Weekly Outlook: 10/25/21 - 10/29/21

Are you ready for another week of trading?

Let’s take a quick look at what happened last week before we start preparing for this new week.

What happened last week?

This week, the bull run in Bitcoin following its introduction on Wall Street and the uncertainty of the markets in relation to the current inflationary context were at the heart of many traders’ concerns. In this article, we will decipher these points and try to provide technical and fundamental answers to your concerns about the movements of the past week, and those of the week to come.

News of the week: New Bitcoin ATH and Bitcoin ETF

Bitcoin lands on Wall Street and rocks the markets!

It’s news that has been making a lot of noise this week and is probably, or at least partly, responsible for Bitcoin’s recent rise. In addition to the many bullish technical signs we’ve been telling you about for the past few weeks in our Telegram and Discord groups, as well as in the latest Weekly Outlook, the fundamentals have aligned in favor of a Bitcoin price explosion.

Last Tuesday the first American ETF on Bitcoin-based futures contracts was launched on the New York Stock Exchange, with the approval of the US financial regulator, the SEC. We won’t go into the technical details of an ETF here, but it’s important to remember that this investment vehicle does not directly replicate Bitcoin, but rather a set of futures contracts that are traded on the CME, the centralized exchange in Chicago. So we’re far from the Bitcoin philosophy, and concretely, we’re not really investing in BTC with this product, but it’s a significant milestone in the history of Satoshi Nakamoto’s crypto, which, let’s remember, has been despised, called “rat poison”, a “Ponzi scheme”, and other niceties since it started to make news. What will be the next step on the road to Bitcoin adoption? No one really knows, but the fundamental news in favor of BTC is piling up week after week, with MintGreen’s solution to managing the excess energy used and produced in BTC mining aiming to use Bitcoin mining to heat buildings in a Canadian city.

Following all the technical and fundamental bullish signs, the price of BTC took off until it reached a new all-time high (ATH). This possibility had been mentioned by our top analysts this week, a few days before the new ATH:

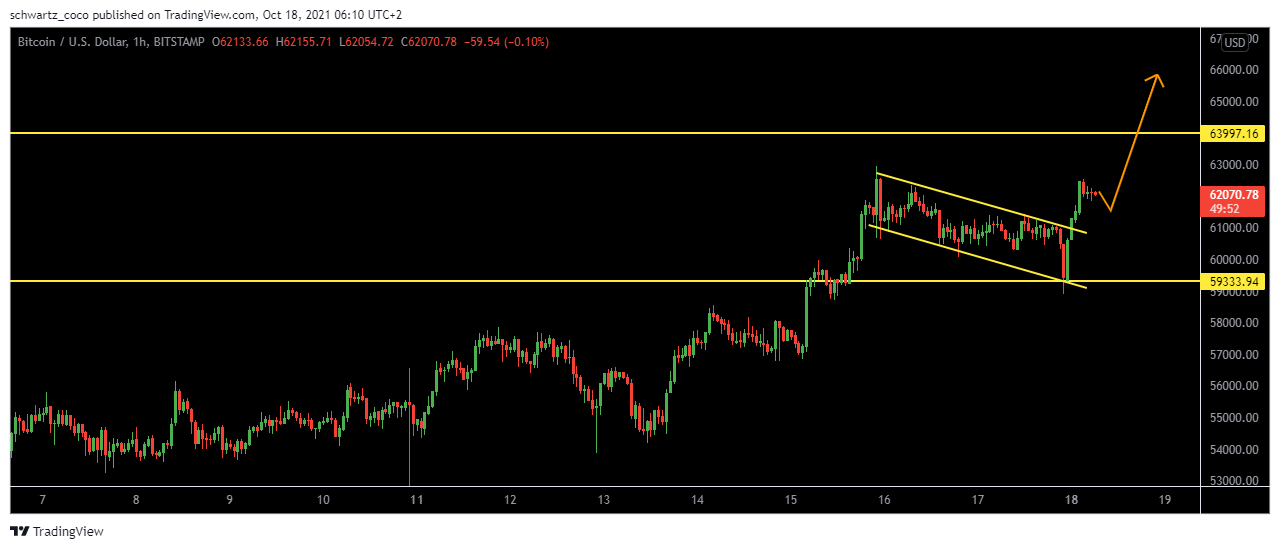

Bitcoin (BTC/USD) before:

Bitcoin (BTC/USD) after:

On Wednesday, October 20th, Bitcoin literally shattered its previous all-time price record ($64,800), an ATH that dated back to last April. The new record is $67,000, and the price has once again followed our analysis perfectly. The queen of crypto-currencies is showing a cheeky form, its capitalization has actually reached the record level just shy of $2 trillion at the time of writing this article.

Bitcoin, the new gold? Trading and financial markets legend Paul Tudor Jones weighs in.

Could gold lose its status as a store of value and bulwark against inflation to Bitcoin? Many observers of the cryptosphere think so as they see many gold investors now increasingly turning to BTC. For analysts at JPMorgan Bank, Bitcoin is in a good position right now because of inflation concerns. “The perception of Bitcoin as a better inflation hedge than gold is the real reason for the price rise and this has triggered a shift from gold ETFs to Bitcoin funds since September,” they said. The Financial Times reports that more than $10 billion has been withdrawn from the largest gold ETF this year.

It’s also worth noting that legendary trader and hedge fund manager Paul Tudor Jones said that inflation is here to stay, and that he prefers crypto assets to gold as a hedge against it. “Crypto-currencies have their place. They’re clearly winning the race against gold right now,” said Jones, who also advises having 5% Bitcoin in your portfolio.

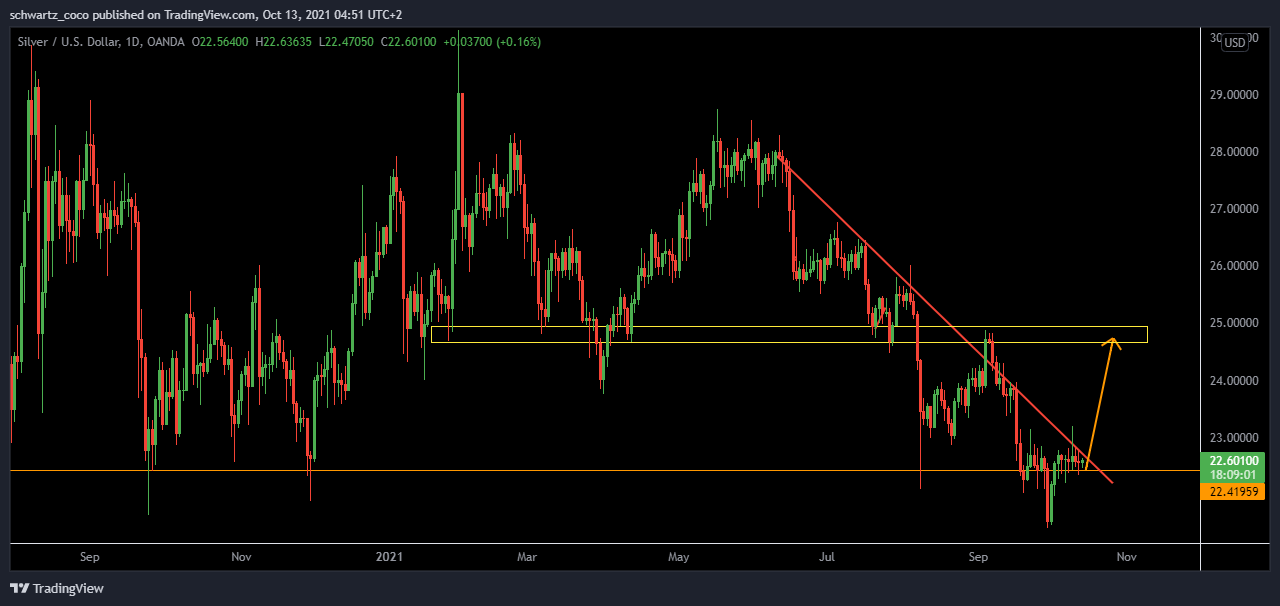

Speaking of gold, our analysis on silver (XAG/USD) hit its target this week.

Published in one of our previous weekly outlooks, we mentioned the potential weakening of the asset’s downtrend.

As a safe haven asset, SILVER (XAG/USD) has obviously not been immune to the global economic environment filled with uncertainty and various risks, including inflation, rising commodity prices, and soaring oil prices. When the economy goes up in flames, safe havens such as gold, silver (and now bitcoin?) soar, and that’s what happened again in the last two weeks.

Our analysis hit its target with a massive impulse from support and seems to have established a new medium-term bullish structure.

Silver (XAG/USD) before:

Silver (XAG/USD) after:

It was another excellent week in terms of analysis. All these movements had been explained daily on our free Discord and Telegram groups, as well as on Twitter. You haven’t joined us yet? Now is the time!

Looking ahead to next week: What moves should we be watching for?

EUR/AUD: After the fall, the correction?

EUR/AUD could bounce back and correct some of its extensive fall that lasted almost a month. The price could bounce off its bearish channel bottom that has been reinstated, and continue to rise to the top of the channel.

USD/CHF: Correction coming?

USD/CHF could re-enter its bearish channel to continue upwards and correct some of its previous bearish momentum.

Gold (XAU/USD): Weakened resistance?

Gold (XAU/USD) could break its resistance zone soon following the recent fakeout of this zone which could have weakened it. Now, in case of a retest in the key support area of the bullish structure and bullish rejection, it could decide to head for the next resistance located around $1828.

DXY: Uptrend continuation?

After a huge initial bullish impulse, the price made a retracement as a breather. The downtrend of this retracement has recently broken, and the price may not have enough strength to maintain the downtrend started below the support. Therefore, a rebound and continuation to the next resistance may be possible.

Dogecoin (DOGE/USD): Price rise imminent?

Doge has been stuck in a range since early September. After numerous failed attempts to break out, the resistance may not have enough strength to reject the buying pressure that seems to be growing. If broken, the price could continue on to the next major resistance area located around $0.32. Don’t forget, Elon Musk is a doge supporter.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.

Fundamentals to watch for this new trading week:

Inflation is at the heart of all the debates, and this week most of the major currency central banks (EUR, JPY, AUD, CAD) will provide answers to this problem that is panicking investors and bringing so much uncertainty to the markets. Will the answers succeed in bringing serenity to the markets? For the moment, it is impossible to know. Here is, first of all, the calendar for the week.

Wednesday, October 27th

AUD – CPI q/q & Trimmed Mean CPI q/q

Traders focus on this news because consumer prices account for the majority of global inflation, and inflation is very important for currency valuation. Indeed, rising prices lead the central bank to raise interest rates out of respect for its mandate to control inflation.

CAD – BOC Monetary Policy Report, BOC Rate Statement & BOC Press Conference

Key day for the DAC with a big political and economic review of the central which bank provides valuable insight into the bank’s view of economic conditions and inflation – the key factors that will shape the future of monetary policy and influence their interest rate decisions.

Thursday, October 28th

JPY – BOJ Outlook Report

It provides valuable insight into the bank’s view of economic conditions and inflation

EUR – Monetary Policy Statement, ECB Press Conference

It is the primary method the ECB uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, such as the overall economic outlook and inflation.

USD – Advance GDP q/q

This news is the broadest measure of economic activity and the primary gauge of the economy’s health.

Friday, October 29th

CAD – GDP m/m

This news is the broadest measure of economic activity and the primary gauge of the economy’s health.

USD – Core PCE Price Index m/m & Treasury Currency Report

They provide a detailed review of global exchange rate policies, economic conditions, and central bank and government actions around the world. Most importantly, the report outlines countries that the Treasury deems currency manipulators.

Quote of the week – Psychological Preparation

“There are people who say they can, and people who say they can’t. In general they are all right.” Henry Ford

If you’ve read this far, you’re really empowering yourself to succeed. You understand that preparation is the key to effective and controlled execution. Now you just need to develop the mental skills required by the financial markets to put the odds in your favor for long-term success.

To start a new week of trading, it is very important to be optimistic and not to burden yourself with negative thoughts. Negative thinking is acting negatively and reacting negatively to the information the markets will give you. The results can, therefore, only be negative. Never be discouraged by your short-term results, and even if you have to deal with one loss after another, remember that one bad day, one bad week or one bad month has absolutely no bearing on a 10 year trading career!

Think positive, harvest positive.

We hope that this article will help you prepare for another week of trading, and that we have helped you to better understand what happened the week before. We put education first and do everything we can to help you progress.

On top of that, we offer you ideal trading conditions to get you settled in the financial markets for the long term.

- Leverage up to 1:500

- Ultra low commissions and spreads

- Exceptional speed of execution

- Same day withdrawal so you can get your profits as soon as you need them

- Free education

- Free risk management tools

This list is not exhaustive and the benefits of Nash Markets are still numerous. For more information, click on the link below:

Have a great trading week everyone, and thank you for your loyalty.