Crypto Outlook: 11/22/21 - 11/26/21

How to successfully benefit from crypto corrections?

The best way to anticipate what might happen in the future is to study what has happened in the past. Price action moves often repeat themselves over and over again, and those who have analyzed previous correction waves know how to take advantage of them.

These correction waves very often come after the price has created one or more new all time highs. The euphoria rises in the markets, traders buy en masse and are desperate to take advantage of the huge price rise… and then the market chases impulsive traders with leveraged chases.

Of course, it is possible to trade a bear market and profit from correction waves. Let’s explore how this was possible this week. Ready to go? Let’s get started!

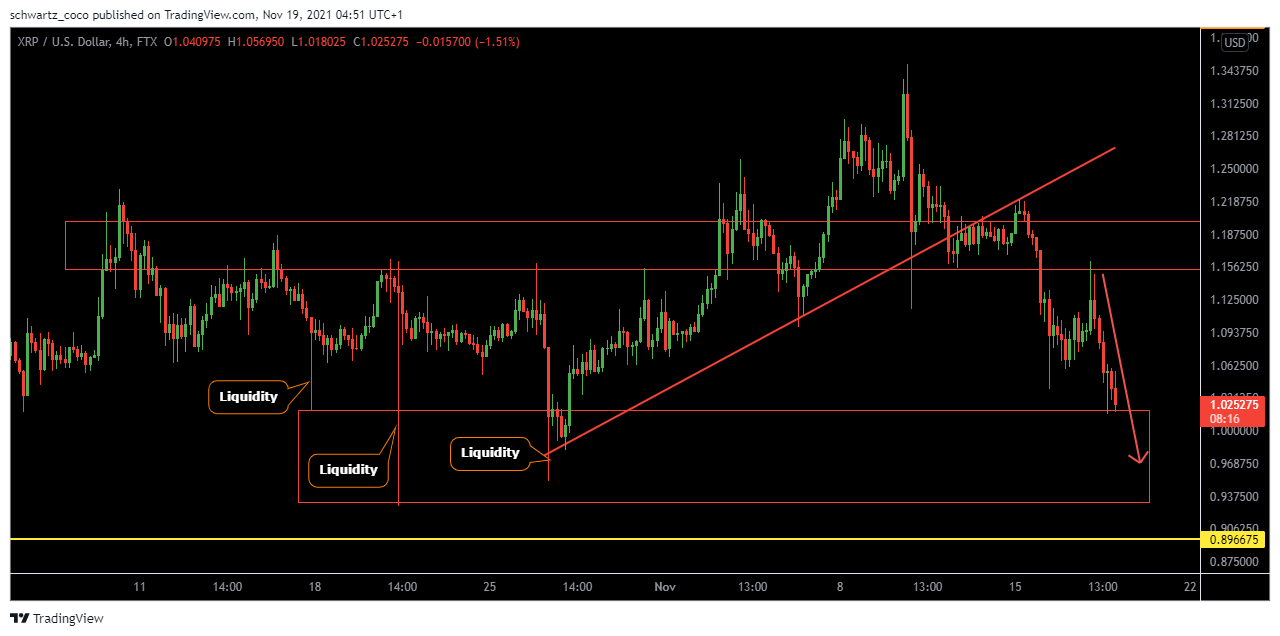

Ripple (XRP/USD) before :

Ripple has broken its bullish structure and started a first retracement. Didn’t catch the first drop in the market? No worries, there is no need to blame yourself and let your emotions get the better of you as it was perfectly possible to re-evaluate your positioning with the retest of the support turned resistance, resulting in a second bearish impulse to the support symbolized by the huge liquidity area where the price has already bounced many times.

Ripple (XRP/USD) after:

This analysis had been shared this week in our free Telegram and Discord groups, as well as on Twitter. Many of them hit their target, with a magnificent 6/6: BTC, XRP, ETH, SHIB, DOGE, LTC all followed our bearish analysis. Let’s study a new movement from these.

Ethereum (ETH/USD) before:

ETH broke out of its bearish structure and made a massive first push towards its support zone. However, the price started to correct before reaching this area and created a bullish correction channel. In case of a break of this channel from below, one could imagine that the probabilities of continuation of the bearish movement to the support could be important.

Ethereum (ETH/USD) after:

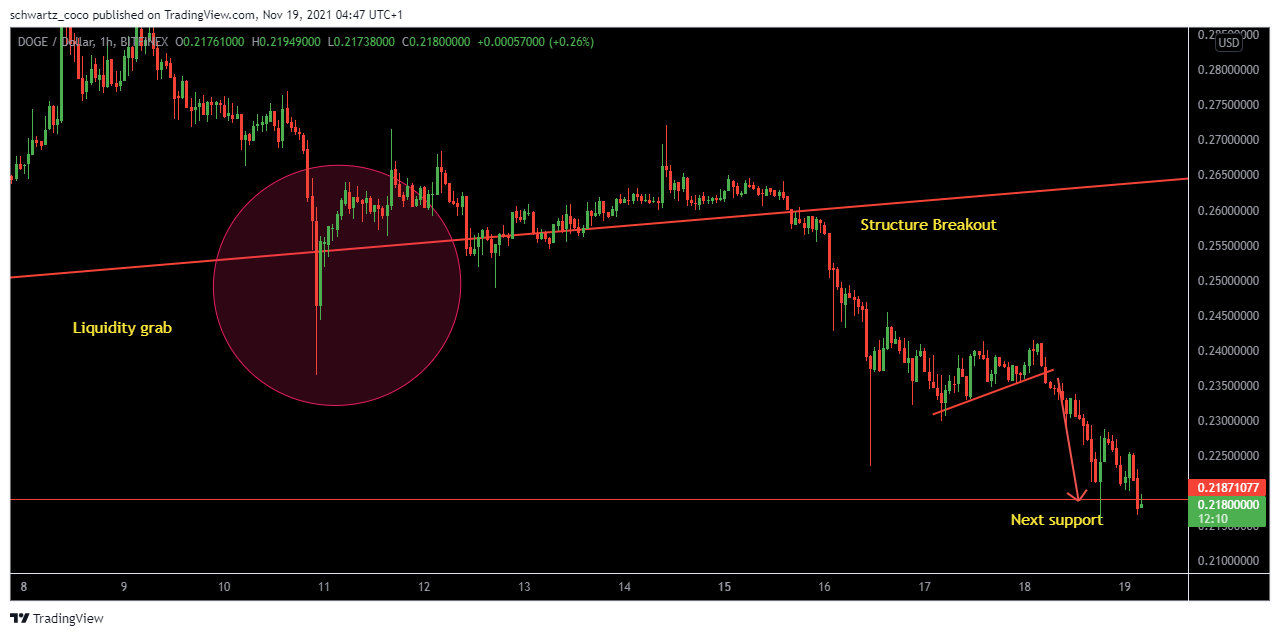

The same scenario happened on the DOGECOIN, with a similar setup of impulse followed by a correction in a short-term bullish channel that breaks from below to continue to the next support.

Doge (DOGE/USD) before:

Doge (DOGE/USD) after:

Study the Price Action, and don’t miss any more opportunities!

Now let’s look at the potential movements for next week. Will the markets continue to fall, or will they rebound? No one knows… but here are our educational analyses.

Litecoin (LTC/USD)

Litecoin could bounce off its technical support area symbolized by a large order block that caused the price to bounce extraordinarily the last time it was rejected. Bullish continuation towards the next technical resistance?

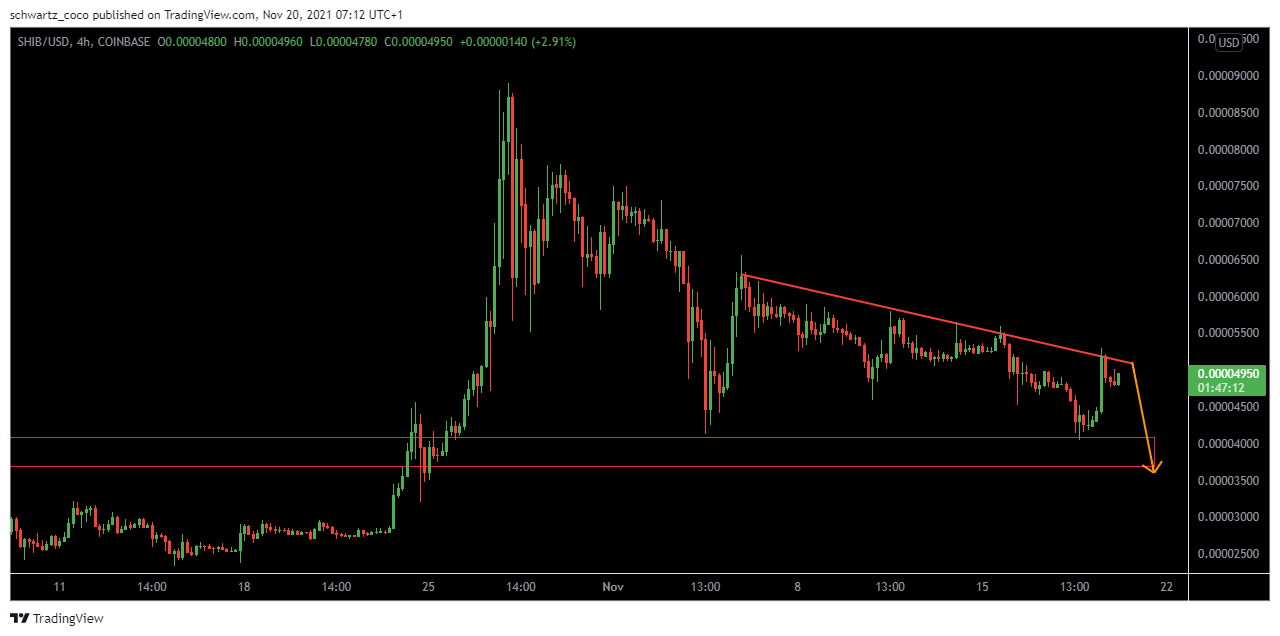

Shibacoin (SHIB/USD)

SHIB could soon continue its fall following its medium-term downtrend, in order to test its major support zone once again.

We hope that this article will help you prepare for another week of trading, and that we have helped you to better understand what happened the week before. We put education first and do everything we can to help you progress.

On top of that, we offer you ideal trading conditions to get you settled in the financial markets for the long term.

- Leverage up to 1:500

- Ultra low commissions and spreads

- Exceptional speed of execution

- Same day withdrawal so you can get your profits as soon as you need them

- Free education

- Free risk management tools

This list is not exhaustive and the benefits of Nash Markets are still numerous. For more information, click on the link below:

Have a great trading week everyone, and thank you for your loyalty.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.