulse. What a trade!

Bitcoin (BTC/USD) before:

Bitcoin (BTC/USD) after:

Bitcoin is not the only one to have followed our analysis this week. For example, Silver and Ethereum also started very nice bullish moves in line with the scenarios we shared on Discord, Telegram, Twitter, and in the previous Weekly Outlook.

Ethereum (ETH/USD) before:

Ethereum (ETH/USD) after:

Silver (XAG/USD) before:

Silver (XAG/USD) after:

Movement of the week: CHF/JPY Bull Run

This week, the majority of XXXJPY pairs saw their prices rise. CHFJPY was no exception to this trend, and the price made two huge bullish waves of almost 200 pips each. The price action showed good bullish probabilities, and it was possible to envisage a continuation scenario after the break and retest of the consolidation resistance.

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: What moves should we be watching for?

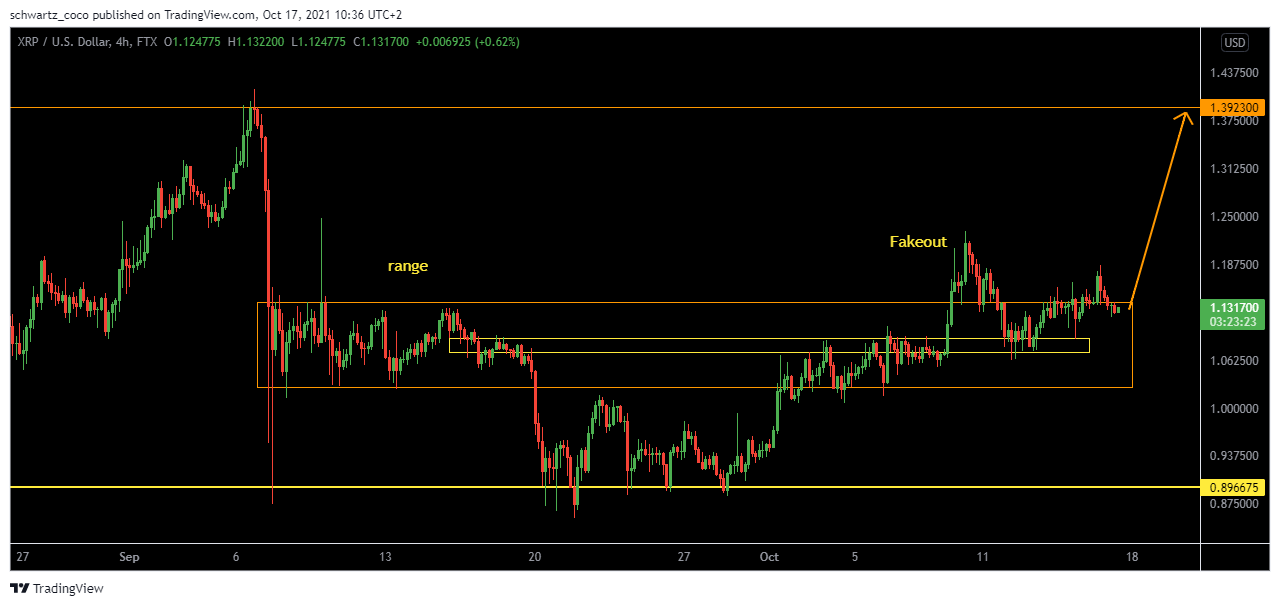

Ripple (XRP/USD): Continuation towards $1.39?

Ripple could continue to rise if this resistance is broken, which seems to be weakened by the numerous attempts to break the price. Will the next attempt be the right one?

EURCHF: Continuation of the downward trend?

The price had rejected the top of its long-term downtrend and may now be ready to break the technical support that was preventing it from falling in order to establish a new low.

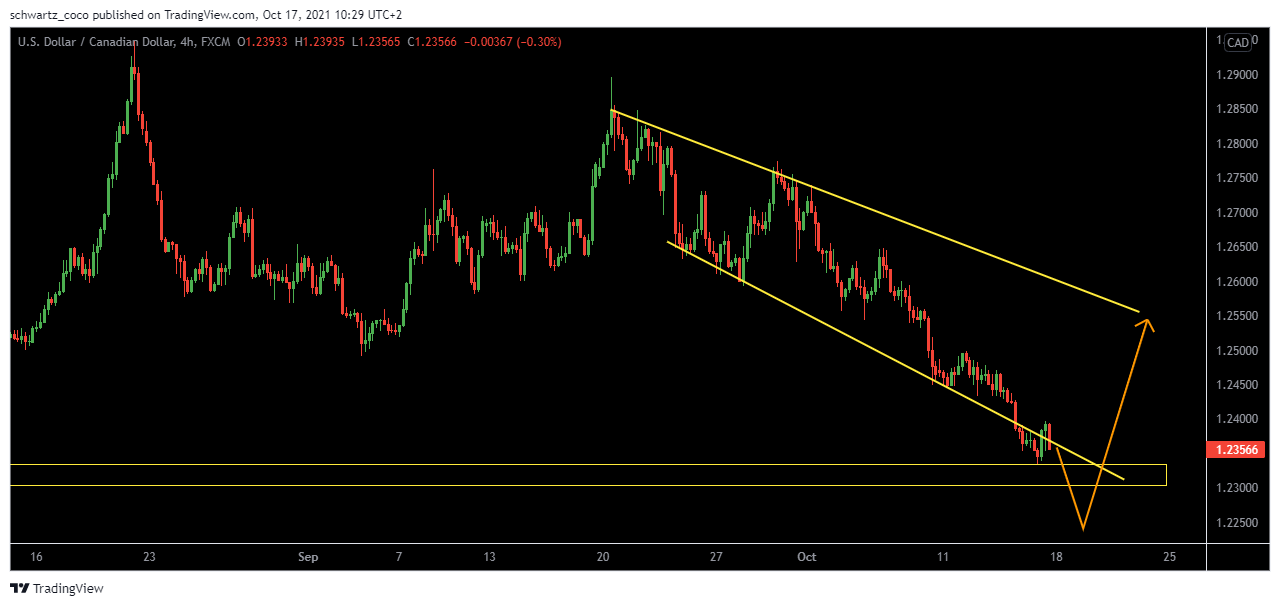

USDCAD: Liquidity hunt then bullish rebound?

USDCAD could break major technical support momentarily in order to seek out the liquidity below it before bouncing back to its bearish channel top.

EURUSD: Trend following?

EURUSD could fall back to its short term bearish channel bottom which also corresponds to its long term bearish channel bottom.

Ethereum (ETH/USD): Heading for one of the highest resistance levels of all time?

Ethereum could continue its uptrend in order to hit the resistance zone located around $4,190, a move supported by the resumption of control by buyers and by the break of the bearish structure.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Tuesday, October 19th

AUD – Monetary Policy Meeting Minutes

Detailed record of the RBA Reserve Bank Board’s most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

Wednesday, October 20th

GBP – CPI y/y

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates.

CAD – CPI m/m

Thursday, October 21st

AUD – RBA Gov Lowe Speaks

As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

Friday, October 22nd

EUR – German Flash Manufacturing PMI & German Flash Services PMI

Very important news to watch as Germany is considered the economic engine of the Eurozone.

USD – Treasury Currency Report

It provides a detailed review of global exchange rate policies, economic conditions, and central bank and government actions around the world. Most importantly, the report outlines countries that the Treasury deems currency manipulators.

Quote of the week – Psychological Preparation

“Sometimes later becomes never. Do it now.”

A new week begins. New opportunities appear, and you’ll have two choices: either take them or let them pass. If you haven’t already, letting them pass will eventually leave you frustrated and pissed off. Every week, the same scenario: opportunities, fear of seizing them or not enough preparation to seize them, intense regrets… and nothing moves forward.

This week, take charge. Write down everything you should change and everything you need to do to successfully seize those opportunities. Break down each problem into small steps that you can correct little by little. Break down each weakness you have and address it. Establish a specific work plan. Prepare for each new week in the markets as if you were preparing for a battle. This week, you need to take charge… because the train will pass with or without you!