Forex Outlook: 11/8/21 - 11/12/21

Last week, the Forex market once again gave traders plenty of opportunities. Like every day, we have been sending out a lot of price action analysis in our Discord and Telegram groups, including this great reversal analysis on AUD/USD.

Advanced Price Action Study and Analysis – AUD/USD.

AUD/USD before:

AUD/USD after:

AUD/USD has broken its uptrend and reversed, dropping to technical support. Here is what Price Action says about this move when studied with a liquidity approach:

- Strong uptrend that has lasted for several days already.

- First attempt to break the trend showing a weakening of the trend. This attempt introduces impulsive sellers into the market and drives out the buyers who bought the rebound on the trendline.

- Sellers are also driven out with this upward movement before the actual break of the trendline.

- Once the liquidity is driven out, the price can start to fall for real.

- AUD/USD falls to support.

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: What moves should we be watching for?

NZD/JPY: Massive correction coming?

After chasing liquidity through the false breaks of the triangle pattern, the price has dropped to technical support. Now NZD/JPY could continue to fall until it reaches the support represented by its bullish trendline.

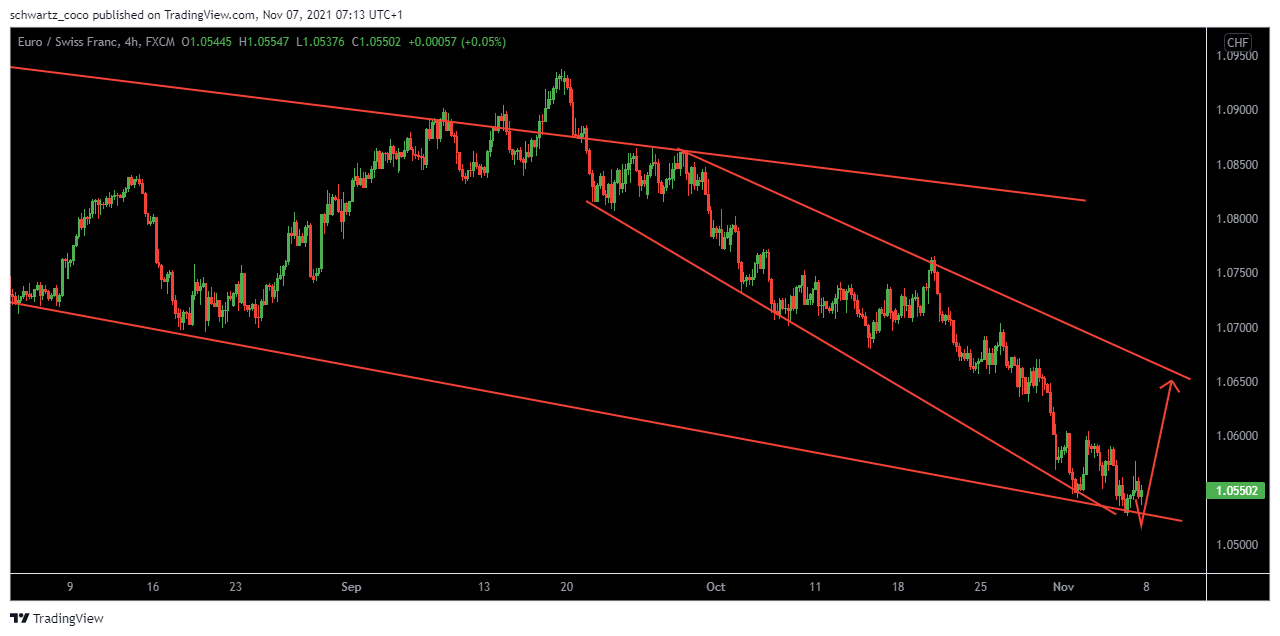

EUR/CHF: Break of the bottom of the bearish channel and then correction?

The price could make a false break of the bottom of the bearish channel at the beginning of the week in order to introduce sellers into the market, and then continue to rise in order to correct some of the massive bearish movement that has been taking place for the past few weeks.

EUR/GBP: Correction to the next support?

After making a big bullish push, the price could retrace to the next support in order to test the foundations of this new short-term uptrend.

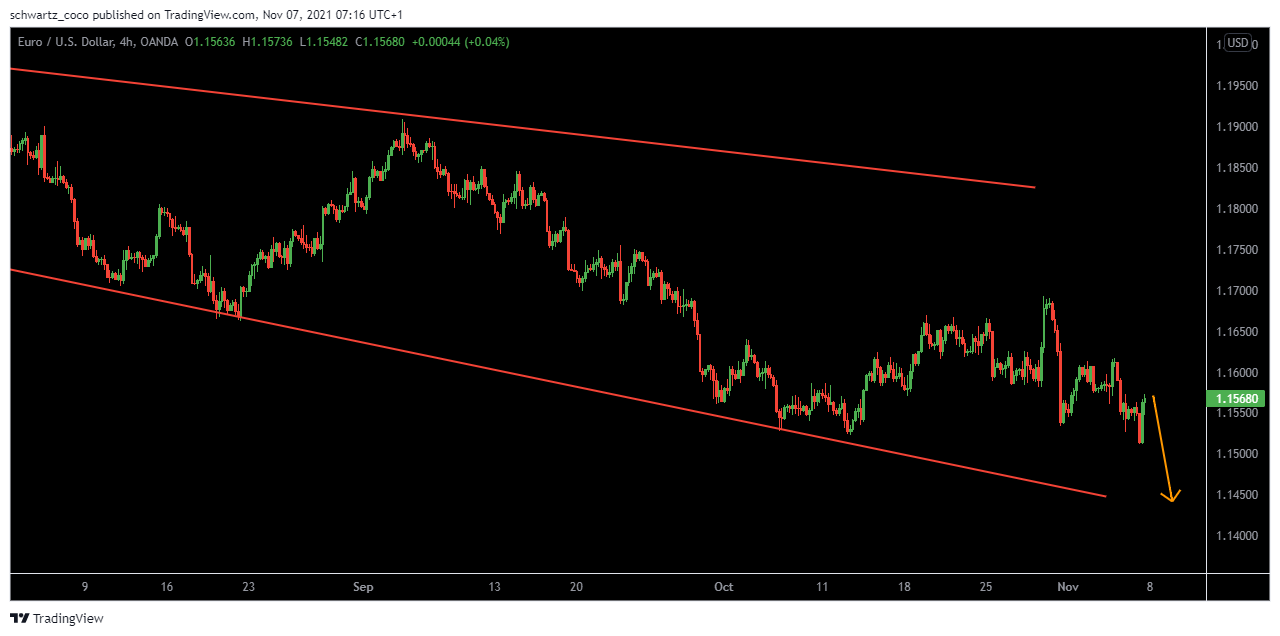

EUR/USD: Falling towards the bottom of the downtrend channel?

EUR/USD could continue its downtrend movement and retest the bottom of the channel before making a new upward correction move.

We hope that this article will help you prepare for another week of trading, and that we have helped you to better understand what happened the week before. We put education first and do everything we can to help you progress.

On top of that, we offer you ideal trading conditions to get you settled in the financial markets for the long term.

- Leverage up to 1:500

- Ultra low commissions and spreads

- Exceptional speed of execution

- Same day withdrawal so you can get your profits as soon as you need them

- Free education

- Free risk management tools

This list is not exhaustive and the benefits of Nash Markets are still numerous. For more information, click on the link below:

Have a great trading week everyone, and thank you for your loyalty.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.