Crypto Outlook: 11/8/21 - 11/12/21

What happened this week in the crypto market? Let’s explore it all together.

Bitcoin: JP Morgan changes its predictions for the BTC price.

Bitcoin’s price is currently consolidating below a significant resistance level and has been for some time. Analysts at JP Morgan recently reversed their January 2021 predictions for Bitcoin’s price, which originally indicated that it could reach $146,000 in the long run.

JP Morgan analysts remain bullish on the asset over the long term, but have factored price volatility into their forecast. Indeed, they had made an interesting prediction this year: Bitcoin’s price could reach $146,000 in the long run. However, the analysts recently issued a new statement regarding this forecast.

In order for Bitcoin’s price to actually break the $100,000 mark, its volatility must decrease significantly. Otherwise, investor interest will wane. For 2022, the bank’s analysts assume that the price of BTC could reach USD 72,000. However, if volatility increases, the asset could also suffer a further fall.

Moreover, JP Morgan believes that Ethereum will surpass Bitcoin in the near future, this due to the DeFi (decentralized finance) boom.

Should we expect an imminent correction?

Bitcoin’s price has been below the important resistance level of USD 63,500 for some time. The fact that BTC has not been able to break through this level is an indication that the short-term trend could be bearish.

On November 3rd, 2021, Bitcoin’s price bounced off a key resistance level. The daily candle has a large, long wick, indicating that buying pressure was strong that day. However, BTC fell sharply the next day, with its daily closing price significantly lower than the opening price on the same day, as well as the closing price on November 3rd. The price trend therefore appears to be bearish.

Here is our technical analysis of Bitcoin (BTC/USD):

The price could fall if this minor technical support is broken, and reach the major support area of $55,000 in the medium term. The break of the short term bearish structure has failed to generate a bullish continuation movement to the extent of establishing a new high, proof of buyers’ weakness. Where is the next support?

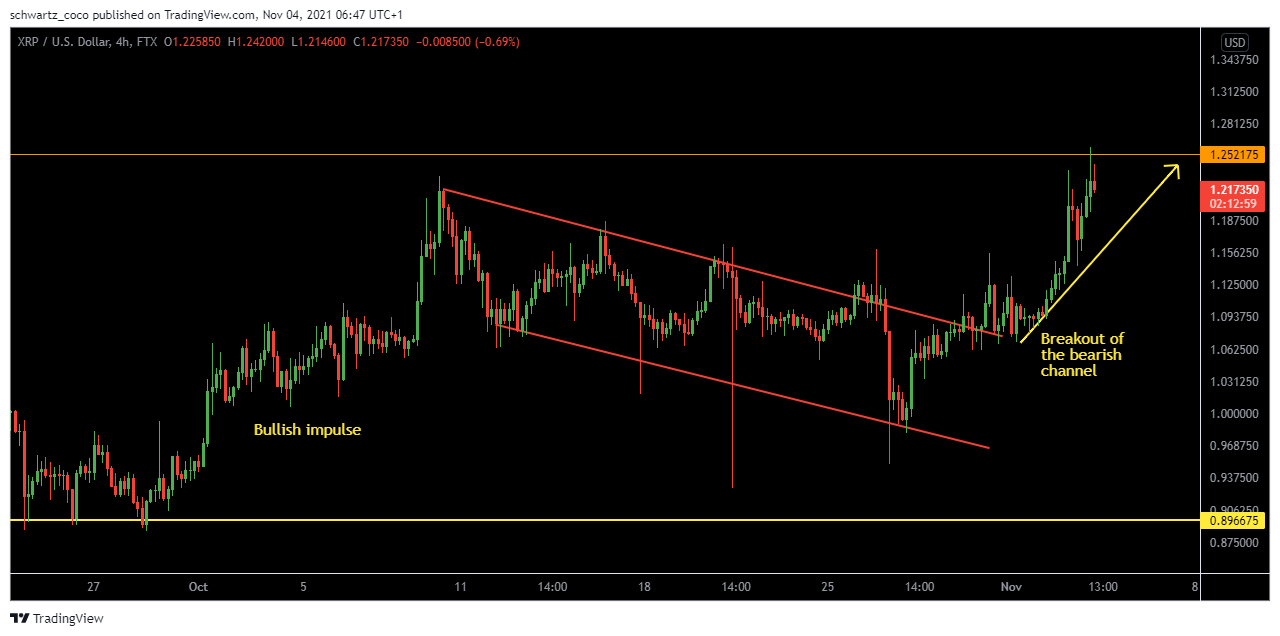

This week, XRP also made a magnificent bullish impulse by joining the price zone targeted by the analysis we had shared in our Discord, Telegram, as well as our Twitter groups.

Ripple (XRP/USD) before:

Ripple (XRP/USD) after:

Finally, here are two more analyses to end this article on a high note.

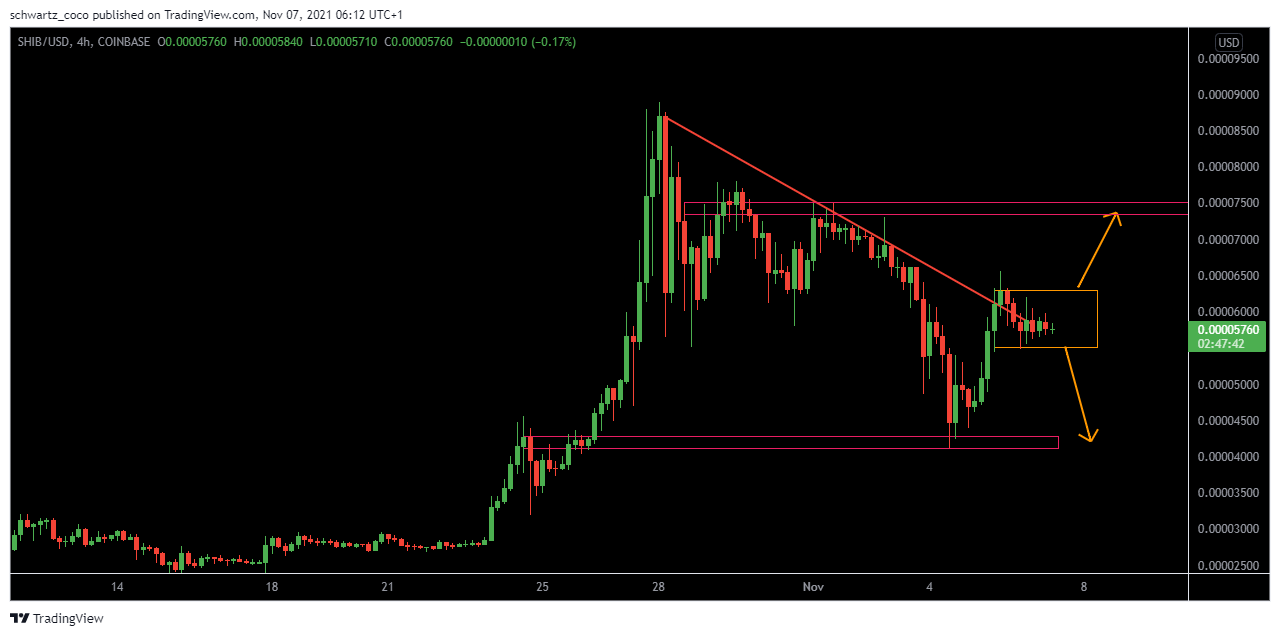

SHIB (SHIB/USD): Bullish or Bearish?

SHIB is consolidating after breaking its medium term downtrend. Two scenarios are possible, with a bullish continuation to the next resistance if the range is broken from above, or a bearish continuation to the next support if the range is broken from below.

Ethereum (ETH/USD): Correction ahead?

ETH appears to be rejecting the resistance established by the new ATH and continues to attempt to break its medium-term uptrend. The next attempt could result in a trend reversal and a significant correction.

We hope that this article will help you prepare for another week of trading, and that we have helped you to better understand what happened the week before. We put education first and do everything we can to help you progress.

On top of that, we offer you ideal trading conditions to get you settled in the financial markets for the long term.

- Leverage up to 1:500

- Ultra low commissions and spreads

- Exceptional speed of execution

- Same day withdrawal so you can get your profits as soon as you need them

- Free education

- Free risk management tools

This list is not exhaustive and the benefits of Nash Markets are still numerous. For more information, click on the link below:

Have a great trading week everyone, and thank you for your loyalty.

Please note that these analyses are based on price action elements only and are in no way trading or investment advice.